More Sales Taxes Incoming

Given today’s Board of Supervisors vote we are almost certain to see a new 0.625% sales tax increase on the June ballot. The new tax will push overall sales tax rates toward 10%, and in some cities well over that threshold. This tax disproportionately affects lower income families buying clothes, school supplies, and other essentials.

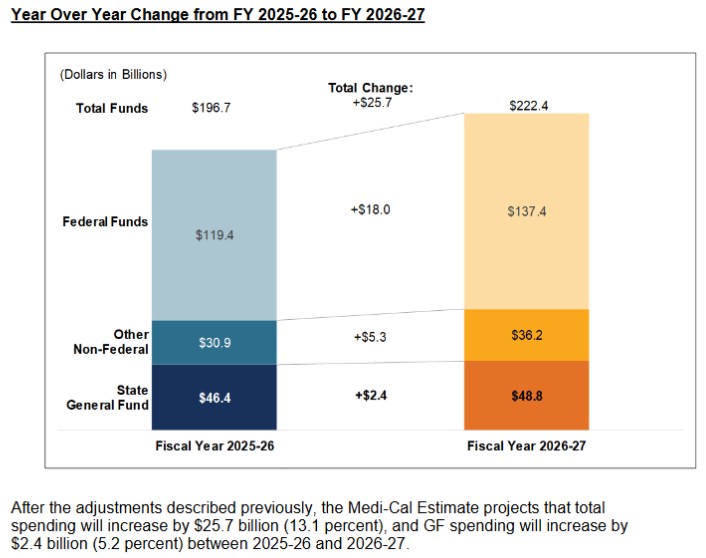

There was no valid FINANCIAL reason for Supervisors to rush this measure onto the June ballot. The stated reason is to offset federal cuts to Medi-Cal. But the bulk of those cuts do not kick in until the after mid-2027. In the upcoming fiscal year (2026-2027), the Governor’s budget forecasts a significant INCREASE in federal assistance for Medi-Cal.

Meanwhile, SEIU-United Healthcare Workers West is planning to place a measure on the November ballot, the Billionaire’s Wealth Tax, which is intended to fully offset federal Medicaid cuts over the next five years. While I don’t agree with it, that’s not significant for this conversation. If it passes and stands up in court, state and local government will have all the money they need to maintain and continue to grow healthcare spending.

The reasons for pushing this measure onto the ballot so quickly are POLITICAL. Contra Costa Supervisors saw that their counterparts in Santa Clara County were able to persuade their voters to pass a 0.625% sales tax measure using the same argument about Medi-Cal cuts. What worked in Santa Clara could well work in Contra Costa.

The second issue is if they waited for November, their sales tax measure would be on the same ballot as the proposed 0.5% transit sales tax. The obvious concern is that voters could be overwhelmed by too many taxes at once and start saying no.

So, they will bank on your short memory and boil the frog slowly. Perhaps those with a longer memory will recall that sales tax in most of Contra Costa County was just 6.5% in the late 1980s. Was life a veil of tears back then or were public services adequate? If the latter, the relevant questions are (1) why can’t local government live with existing tax rates and rely solely on economic growth for higher revenues, and (2) where does this all end? Are we headed for 15% sales taxes and $5000 per property of special taxes? Is there any limit?

Upcoming Events (all lunches at Denny’s)

Friday. January 23rd: Contra Costa Governments Spend Big – Get a breakdown of CoCo County’s $13 billion public sector from my recently released research paper.

Friday, February 27th: Get the Full Story on Marin Clean Energy from MCE CEO Dawn Weisz. Note change in speaker. Rather than center our program around an outside critic, we will give Dawn the platform to respond to previously published criticism and to address our questions.

Friday, March 27th: When Public Schools Stray from Education – Attorney and public school mother Laura Powell will discuss her thoughts about the waste and parental rights violations occurring as local school districts focus on student gender identity rather than teaching the ABCs.