Conn men?

Announcement: I'm giving a lecture at Teachers College, Columbia University this Thursday at 5:30pm titled "Education Finance, Statistics, and Philosophy." I'll be drawing from material I write about in this newsletter. If you're in New York City and want to come, please do! It'll be in Thompson Hall Room 229. If you want to join a zoom and listen in, use this link. I'll also publish a version of it here afterwards. Now onto the week's post!

*

I'm getting interested in higher education finance, and I saw an article in the Chronicle of Higher Education's newsletter that caught my eye. It covered a fiscal crisis at the University of Connecticut. The system announced that it was projecting a $70 million budget deficit for 2025 and that they'd have to cut budgets by 15% over five years to stay out of the red. This led to a faculty open letter detailing the havoc these cuts will wreak and widespread concern.

Generally I'm wondering about the financial architecture in and around this budget hole. The Chronicle article mentions a reduction in state aid in the wake of federal covid funding drying up--which is surely a thing, even in K-12--but what's the context of that state reduction? And what else is happening with the university budget? What questions would I ask?

Caps

I wrote an initial post about internal budget information I found, which I sent around and even made a tiktok about. I'm including that stuff below, which is relevant for sure. I got some good feedback on bluesky from the chair of the history department at UConn though, who was actually quoted in the reporting above. So I'm starting with what I learned from the CT Mirror's in-depth reporting on the state's fiscal situation post-pandemic.

The big talking points about these cuts have been about declining state aid, which is happening because of federal covid funds drying up. The more initiated point to pension contribution debt as well, sapping state monies. But from what I can tell, the declining state aid has to do with a spending cap policy the governor's administration can control. They're just choosing not to.

Connecticut was famous in the postwar era for not having an income tax. That's more or less why the southwestern part of the state has all these big houses: rich people moved there from New York State to get out of paying income taxes. That was all well and good, but by the 80s--deindustrialization, etc--this was untenable.

CT passed an income tax to get budgets in order, along with rules around how much state agencies can spend as a proportion to household income and inflation. That's a spending cap: programs like higher education can only get a certain amount of money relative to how much money people make and how much inflation goes up or down.

The Mirror articles detail the history of this policy over the years. What's important is that many administrations found ways of working with this cap to make sure important programs got money. While some in the state are blaming pension contributions as a big pressure on state spending right now, as we know, pension politics are all about market projections, and the last few years of economic data have been all over the map (plus former governors declared pension contributions cap exempt!). So I don't think it's quite fair to blame public pensions, particularly when you consider recent cap policy decisions.

In 2017, fiscal conservatives made the cap policy more stringent. They called it a "guardrail" against spending. That tight, stingy cap policy is actually still in place, even as federal funding dries up in 2025, which Lamont was fine to spend lavishly, and inflation goes down, making the cap policy even tighter. Plus, the state has a $3.3 billion rainy day fund and money coming in from other revenue sources. It's fine!

Conditions have changed since 2017, or maybe even early last year when people thought inflation was more entrenched. It was actually transitory, like all the leftists said it was, and, so, what, should UConn professors lose students and programs because the Lamont administration won't get with the times?

This feels like the kind of thing that professors could organize around and try work stoppages or other big actions. Pressure the Lamont administration to make pension contributions exempt from cap policy, ease the stringent cap policy, and increase that state aid. It's in their power to do it.

But the university still has options too, or at least faculty should look at some specifics to pressure the administration to go back to the governor and push for the demands I laid out above.

Ledgers

The first announcement of the cuts was a line on a powerpoint presentation that said that a "~15% permanent 2-Ledger reduction required with selective reinvestment" was required. This language was echoed in a campus newspaper article on the faculty response: "a 15% reduction in the permanent two-ledger budget." What's a permanent two-ledger budget? Are there other budgets?

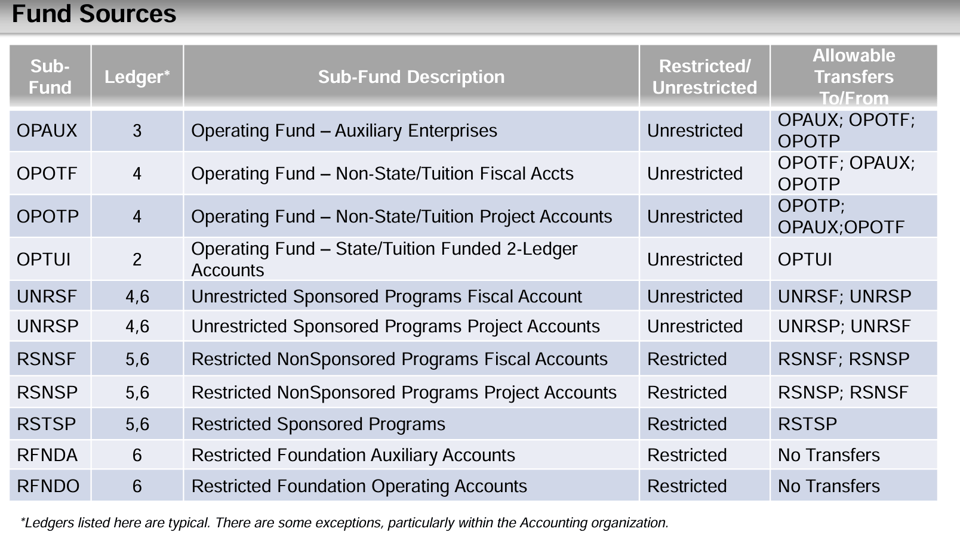

According to a UCONN budget fundamentals document there are multiple subfunds of the main operating fund and the 2-ledger permanent fund is only one of eleven different funds, six of which are unrestricted. The 2-two ledger unrestricted budget is for "state/tuition funded 2-ledger accounts," which makes me think there are multiple of these 2-ledger accounts. Sure enough, there are.

According to a transfer guidance document from 2016, there are at least two kinds of 2-ledger funds: permanent and one-time. In their presentation announcing the original cuts, they do say they're going to have to dip into the one-time funds to cover budget holes in the permanent fund. It looks like this 2-ledger permanent budget fund is the main artery of state monies and tuition, which I look at a little bit later.

But what about these other accounts from the chart before? What's a six ledger budget? five? etc? Can we see those maybe? What's up with the money in "sponsored programs" fiscal and project accounts, and the "non-state tuition" project and fiscal accounts (is this federal, eg)? What's the difference between project and fiscal accounts? I'd like to see the budgets for those. If they're unrestricted, then couldn't they be mobilized?

Funds

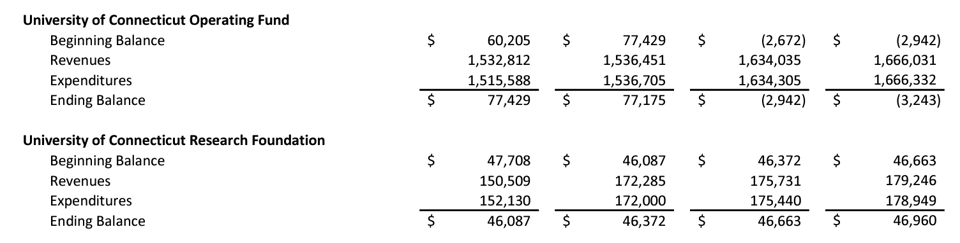

Thinking generally about state monies, when we look at the governor's budget we can see the university headed into the red, you can see in the Operating Fund line the parentheses indicating negative beginning balances and ending balances, popping up like little terrible poisonous weeds, the numbers getting bigger:

I have questions though. What's up with the "University of Connecticut Research Foundation"? It's pretty flush with a beginning balance that's more than two-thirds the operating fund. It's money is going up actually!

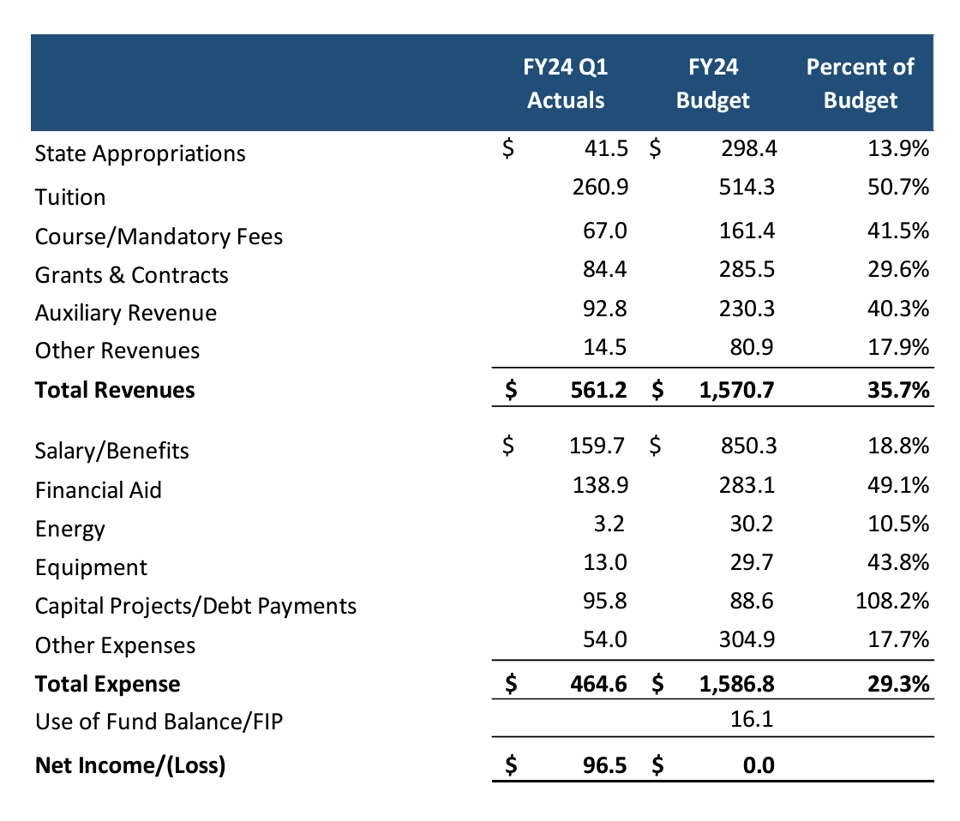

When we look at the university's quarterly reporting from Q1 of 2024, here are the percentages of revenues and expenditures.

It's interesting to me that state appropriation is 14%, tuition is 50.7%. That's a sizable chunk but it's not everything. What about that auxiliary and "other" revenues? Is that all covid funds, or is it something else? Are state reductions the whole story? Like, oh, would you look at that: capital projects/debt payments is 108% of the quarterly budget? Let's look at a bond statement to check that out.

Underrighting

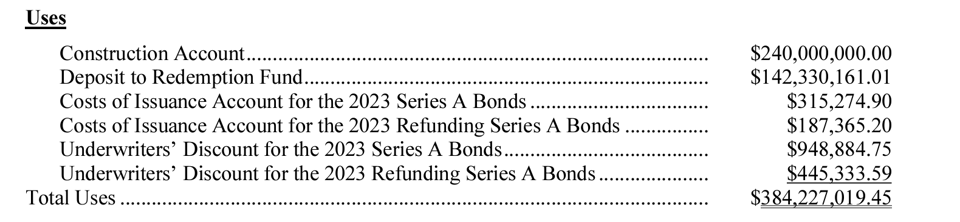

The most recent statement is an amendment to a refunding bond series from 2023. One thing I see right off the bat is a pretty sizable underwriter's discount from these bonds, which combined from 2023 adds up to over a million dollars. Why is the discount for the original series almost twice that of the refunding series?

But also look where the money is going. $240 million is going to the construction account and $142.3 million is going to the "Deposit to Redemption Fund." I wonder what's happening with that DRF? Is it like a sinking fund?

The construction account pays for projects in the UConn 2000 Infrastructure Improvement Program. Starting in 1997, that's an ongoing $4.6 billion project to improve the university's infrastructure. The legislation that jumpstarted the infrastructure program enabled the university to sell its own bonds. As of 2023, the University owes about $1.4 billion in principal on general obligation bonds in this program (some of which is paid by the state I think), which it's been taking out since the program started. Add to that $271.5 million in principal owed on special obligation bonds that are paid from "certain pledged funds" including student fees. I wonder those are the funds in the other accounts above?

The Board of Trustees approves all these bonds, but do the faculty have a say? What're all the project that are going to be funded? Do they really need them at this moment of budget crunching?

There's a lot here, but I'd at least start by asking these questions. If you have any insight into them let me know! Meanwhile, I'll keep digging.