The Majesty of Simplicity

Perhaps like many of you, I recently filed my 2022 tax returns. I always try to itemize my deductions, and this year, as I was working on them, I was struck by how simple it was to do that.

I use Intuit's Turbotax product and have for many years. That enables me to import all my data from last year, add and delete as necessary, and update the numbers in all the various categories.

Another thing that makes the process relatively painless (except when I have to pay some taxes) is that I have all of my finances consolidated at one firm (Fidelity Investments), which enables me to get most of the information I need from one place.

I can get my normal 1099 information (income and withholding) and transaction data if needed to help with the deductions.

I know some people don't like consolidating to that extent, as it introduces some institutional risk. I would be negatively impacted if Fidelity had a significant financial or technological failure. However, I think the risk of such an occurrence is low; for me, the positives outweigh the risks.

The value of simplicity

If you read the "About" page on this blog, you will see that one of the things that I value, espouse, and have tried to practice in my retirement stewardship is simplicity:

My basic views on personal finance are that I value simplicity over complexity and pragmatism over sophistication. I believe that money is a gift from God and a means to an end, not an end in itself.

I'm not talking about a Zen-like approach to personal finance such that we just put all of our money in a jar, hide it in a closet, and hope it stays safe and grows as we meditate on it and send it positive energy. No, I'm talking about a practical simplicity that reduces complexity, increases transparency and manageability, and enhances focus and decision-making related to our saving and investing decisions and actions.

Now I'm not suggesting that practicing simplicity in the context of retirement stewardship is basic, easy, or non-complex. There are many aspects to it. Instead, I'm discussing working through the complexity to achieve what financial planning author Carl Richards calls the "elegant simplicity that is on the other side."

Finances and the issues related to retirement stewardship can be pretty complex. There is no one-size-fits-all "simple" solution for any one person's retirement stewardship—there are just too many variables. Saving, investing, retirement income, Social Security, health care, long-term care, life insurance; the list goes on and on.

My goal, then, has been to simplify some of the complex questions about saving, investing, and providing income in retirement. So, in this article, I want to discuss some things you can do to simplify your financial life. Exactly how you do this and when will vary based on your unique circumstances, needs, and desires.

Here are some things you might do to reduce the complexity of your financial life:

Reduce the number of your bank accounts

One of the most important things you can do to simplify is to reduce the number of financial accounts you must manage. When it comes to this, more simply is seldom better. More accounts can mean more complexity and confusion. "Truth is ever to be found in simplicity, and not in the multiplicity and confusion of things." — Sir Isaac Newton.

You probably don't need more than one savings/money market or checking account or have accounts with many different financial institutions. If you reduce them, you'll have lower fees, better service, and make them easier to optimize.

If you need multiple accounts to help track your saving and spending, the alternative is to break down a single bank account into virtual sub-accounts and track how much goes into/out of the different sub-accounts.

Some people do that with a simple spreadsheet, which can get tedious. Another option is to use a money management tool to do that. (I've previously used Quicken, but now I use Banktivity, mainly for that purpose and tracking expenses.)

With that software, I can "virtually" add and subtract money from my sub-accounts as needed. I use it for all my sinking funds and saving sub-accounts, including my emergency fund, but it's all under a single Cash Management Account at Fidelity.

You don't have to purchase software like Quicken or Banktivity to do this. You can use something like Mint.com or a similar service. Some banks may offer this capability as part of their online banking services.

Reduce the number of your investment accounts

To manage your assets, you need a minimum of statements, which means a limited number of accounts.

Many of you have been saving for years—probably because you are older and have been with an employer with a 401(k) or 403(b) program. And if they didn't, you were at least contributing to an IRA outside of work.

So now you have some retirement savings accounts (or will eventually), perhaps of different types. (And hopefully, you know where they are. Don't laugh—people do lose track.) As you plan for retirement, you must ensure that those assets grow and earn income (and certainly that they don't disappear) so you can use them when you reach retirement age.

By retirement, you will probably have worked at different organizations and participated in approximately the same number of retirement plans. You may have some of your own (IRAs), perhaps more than one, and you may have a spousal account or two in the household.

Whether you're getting close to retirement or not, you need to get your assets consolidated and organized as soon as possible to track what's happening with them and manage them holistically as a single portfolio of investments.

Doing incremental consolidation is an excellent idea, but by age 55, you need to get your act together. By then, they will hopefully have grown to the point that they need serious attention and active management. However, that probably won't happen if you slice them up into different, random accounts scattered everywhere.

How to consolidate your retirement accounts

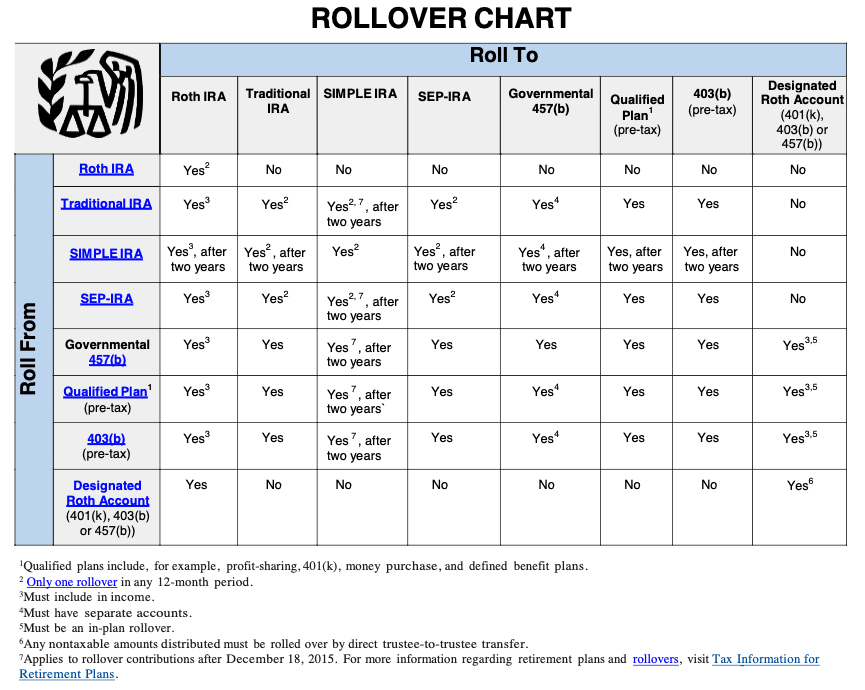

The best way to consolidate old retirement accounts is through "rollovers." You can generally roll over retirement accounts into other ones to reduce them.

The chart below is taken from the IRS site and shows different "from/to" possibilities, including "Qualified Plans" like Pension Plans and 401(k)s. (If some of the terms on this chart don't make sense to you, don't worry – most would be mainly concerned with "Qualified Plans" [like 401(k)s]-to- IRA transfers.

As you can see, the key is like-to-like (based on IRS classifications) consolidating of accounts. You can't merge an old Traditional 401(k) account into a Roth IRA, nor can you consolidate a Roth IRA into a Traditional IRA. There will be limits to how much you can combine based on the number and types of accounts you have.

Before I retired, I consolidated all my retirement accounts (except for a Roth 401(k) I had with my employer) into a single Traditional IRA brokerage account. I LOVE having it all in one place.

Where to consolidate these accounts is, of course, up to you. I recommend considering low-cost, high-quality service providers such as Vanguard, Fidelity, and Schwab. Each of these companies can handle the transfer and consolidation for you so that the money doesn't flow through your hands, which helps ensure you don't get hit with any IRS penalties.

Consider combining accounts to reduce the confusion about account statements and to improve your ability to understand how your assets are doing. If you don't, you may find things somewhat tricky before you retire and regret it after you retire.

Go paperless

We'd all have to acknowledge that nowadays, financial management is all about computers, tablets, smartphones, and the Internet. You can say goodbye to paper if you want to. All financial institutions now offer electronic trading, statements, and auto transfer and deposit options. I've changed all our statements to email or digital (online), even for our largest investment accounts.

One word of caution here, however: Ensure that your important emails don't get lost in the sea of triviality that we all deal with in our email accounts. If you are like me and get loads of emails (and perhaps have more than one email account), consider setting up an email account that is used just for your important financial accounts and other services. That way, essential communications, statements, and documents won't get lost in the ever-rising tide of incoming emails.

If you're still working, if you're not already doing it, auto-deposit your paychecks and make auto-withdrawals of any savings you are doing outside of what your employer is withdrawing from your pay, such as 401(k) contributions. You can set up auto-deposits to most checking and savings accounts, and IRA accounts for retirement savings.

If you're already retired, auto-deposit your Social Security check and other regular payments such as pensions or annuities. You can also set up automatic withdrawals from your retirement savings if you need them for income.

Finally, if you "go digital," you'll log into your financial accounts more often. Be sure you take care to use strong passwords. I also suggest using a password vault (like Last Pass or 1Password) to generate and store all your passwords. I started using Last Pass many years ago and wouldn't be online without it. (You can read more about online security here.)

Simplify your investments

In this context, I would define simplicity as "accomplishing our investing goals using the fewest possible number of investments and investment accounts, requiring as little time as possible to manage, while appropriately managing risk."

I've recently worked with some blog readers to help them simplify their retirement savings and investment accounts. In both cases, I observed a lot of complexity regarding the number of investments held in the accounts. In one case, there were several mutual funds of the same asset class, which is usually an unnecessary level of duplication for a diversified portfolio.

I believe that, when it comes to investing, less is more. We introduce needless complexity when trying to find the 'perfect' investment, or combination of assets, to reach our goals.

Complexity can cause you to tinker with your portfolio continually. You will be tempted to constantly fine-tune it since it has many moving parts. That probably gets most individual investors into trouble – buying and selling too frequently and often at the wrong times.

You don't need ten or twenty different stock mutual funds when we can own a few that contain hundreds or thousands of individual stocks diversified by size and type. So, when building a portfolio, you rarely need more than ten or fewer mutual funds and/or Exchange Traded Funds (ETFs) to implement your investment strategy.

Some investing experts, like Rick Ferri, believe you can get by with as few as four. Others say even less. Also, it's best to avoid supposedly safe, high-yielding investments like GNMAs, MLPs, and closed-end funds, not because they are necessarily a bad investment, but because they take time to fully understand how they work, the risks involved, and how they should be managed.

Once you (or your advisor) have decided on a diversified portfolio of 4, 6, 8, or maybe ten funds (take a look at Tim Mauer's 7-fund "Simple Money Portfolio," all you need to worry about is rebalancing it periodically and adjusting your allocation as your risk tolerance changes. (Tim's model portfolio with 60% stocks is high risk, so you might want to tamp it down by adding more bonds.)

Keep it simple

I like this quote from Albert Einstein: "Keep it simple: as simple as possible, but no simpler." Simplicity is good, but everyone's situation is different. I have simplified as much as I need to or want to. I did it for my sake and my wife's and anyone who may need to help her if I can't manage things.

I have one checking account for day-to-day transactions, one savings account, one traditional IRA, and one Roth IRA, all at Fidelity. I manage all of these at fidelity.com and with Banktivity.

We have twelve investment positions between the two retirement accounts, including a government cash reserves fund. I may pare it down even further, perhaps one or two balanced index funds for retirement income and an immediate income annuity. I'm not ready to go that far quite yet.

Simplify, but don't do it in ways that could be detrimental to your financial health (for example, going all-in with a variable or indexed annuity that you don't understand or investing in a single, all-stock-market index fund at age 70 and no others for diversification or a single target-date retirement fund that isn't appropriate for your age and risk tolerance).

Too many accounts and investments can sap you of time, energy, and attention from more important things—like living life.

I'm not saying you don't need to pay attention to your investments; you should, whether managing them or paying someone to do it for you.

But simplifying in both near- and post-retirement will lead to less time, less paper, less cost, less worry, and less bother to manage. The fewer details you have to track, the easier it is to optimize the ones that matter. This is "elegant simplicity."

John Bogle, the founder of Vanguard and creator of the first index mutual fund, died a multimillionaire. He was not a billionaire, like some of the Wall Street characters who don't have his sense of ethics or public service. He wrote an excellent book titled, "Enough: True Measures of Money, Business, and Life," among others, and wrote:

…the key to whatever success I may have enjoyed during my long investment career is that the Lord gave me enough common sense to recognize the majesty of simplicity.

I think Mr. Bogle summed it up pretty well.