Educational erosion in Long Beach

I got a request on TikTok to look into a budget crisis situation in Long Beach City School District in Nassau County, Long Island. Apparently the budget vote is happening in May so I'm sending along this quick post with some stuff I found. The whole mishegoss revolves around a school closure and reductions in special education funding, which district officials claim has to do with reductions in state aid and "interest earnings."

"Due to uncertainty about foundation aid and interest earnings, the school board is taking a cautious approach to its financial planning."

Let's dig into this. In New York state there was actually an increase in overall state aid, but the appropriation was ultimately a decrease for Long Island, with 34 districts losing funding. The LBCSD stands to lose 12% of its state funding. But there's also some decrease in the district's funding for itself, so it's a decrease on both counts. Weirdly I can't figure out exactly how much they're actually losing.

In the governor’s proposed budget, the district would receive just over $25 million in 2024-25, a decrease of $3.3 million, or just under 12 percent. The district’s foundation aid would drop from $19.5 million to just over $15 million.

Does this mean that the district's losing about $8 million? That's pretty significant for a small district with only a few thousand students. Why are these numbers going down?

This must be because of population/attendance decreases, right? To some degree. The census shows some decreases in population between 2020-2023. Apparently, Nassau county has experienced 1% population decrease in that period. I can't find current numbers on the population of students, which I imagine is decreasing.

At the same time, it looks like taxable property values are going down. According to a bond statement from 2020, assessed property values decreased slightly 2015-2020, between 5-10%. That means the districts was getting less revenue from its local sources, which is really relies on. Decreasing population, decreasing property values all mean decreasing revenues.

I also noticed that while the assessed values are decreasing, the full value and special values are increasing. As an astute commenter mentioned on the tiktok thread, it's clear that the Long Beach community is deflating the assessed value of their properties so they don't have to pay as much in taxes. They're most likely contesting their assessments systematically. So as the property values are increasing, demand goes up, but the schools get starved.

So all eyes have gone to East School, an elementary building that they're thinking about closing. This is always a tough experience. A parent told a vivid story about her kids going to East, but her testimony has a curiously capitalist turn at the end:

“the first two months that my daughter attended East (School), she walked to school sobbing,” one parent said at last week’s meeting. “She was only 4, and it was her first time leaving home. My son similarly started his education, with the added bonus of Covid-19, masked, crying and filled with anxiety. My children both took their first big steps into the world in this building, as they began to navigate their new lives outside our home. The transformation between the children who first entered this building to the little people today is tremendous. They’re thriving and excelling in their academics and numbers. I want to thank the staff, who has my gratitude always for being my kids’ first teachers, and for starting them off with a positive association with education. That’s why I’m here to say I care, to take care of my family. I’m more than just a mother, I’m a homeowner, astounded by the lack of preparation, foresight and transparency when it comes to East School.

The concern about property value decreasing seems in line with the numbers I'm seeing. But I noticed something else along these lines.

Two questions

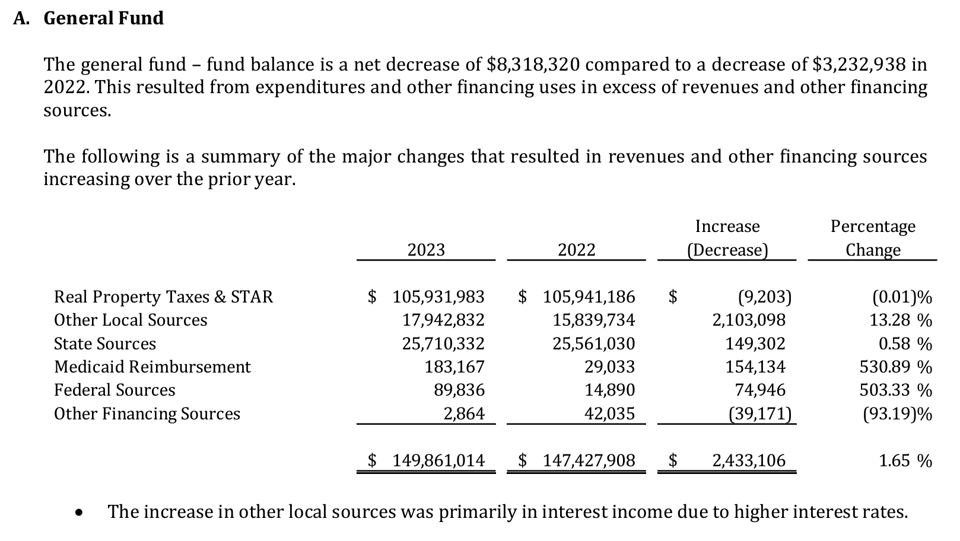

According to audited financial statements from 2023:

The District’s general fund fund balance, as reflected in the fund financial statements was $26,007,763 at June 30, 2023. This balance represents a $8,318,320 decrease (24.23%) from the prior year due to an excess of expenditures and other financing uses over revenues and other financing sources..as follows: Nonspendable fund balance decreased by $156,724, due to the elimination of related advances. Restricted fund balances decreased by $3,280,855, due to the use of the reserves, offset by funding of reserves and interest allocated to the reserves. Assigned fund balance decreased $4,869,356, as the District decreased the fund balance appropriated to fund the 2024 budget and had fewer encumbrances outstanding at year end.

I'd ask about the general fund decreases here. How'd it go down by 24%? What are the "excess of expenditures and other financing uses over revenues"? What's up with this use of reserves? Why'd the district decrease the fund balance? What's the story with those "fewer encumbrances"? There's a missing $8 million!

Is it a coincidence that this missing $8 million--that came in before the Hochul 2024-25 budget--has something to do with the $8 million they're reporting as decreases in that budget allocation? That's a weird symmetry. I'd ask them about that.

My second question is about that "interest earnings" concern they professed to have. I think this maybe refers to earnings the district gets on investments due to higher interest rates. But this is strange because there was actually a $2.1m increase in "other local sources" from increased interest rates. Yes, there was a roughly 40k decrease in "other financing sources" in that same period, but that's not that bad relative to the $8 million decrease in the general fund that the audited statements show above. What gives?

Crises under the crisis

Finally, I'm thinking about these decreasing assessed property values and population numbers, and the crises underneath this crisis.

There's a climate change element to this story. Steve Cohen, writing for Columbia University's Climate School, talked in 2018 about owning property in Long Beach in the wake of Superstorm Sandy. He cited ongoing projects to replenish beaches that erode, the need to raise houses on stilts to account for rising water levels, and the costs associated with climate change's impacts in places like Long Beach.

He cited a 2018 report from the Union of Concern Scientists, which said: "More than 300,000 of today’s coastal homes, with a collective market value of about $117.5 billion today, are at risk of chronic inundation in 2045—a timeframe that falls within the lifespan of a 30-year mortgage issued today."

The threat of climate change causing havoc in Long Beach's resident property market is quite real. In the comments section of the tiktok I made about this, someone said explicitly that people were leaving the town because the barrier sand is eroding and weather patterns are getting worse. One of the secondary effects of the climate threat are decreasing taxable property values that fund schools. As people leave, as property decreases in value, the district can't make as much money by taxing property because it becomes less desirable.

While the potential closure of East Elementary feels like a budget crisis problem, and it is, the crisis beneath that crisis may be how climate change is reshaping the contours of the community itself. One wonders, in a tragic way, how much carbon East Elementary sent into the atmosphere, and to what extent that process is now forcing the closure of the school. We'll have to expect more of this educational erosion, like we're seeing in Long Beach, as the sands erode from rising waters.

The other larger-scale tendency to consider here is the right wing movement's work in public schools. I've been trying to see whether Moms for Liberty, for instance, has a presence in Long Beach. They have a sizable Nassau County facebook group, but I haven't seen anything too explicit, like targeting school board meetings. I have a hypothesis that property values in school districts where Moms for Liberty have been active will go down over the next five years and I'm wondering whether this situation could be a test case.

As a final coda, I think the decreasing assessed values is an odd variant of the rightwing attack on public schools, all in the midst of eroding beaches. Even if there's no Moms for Liberty chapter, there's a similar spirit behind the refusal to pay increasing taxes to keep the public schools open. It's the spirit of tax revolt, the militant withholding of revenue for public provisions. If the story is anything like the one I'm sketching here, it's a sad and enraging one that's uniquely American.