Bondfinders

Some exciting news! After working with the press on the promotion of my new book As Public as Possible, they gave me a discount code for readers of this newsletter.

If you pre-order the book now, you can use the code TNP30 to get a discount.

Meanwhile, I’ve got some book event dates set up. Here are the dates and places so far:

12/3 @ 7pm - HUUB, Orange, New Jersey

12/10 @ 6:30pm - Skylight Room, CUNY Grad Center, New York City, co-release with Celine Su

1/12 @ TBD - School for Advanced Studies in Social Sciences (EHESS), Paris, France, with Nora Nafaa

If you want me to come do a talk, either online or in person, with your group/office/chapter/whatever, I’m happy to set it up. Just respond to this email. More dates to come!

***

Since they’re so difficult to find, catalogue, and understand I’ve been looking for ways to find out about municipal bonds. Recently I’ve run into a handful of new ones and I thought it’d be interesting to share each of them here.

The original and best way to find out about municipal bonds is the Electronic Municipal Market Access dashboard (EMMA), which is free and open to the public. It takes a bit of searching to find the right entity for your inquiry, but if you just keep searching you’ll find a page that has recent bond documents, financial disclosures, event-based disclosures and the like. It’s my go-to. There’s just something about EMMA.

But there are others, some require a subscription but some don’t.

MuniOS has a very pleasing dashboard and search function that finds issuing authorities and recent bonds. It’s visually much easier to deal with than EMMA but it lacks all the documents. But you can find the bond document and basic information about it.

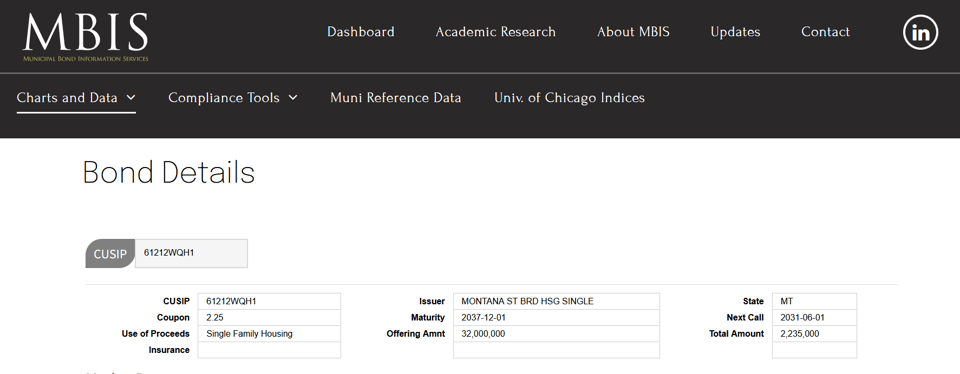

Municipal Bond Information Services (MBIS) also has a relatively pleasing dashboard, and you can search by CUSIP number to get all kinds of information about bonds. It also finds comparable bonds and charts yield, spread, and price. It’s somewhat investor-oriented but it’s still a free source of information about municipal bonds.

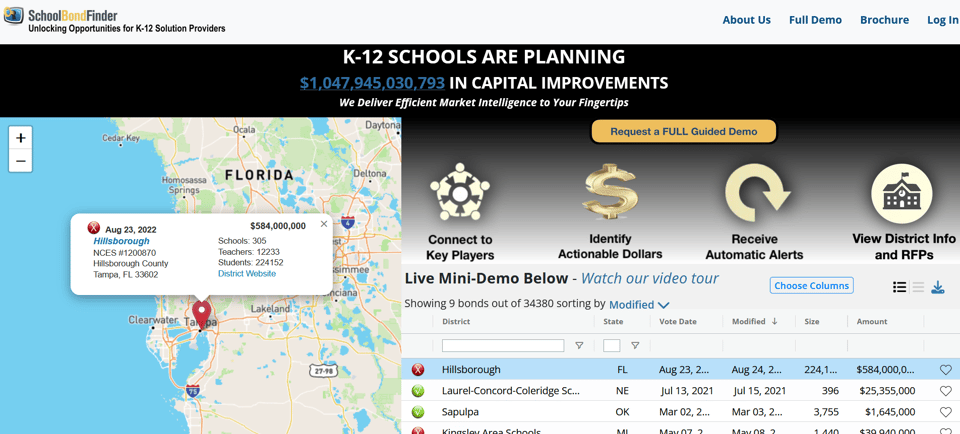

I was shocked to find out about schoolbondfinder.com, a service that tracks school bonds specifically. You can search for information on school bonds across the country from an infrastructural perspective, with up to date information about leaders, consultants, architects, etc. It also tracks upcoming bonds that are in process of being planned (which would be super helpful for green school infrastructure organizers, since we can know which districts are still considering their projects). It’s a prescription service, but the founder is very amiable and provides free subscriptions for research under certain conditions.

The final venue, MuniBonds.AI is a municipal bond clanker. They use artificial intelligence to track municipal bond information for potential investors. The use of AI is pretty astounding, including the creation of podcasts you can listen to, generated by the AI program that analyzes documents and creates podcasts. They have a naughty list where you can listen to the fake people talk about the real municipal finance in Nassau County, Long Island.

It’s…bad. As someone who reads municipal bonds for a living, I found the podcast vapid and lacking in real information. Maybe to the investor-brain it makes sense but it doesn’t have much for us. Except perhaps this “naughty list” and how they break it down. But also to think about the horizon of municipal finance in the time of AI.

It’s fun to play around with all these and see what you can see. Put in your school district, county, city, or other kind of local or state government and see what comes up!