How school districts can take advantage of IRA programs

Last Thursday, the Philadelphia School Board had a public meeting. I submitted the following testimony into the public record urging the board to encourage the District to email the Environmental Protection Agency by April 28th to take advantage of Inflation Reduction Act programs to fix up and green up our toxic school buildings. The federal government can compensate up to 70% of the cost of school infrastructure projects.

Please feel free to use this letter as a template to write to your school district officials and ask them to establish a connection with the EPA by April 28th. The letter below has links and more info.

Dear School Board members,

I'm a West Philly parent and a professor of education policy at West Chester University. My research specialty is transformative school facilities finance.

I chose this specialty to try to make sense of the toxic buildings crisis in Philadelphia. I've made it my business to figure out the business of school facilities resources. My goal is to propose how to get the money we need to make our buildings not only safe but something we can all be proud of.

I'm writing today because there's an important deadline coming up that I urge you not to miss.

It's April 28th. All you have to do is write an email to the Environmental Protection Agency.

I'm sure you know about the Biden Administration's massive green industrial legislation in the Inflation Reduction Act (IRA), as well as the bipartisan Infrastructure and Investment Jobs Act passed last year (IIJA). There are programs in these pieces of federal legislation that are tailor made for our district. They could be the financial basis for a transformative approach to our school buildings.

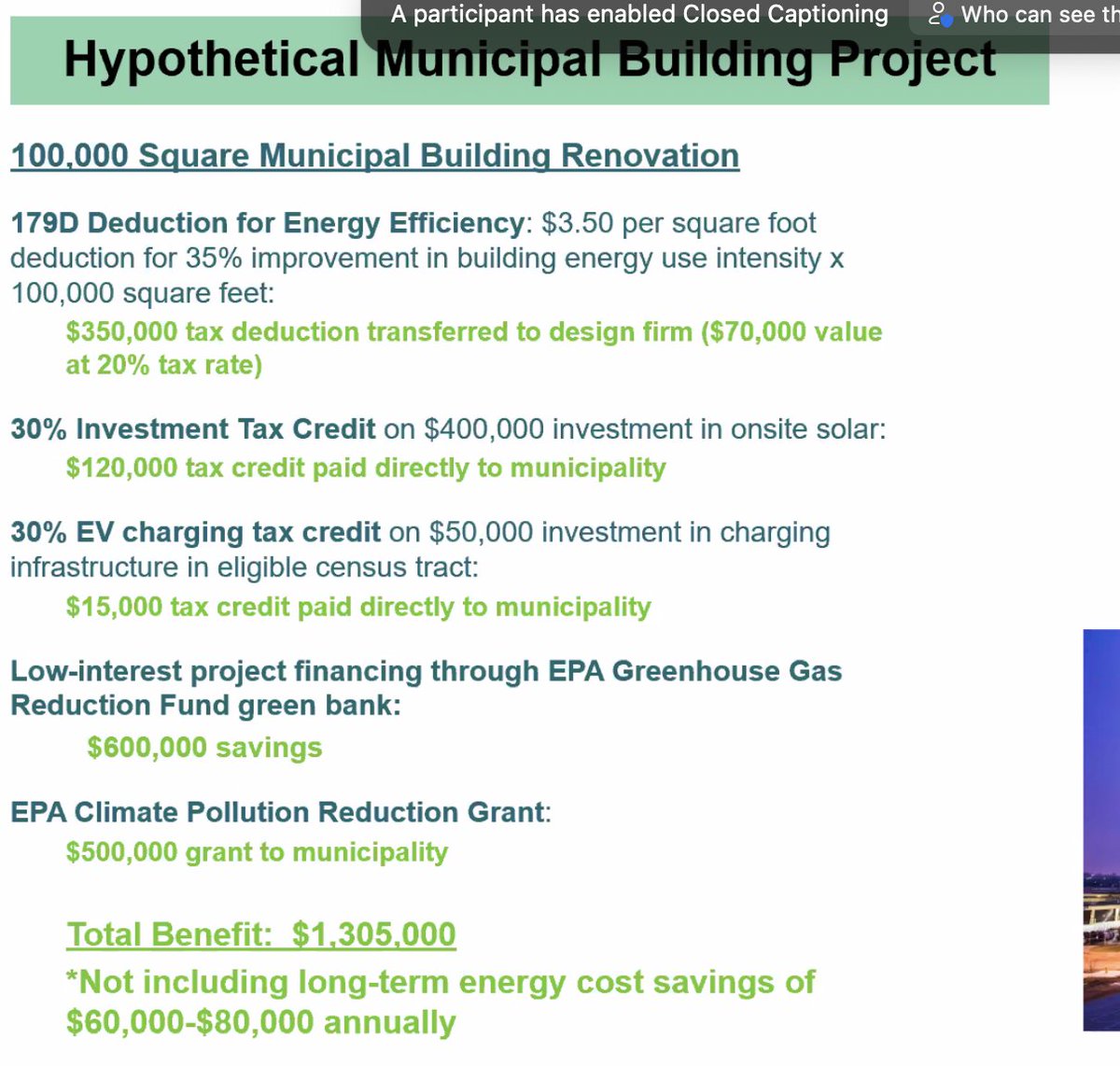

The school district could potentially get up to 70% reimbursement from the federal government for infrastructure projects on our school buildings that would both fix them up and reduce their carbon emissions. Here's an example provided by the U.S. Green Building Council:

The money comes from direct pay investment tax credits (ITCs) available to public entities like school districts for green infrastructure. There are also billions of dollars in capitalization for green banks to design instruments for public entities like school districts in the Greenhouse Gas Reduction Fund.

Information about all this is available through the Internal Revenue Service.

But there's also funding for public entities like school districts to make a plan to take advantage of these programs over the next ten years. They're called Greenhouse Gas Planning and Implementation Grants and Climate Pollution Reduction Grants.

To get one of these grants--which provides money to make a plan to use the IRA and IIJA programs--the district needs to write an email to the Environmental Protection Agency expressing interest by April 28th. That's it.

Establishing this connection with the EPA then positions the district to get information and help for taking advantage of the financial programs in the legislation.

I have written directly to Vince Pagliaro, Jr. and Oz Hill in the Office of Operations and Office of Capital Programs to ask whether their teams are aware of this deadline. I offered to help if in any way necessary, but I never heard back.

I strongly urge you to encourage them to write to the EPA.

By taking advantage of the programs in the IRA and IIJA, we can transform our district's seemingly intractable facilities issues into an opportunity to lead big city districts in fixing up our buildings and reducing the amount of carbon they emit into the atmosphere, protecting our students' future by making sure their school buildings are safe and don't contribute to the imminent catastrophe of the warming climate.

Thank you.