Education 040

Quick Links

Mia on the It Could Happen Here podcast featured my Baffler essay on the municipal bond market in a recent episode. Check it out.

New fancy website for my book is up with events, a request form, etc.

Natality! My partner gave birth to our second kid, Sylvan, and the world is alight with the possibilities of mayor-elect Mamdani. I’m also going to get back to my birthroots with this newsletter: spelunking the school finance of my home district.

I’ve written a little about NYC already, but I haven’t done that kind of cave-examination that I used to do in Philly, getting to know the little esoteric finance policy things and thinking through them in the larger class struggle. Seems like as good a time as any to descend.

The thing about NYC is that it’s not representative. It’s it’s own thing. A city-state. And yet, socialists have state power here now and I’m curious to dig and see what can be seen. I’ll still do tiktok videos about other places in the US, but in this space I’ll be writing about NYC.

The NYC department of education is just that: a department of the city government. It’s not quite a district with relative autonomy in the same way that many districts across the country. So I’m going to start with the 2025 Comptroller’s annual comprehensive financial report, the most recent set of numbers looking at the city’s finances in terms of broad revenues and expenditures for schools.

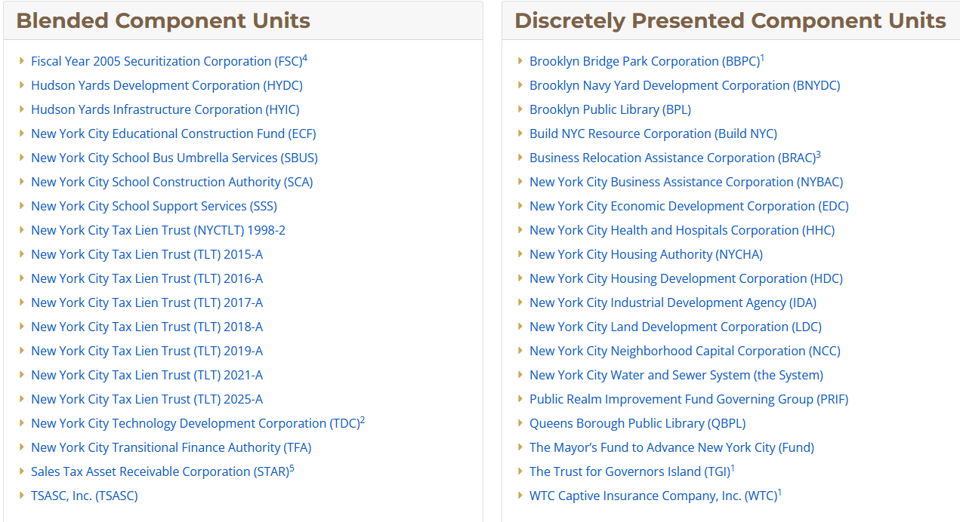

The Comptroller has reports for the School Construction Authority (how the city manages its school buildings), the Transitional Finance Authority (how the city borrows to finance its infrastructure needs, including school buildings), the Educational Construction Fund (a more marginal mixed-use bonding outlet that I’m interested in). But there’s a veritable swarm of component units through which the city borrows and repays its debts, too many to list, divided into “blended” and “discretely presented”:

Like, what’re all those lien trusts? What’s the Sales Tax Asset Receivable Corporation (STAR)? Does the Economic Development Authority finance anything relevant to education, like charters? Who knows where I’ll end up!

For this first post, I want to note a few things I’m seeing in the Comptroller’s ACFR, just on first glance, supplemented with other documents.

Education 040

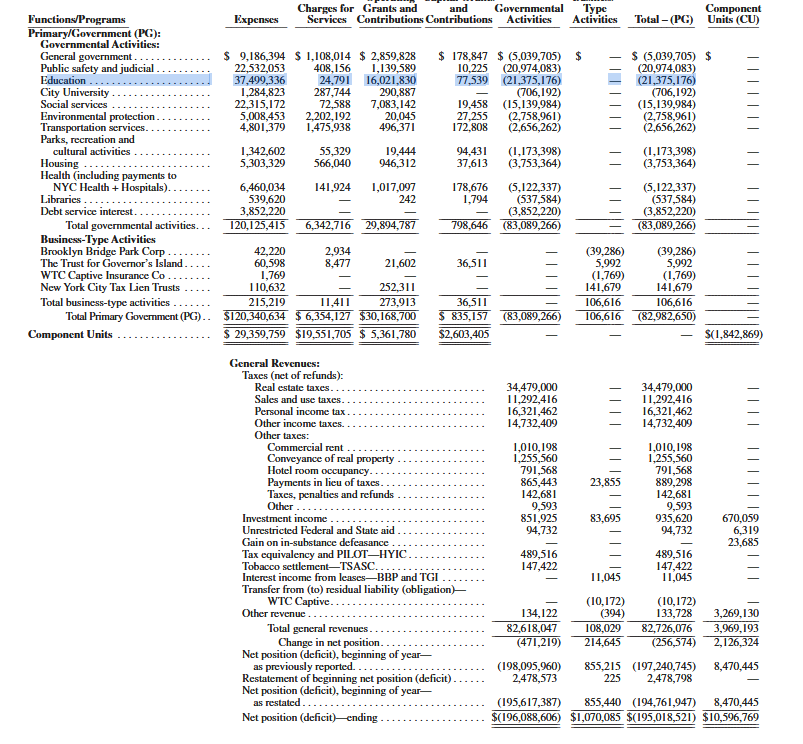

Let’s look at the overall statement of activities for the whole city, which is the hundreds of billions:

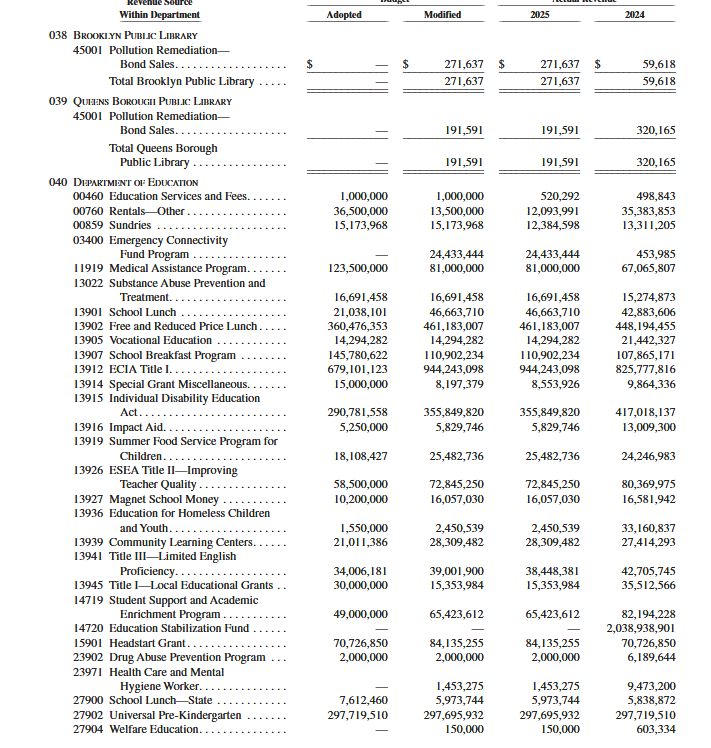

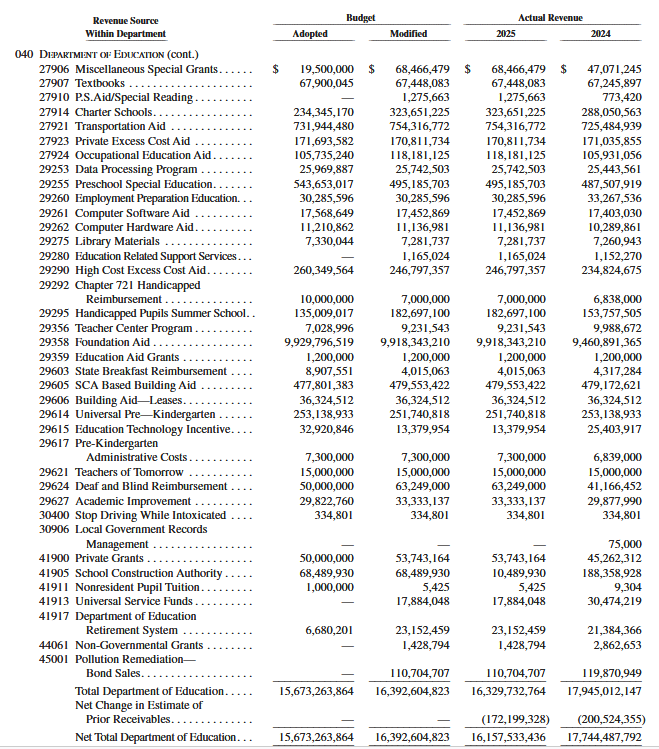

Education is about $37.5 billion. Woof. What’s in that number, specifically for the DOE? The accounting number is 040, and through it we see all the things the DOE spent on in 2025:

So the 2025 total modified expenditure on the DOE side was $16.4 billion, with an actual revenue of $16.15 billion. That leaves a gap/shortfall in the hundreds of millions, wonder what’s up with that? And how does this number differ from the $37 billion number before?

Now I’d like to look at some specific numbers, starting with the biggest: Foundation Aid (29358) is nearly $10 billion. That’s the big pot of money going out for operational expenditures, combining state aid (40%) with local tax revenues (56%). (For background, the IBO put out some cool reports.)

In 2024, the Education Stabilization Fund (14720) had more than $2 billion in it, but the 2025 number is blank. Why?

ECIA Title 1 (13912) is next at $994 billion, and there’s a big swing from the adopted budget to to the modified budget for this stream, to the tune of roughly $250 million. Wonder why?

I could go through numerically like that, but meh. I’m interested in debt and school infrastructure, which we can see in the following: Pollution Remediation—Bond Sales (45001) at $110.7 million—wonder what that is?

The School Construction Authority’s line (41905), is very wacky: the revenue in 2024 was $188 million and then decreases tenfold to $10 million 2025, with a modified budget amount of even less, at $68 million. What the hell? I know that the SCA is way behind on its targets for seat construction, but make this make sense!

Perhaps the issue is the difference with SCA Based Building Aid (29605), which gets to $479.5 million. It could be that the wonky numbers above are the SCA’s operating expenses?

There’s a sizeable increase in charter school spending (27914)between 2024 and 2025, which increased by $35 million to $323 million. Why?

I always like to look at vague categories, like Miscellaneous Special Grants (27906), which increased by about $11 million. Sundries (00859), which cost upwards of $12 million. If we wanted to look into any of these more specifically we’d search for the accounting number and get the specific pages (oddly, these aren’t in the 535 page comprehensive report, have to track that down).

Debt questions

When it comes to the debt that the DOE has, how can we know it? I have questions.

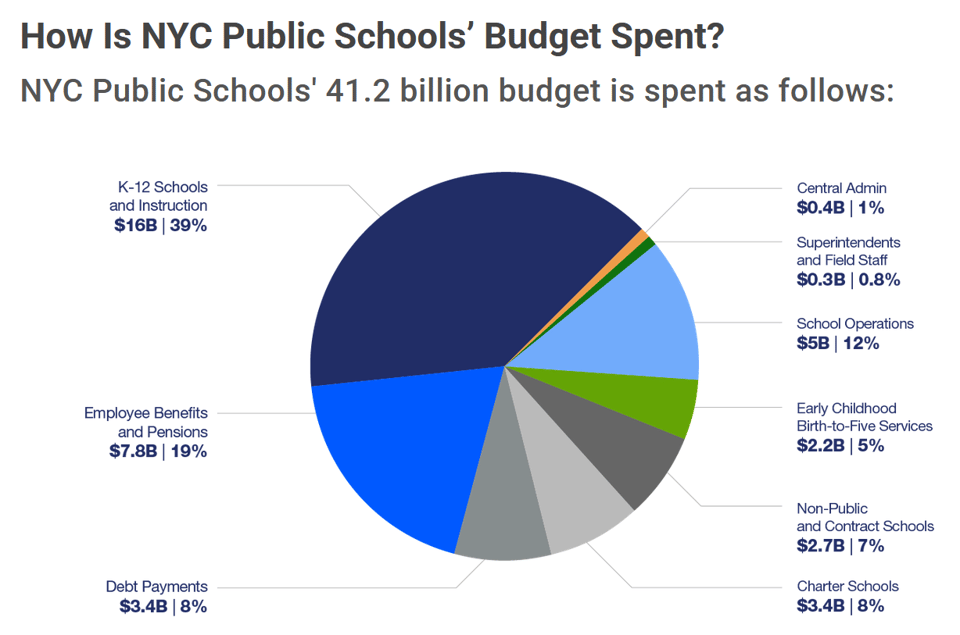

First off, the audited financial statements for the DOE only go through 2024, even though the comptroller released statements for 2025. Why is the DOE behind? Is that typical? When the DOE puts out its budget numbers, we see a $3.4 billion debt as part of its pie chart. That’s the same as it spends on charter schools. So we could pay off our debts with the money we spend on charters!

But how does this $3.4 billion break down? Where does it come from exactly? This is where I’ve tried to find up to date information and it’s difficult. The ACFR doesn’t list debt service in the DOE expenditure. The DOE doesn’t have its ACFR published.

But then I finally figured out where the most up to date info is, particularly for debt.

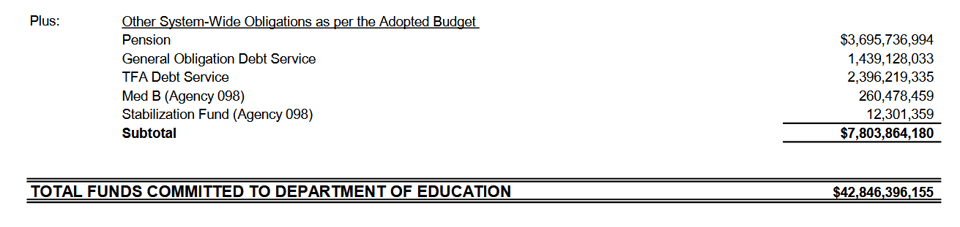

You can find up to date financial documents, called financial status reports, published six times a year. Here’s the one from September 25th. Here we can find very precise debt information.

So we can confidently say that the DOE has actually about $3.7 billion of outstanding debt service, broken down as $1.44 billion general obligation debt and $2.4 billion in TFA. That’s an increase of $300 million from the last time the DOE made the pie chart above.

We also know from the DOE’s financial reports that it can’t issue it’s own debt. And if the city can’t pay its obligations, state aid goes to pay them off.

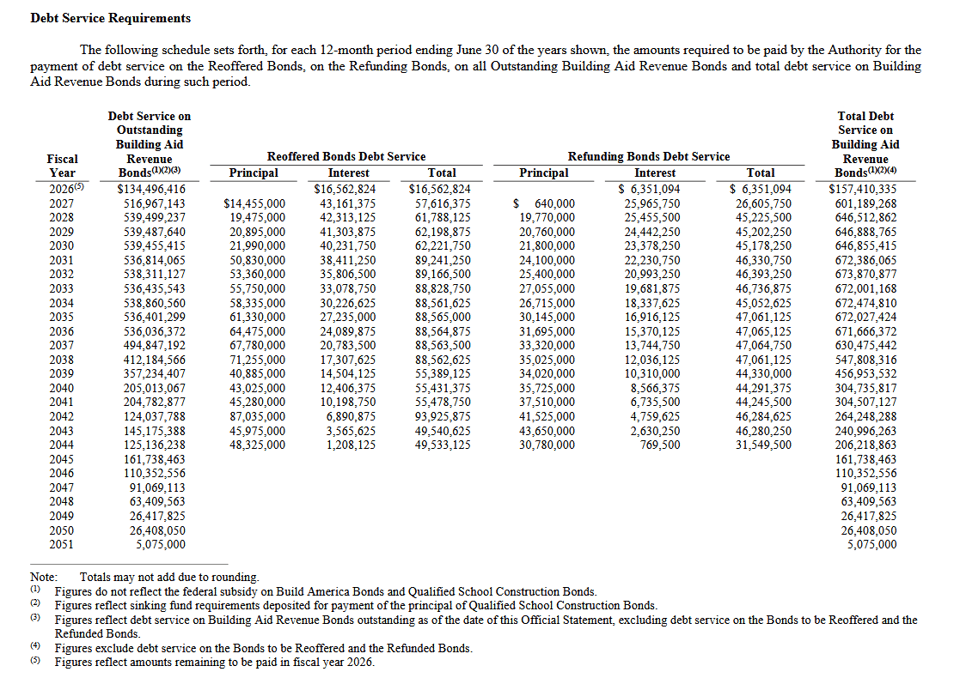

Where does this debt go? Here’s a breakdown of repayment of interest and principal from a recent building aid revenue bond statement, p. 29.

What gives me pause is the big increase in repayment coming in 2027 when Mamdani has been in office for a year. It goes from $134 million in 2026 to $517 million in 2027, with parallel increases in interest. I’m also looking at the interest paid on refunding bonds, which will double between 27-28.

But this table is all for the TFA debt, which funds the SCA. The former, the GO bonds, must be general expenditures, but I’d love to know more. I also want to know about the stabilization fund (which I asked about above) and Med B. These are obligations but not necessarily debt obligations. Notably the pension obligation is about as much as the debt service.

The next step would be to look at the SCA’s financial report, which the comptroller does have, but I’ll leave to next week!