✅ You've got a month to check your state pension

✅ Checksies

Money things to read, money things to do.

7 March 2025

Hi, long time. This is Checksies. You signed up for it ages ago to get occasional money ideas from Anna and Rod, who are not financial advisors. Unsub details are at the bottom, but don't because it's good.

(Before we get into it: What money stuff do you want us to write about? Hit reply.)

There's a deadline coming up for state pension top ups: 5th April 2025

For most people the state pension will be £221.20 a week, or £11,502.40 a year. That's the 2024-25 value of the state pension. (The state pension is linked to inflation, so when you do retire, it's going to feel like £11,502 does right now.)

Your National Insurance (NI) record affects the amount of state pension you'll receive when you retire. You need 10 years worth of NI contributions or credits to receive any state pension, and most people will need 35 years worth to receive their maximum forecast amount.

If you've always had full time jobs, then you and your employer have probably been paying NI - you can see the deductions in your payslip.

But if you're self employed (hi), you might have some gaps in your NI record. If there are too many gaps, you might get a smaller pension.

You can make manual "top ups" to fix gaps in your National Insurance record. Make a one-off payment now, and you increase the amount of state pension you'll get every week until you die. After 5 April 2025, you can only fix gaps going back 6 years. But until 5 April, you can fix gaps that are older than 6 years. So if you have a lot of gaps, you might want to deal with them quickly.

To work out if you should top up your state pension urgently, here's your to do list.

1 - Check your state pension age

Go to GOV.UK - you need your date of birth. This will tell you the earliest date you can start receiving the state pension.

2 - Check your state pension forecast

Next you check your state pension forecast, also on GOV.UK - you need a Government Gateway account to do this. You've probably already got one if you've renewed a passport or driving licence in the last 5 or so years.

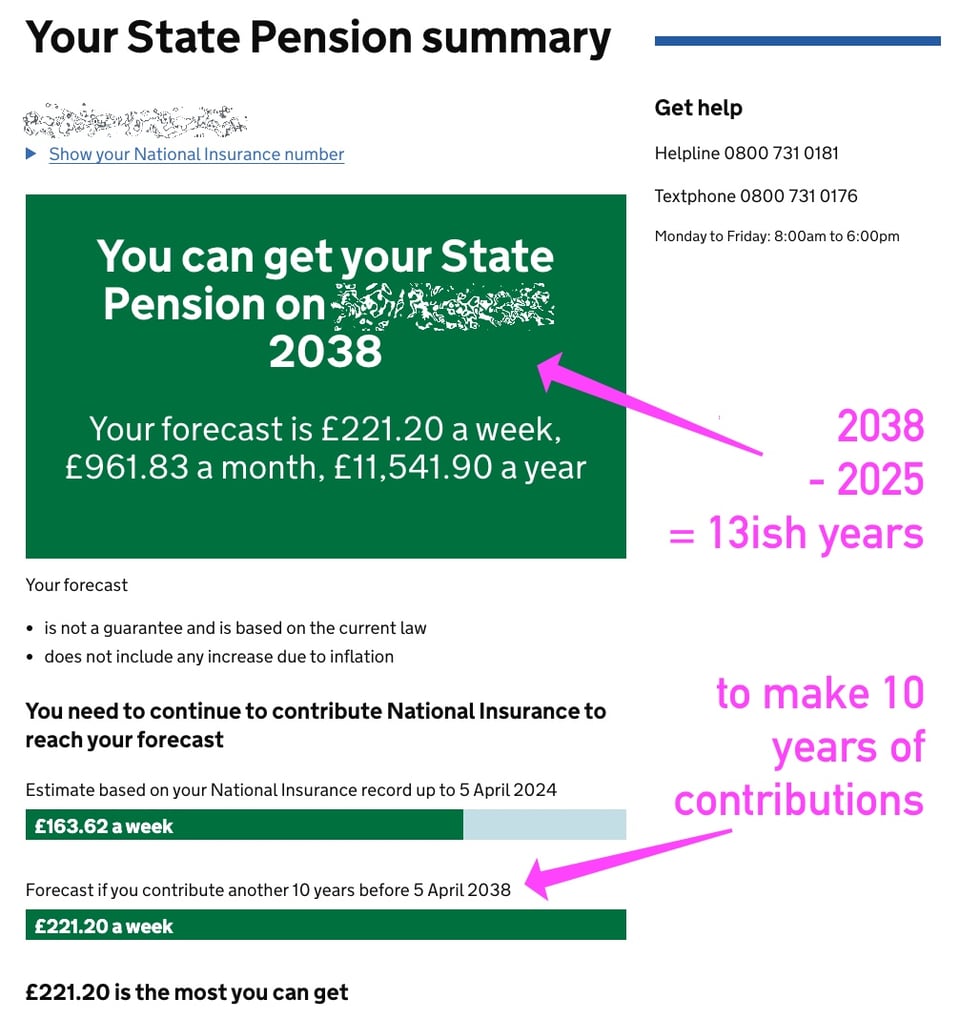

It'll tell you your state pension date, and provide 2 forecasts, what you're currently entitled to, and what you'll get if you contribute another X years of NI.

That second forecast is important info: this person still needs to contribute another 10 years of NI before their state pension age if they want to maximise their state pension.

If you don't need to contribute any more NI (we, er, don't have a screenshot of that), you're all done and can get on with your day.

3 - Decide if you need to fill some gaps in your NI record

You can see your National Insurance record here - you need a Government Gateway account to do this.

For each year it'll show if you have a "full" year or not of contributions, and whether you can fill any of the gaps ("payable gaps").

Next, you'll work out if you need to act urgently.

Do this sum: years of NI contributions still needed MINUS years til state retirement age

(Worked example from the image above: 10 years still needed - 13 years til state retirement age = -3)

More than 6 | 🎸 🔌 Consider urgently filling in the gaps that are older than 6 years before the 5 April deadline.️ |

Between 0-6 | Consider filling in gaps, but you don't have to rush to beat the 5 April deadline. |

Less than 0 | ✅ Do nothing, you're on track. Or fill in gaps if it gives you peace of mind. |

And if your years of NI contributions still needed is 0... | ✅ Do nothing, you're all sorted! |

Is it worth doing though?

Very rough rule of thumb, for most people (NI has lots of small rules): if you voluntarily pay for 1 year's worth it will probably cost you either £179 or £907, depending on the class of NI you pay. And your state pension will go up by an extra ~£5.80/week or ~£300/year while you're retired. If you live for 20 years after retirement age, that adds up to an extra £6,000 to you. For most people it's worth maxxing out their state pension.

4 - Fill a payable gap in your NI record

There are 2 ways to fix a gap:

You might be able to do this online from your NI record - it depends if you were self-employed or not.

Or, if you are/were self-employed, you might need to contact the Future Pension Centre and talk to them first. Go here and request a callback. The callback will happen after 5 April (they're busy), but as long as you're in the system before 5 Apr you're ok.

OK, good luck.

More info on all of this: the GOV.UK guide is a really good walkthrough. And Moneyhelper) is also good, so is uncle Martin Lewis.

Caveats

This guide is for people who haven't yet reached retirement age. Pensions can have complex rules: they're different if you retired already, or were "contracted out", or retired before 2016, or live abroad (or etc). Read the GOV.UK state pension page, talk to [Moneyhelper(https://www.moneyhelper.org.uk/en/pensions-and-retirement/state-pension/state-pension-an-overview) or an IFA.

Thanks for reading

Were you forwarded this email by a friend? Sign up to receive Checksies - it's occasional.

Tell your friends to sign up: checksies.com

Small print

We're not independent financial advisors, so this isn't financial or investment advice. Before spending money on financial products, you should talk to an Independent Financial Advisor. The ones you want are qualified as "Chartered Financial Planners", and you can find one here. We're in the UK, which means we don't understand anything about advice, money or tax in other countries. We have biases. We hold shares in whatever Vanguard thinks is appropriate. We may also hold shares in individual companies, for instance our employers. We're trying to work out what's best to do, just like you are. Look after each other everyone.