Grab the popcorn

Quick links

My old friend and comrade Jason Wozniak gave a great interview on the podcast Another Education is Possible. The conversation is about debt, higher education, and organizing. Check it out.

Another old friend and comrade Aleks Perisic is out with a new book on Yugoslavian-Francophone anticolonial connections which looks amazing (readers know that I have a little obsession with Yugoslavian market socialism—it was Aleks that inspired that interest).

If you’re in Iowa (or just interested in Iowa), I’ll be doing a School Finance 101 event with Concerned Citizens of Iowa tonight at 8:30pm EST.

Speaking of Iowa school finance, Nick Covington wrote a great op-ed citing yours truly.

Zohran Mamdani came out and announced a $12.2 billion budget deficit found by the new comptroller Mark Levine. It breaks down to a $2.2 billion shortfall for next year and then $10 billion for 2027.

This is going to impact schools and every other city service that helps students and families succeed, so it’s important to look at, he’s even sort of threatening to make an Office of Savings with embedded people everywhere in the government to find places to cut if we can’t generate the revenue, which the nyc public servants’ subreddit just loves.

Notably, in the Comptroller’s press release, we get a bit of detail in where, exactly, the spending in excess of revenue occurred:

Instead, Comptroller Levine emphasized that the Adams Administration’s FY26 spending levels, which exceed revenue, and failure to properly budget for known, re-occurring expenses, have led to unusually high budget deficit projections for FY26 and FY27. Examples of this type of chronic underbudgeting include rental assistance, overtime, shelter, public assistance, Department of Education Due Process Cases, and contributions to the MTA that together account for 3.8 billion unbudgeted dollars in FY26 alone and even more in the out years.

I’m interested in the chronic underbudgeting for DOE due process cases there, something to look into later.

As NYC municipal government gears up for the budget process in Albany, one question will be how to address this shortfall brought on by the Adams administration, as well as austerity the Gov. Cuomo years.

The answer to that question is: tax the rich. But what does that look like exactly? I’ve seen a number of proposals that are being considered and I wanted to look into them.

The first is Mamdani’s proposal to increase the 3.88% tax on income above a million dollars by two points to 5.88%, about which there was plenty of pearl-clutching but not as much substance in the froth of the election.

To do this, the state government, with Kathy Hochul’s signature, will have to approve legislation. The city can’t just increase it on its own.

But there are several other Tax the Rich proposals swirling around budget negotiations worth mentioning that I came across from the Alliance for Quality Education (AQE) feed.

Here are some of these initiatives with links, descriptions, etc.

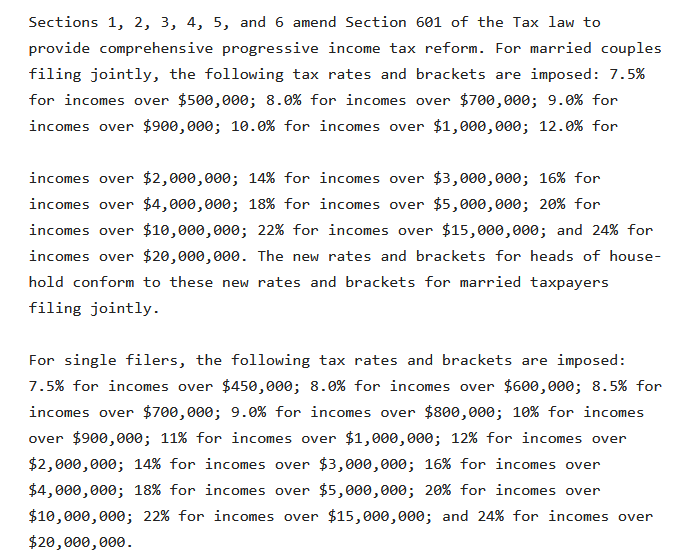

There’s a progressive income tax proposal that will “increase state tax revenues and reduce economic inequality by creating a fair and progressive personal income tax.” Here are the numbers its proposes:

There’s a corporate franchise tax proposal that undoes a lot of harmful stuff the 2017 Trump tax cut created, whose language I can only find through the Business Council’s big-mad opposition to it. This is the their language, but they say:

…the additional tax [is] equal to the difference between the federal corporate income tax rate effective in 2017 (35 percent) and the current federal rate – now 21 percent, as adopted by the “Tax Cuts and Jobs Act (TCJA)

This bill also imposes an additional levy under the state’s personal income tax (PIT) on a taxpayer’s business income received from pass-through entities (i.e., partnerships, LLCs, S-corporations) that was subject to a federal deduction under the TCJA’s Section 199A, at a rate equal to the highest federal PIT rate that would apply to the amount deducted under 199A by any such taxpayer’s. (The bill would exempt taxpayers with total taxable income from all source less than $207,500.)

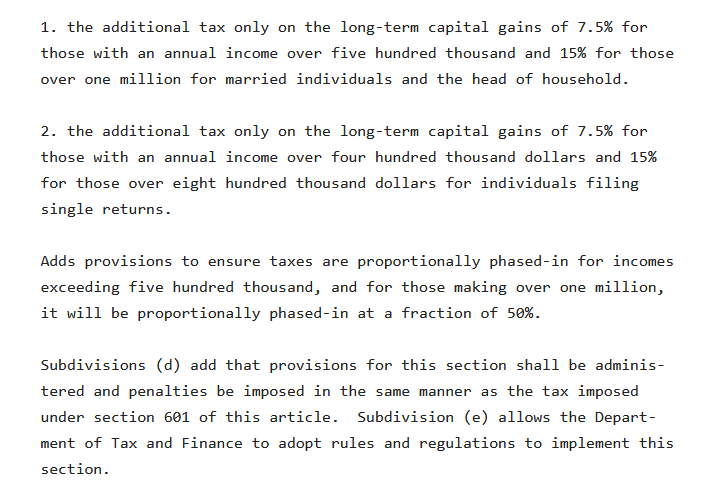

There’s a capital gains tax proposal too, on investment income. It’s also a kind of Trumproofing. “The purpose of this legislation is to amend the New York tax law to introduce an additional tax on investment income (capital gains), for the purposes of correcting the unfair federal tax benefit for income earned from investing rather than working.” Here are some things it does more precisely:

Finally, we’ve got an heirs tax in the works that’s “a separate tax on inheritance income, creating a separate tax on gift income, the computation of the estate tax, and creating a gift tax.” It does a lot of stuff I’m going to dig into later, but it’ll generate revenue!

I’ve actually seen a secret fifth one recently, Liu and Souffrant’s “Fair Share Act,” described as the following by the Tax the Rich statewide coalition: “New York City charges essentially a flat income tax–if you earn $50,000 or $5 million, you pay practically the same tax rate of roughly 3.9%. By adding a 2% surcharge to those with incomes over $1m per year we can raise $4 billion.

And that’s really what we need right now: revenue.

But that’s the first level of analysis of the NYC budget situation. There’s a next level when you read Hellgate’s essential coverage of it (and you can listen to it here).

We know that the budget cycle between state and city is an intricate dance between governor and mayor. That dance has acts, and the first act is the mayor’s announcement that there’s a severe budget crisis. This, to some degree, is what the Hellgaters call budget theatre.

The severity of and responsibility for the budget crisis has a dollar value but also a political value. If the mayor can perform a huge deficit, lay it at the feet of past administrations and governors, that mayor can set up a play where the current governor can advocate for their preferred fiscal policy, whether austere or generous.

They can also create pressure to make the ensuing cuts and dysfunction the governor’s problem, particularly in an election year when the left has juice.

In this case, Zohran is part of a political program to tax the rich using the above policy demands. This is the kind of dance you have to do in the first act to win that demand. There’s even an organizing apparatus set up for the purpose by the NYC-DSA’s Budget Working Group. There’s also a New York State campaign that’s a coalition of DSA chapters, along with Zohran’s post-campaign outfit Our Time, all of them specifically focusing on childcare.

The theatrical quality of the situation (Althusser said that social structure is better understood as an authorless theatre than a simple building) led Hellgate to ask the question of whether the budget crisis is as big as what Zohran says.

Some fiscal conservatives even say that it’s not that bad, and budget people on city council also seem skeptical. Maybe it’s zero shortfall now and four billion next year, they say. Maybe it’s even lower, they say.

Hellgate analysts make the good point though that the first deputy mayor Dean Fuleihan knows his budget shit. So maybe it is that bad. What’s interesting here is that we sort of don’t know. The deficit itself, the number, is a social object with many faces constructed in the theatre of fiscal politics, the plays of ideology.

To some degree, what happens in this cycle will set a kind of tone or precedent for democratic socialist municipal financing in the 21st century, coming out of a period of austerity amidst a polycrisis-instability. Grab the popcorn.