the news of two weeks ago (sorry)

74 million euros for Ada Health from Berlin

Berlin-based digital health company Ada Health today announced a Series B financing round worth the equivalent of 74 million euros (90 million dollars). The financing was led by Leaps by Bayer, the investment unit of the pharmaceutical company Bayer AG. Other investors are Samsung Catalyst Fund, Vitruvian Partners, Inteligo Bank, F4 and Mutschler Ventures.

Ada Health has developed an intelligent communication assistant that, with over 23 million health analyzes carried out, has helped more than eleven million people with questions and answers to assess their complaints. In the coming months, the company plans to invest more heavily, especially in the US market. In addition, Ada is currently exploring a long-term partnership with Bayer, according to a press release.

74 Millionen Euro für Ada Health aus Berlin

Mit einer neuen Millionenrunde will Ada seine Präsenz in den USA stärken. Auch eine langfristige Partnerschaft mit einem Pharmariesen ist in Aussicht.

Origin.Bio Raises $15M in Funding

Origin.Bio, a Munich, Germany-based synthetic biology company, raised $15m in funding.

The round was led by EQT Ventures with participation from existing investor BlueYard Capital and new investors Taavet Hinrikus and Sten Tamkivi, Acequia Capital, Inventures and Charlie Songhurst.

The company intends to use the funds to expand the technology and team.

Founded by Jens Klein, CEO, Origin.Bio is a synthetic biology company which creates synthetic microorganisms that can make many of the same ingredients as traditional chemical industrialisation processes but with less energy requirements and waste produced.

Origin.Bio Raises $15M in Funding - FinSMEs

Origin.Bio, a Munich, Germany-based synthetic biology company, raised $15m in funding.

traceless materials Raises Lower Million Euro Seed Funding

traceless materials, a Hamburg, Germany-based circular bioeconomy startup, raised a seed financing round of undisclosed amount.

Backers included Planet A, HTGF and b.value AG.

The company intends to use the funds to continue to hire new people and to build its pilot plant, scaling production from laboratory scale to producing sufficient material to bring first pilots to market in early 2022.

Founded in 2020, traceless materials is a circular bioeconomy startup advancing technology that allows to use agricultural industry by-products to produce storage-stable films, rigid materials and coatings providing the beneficial properties of plastics while being fully compostable in the environment.

traceless materials Raises Lower Million Euro Seed Funding

traceless materials, a Hamburg, Germany-based circular bioeconomy startup, raised a seed financing round of undisclosed amount

Swedish healthtech startup Doktor.se secures €50M; aims to expand to over 7 countries by 2021-end

Based out of Stockholm, Doktor.se aims to improve healthcare worldwide, making it more efficient, more accessible, and more affordable. Recently, the healthcare company has secured €50M (SEK510M) funding from institutional investors Consensus Asset Management, Norron, and Skabholmen Invest, among others. The company is planning to use the fund to expand its footprint internationally and develop its technical platform to offer new and improved services for mental health and chronic illnesses. A part of the funding will be used to expand its digital operations and physical clinics to meet growing demand as well.

Swedish healthtech startup Doktor.se secures €50M; aims to expand to over 7 countries by 2021-end | Silicon Canals

Doktor.se, a Swedish company that aims to improve healthcare worldwide, making it more efficient, more accessible, and more affordable, bags €50M.

Noom Raises $540M in Series F Funding

Noom, a NYC-based digital health platform focused on behavior change, raised approximately $540m Series F funding.

The round was led by Silver Lake, with participation from Oak HC/FT, Temasek, and Novo Holdings and existing investors Sequoia Capital, RRE, and Samsung Ventures.

The company intends to use the funds to expand its business reach and for share repurchases.

Led by Saeju Jeong, Co-founder and CEO, Noom is a psychology-based digital health platform powered by data, technology, and human coaches. The company will use the capital to expand its behavior change platform to address a broad range of conditions with meaningful opportunity to further generate positive change across health, including stress and anxiety, diabetes, hypertension, and sleep.

Noom Raises $540M in Series F Funding

Noom, a NYC-based digital health platform focused on behavior change, raised approximately $540m Series F funding

NiKang Therapeutics Raises $200M in Series C Financing

NiKang Therapeutics Inc., a Wilmington, Del.-based clinical stage biotech company focused on developing innovative small molecule oncology medicines, closed a $200m series C financing.

The round was led by Cormorant Asset Management, HBM Healthcare Investments and Octagon Capital Advisors with participations from a premier syndicate of funds, including new investors EcoR1 Capital, Perceptive Advisors, Wellington Management, Ally Bridge Group, Pavilion Capital. Proceeds will be used to advance the company’s lead drug candidates into the clinic, expand the pipeline and fund internal drug discovery programs.

Led by Zhenhai Gao, Ph.D., co-founder, president, and chief executive officer, NiKang is a clinical stage biotech company focused on discovering and developing innovative small molecules oncology medicines whose target selection is driven by deep insights into disease biology and molecular pathways. The discovery approach is informed by target structure biology and capitalizes on structure-based drug design.

NiKang Therapeutics Raises $200M in Series C Financing - FinSMEs

NiKang Therapeutics Inc., a Wilmington, Del.-based clinical stage biotech company focused on developing innovative small molecule oncology medicines, closed a $200m series C financing

Akili Interactive Raises $160M in Funding

Akili Interactive, a Boston MA-based digital therapeutics company, raised $160M in funding.

The $110m equity round, which brought total equity funding to date to $230M, was led by Neuberger Berman Funds with participation from new investors Polaris Partners; Mirae Assets; Shionogi & Co., Ltd., New Leaf Venture Partners; Dave Baszucki, Founder and CEO of Roblox Corporation etc.

In conjunction with the Series D financing, Akili also closed a credit facility for up to $50M with Silicon Valley Bank.

The company intends to use the funds to accelerate commercialization of its flagship treatment EndeavorRx™, expand its core technology to treat acute and chronic cognitive disorders, and drive further research and development of new technologies to treat broader range of conditions.

Led by Eddie Martucci, PhD, co-founder and CEO, Akili Interactive is the maker of EndeavorRx™, a FDA-cleared treatment delivered through a video game experience. Indicated to improve attention function in children with ADHD, EndeavorRx is built on the Akili Selective Stimulus Management Engine (SSME™) core technology, a proprietary technology designed to target key attentional control systems in the brain. Delivered through an action video game experience, SSME presents specific sensory stimuli and simultaneous motor challenges designed to target and activate the neural systems that play a key role in attention function while using adaptive algorithms to personalize treatment for each individual patient.

Akili Interactive Raises $160M in Funding - FinSMEs

Akili Interactive, a Boston MA-based digital therapeutics company, raised $160M in funding

binx health Raises $104M in Series E Financing

binx health, a Boston, MA-based healthcare technology and diagnostics company, closed a Series E financing of $104m.

The round was led by OrbiMed, with participation from new investors Arrowmark Partners, Hildred Capital Management, Alta Life Sciences and Parian Global, and existing investors LSP and Johnson and Johnson Development Corporation, among others. In connection with the financing, Andrew Goldman, Co-founder and Managing Partner of Hildred Capital Management, will join binx health’s Board of Directors.

The company intends to use the funds to expand its business reach, ramp manufacturing, scale its proprietary binx io testing instrument and cartridges, expand its sales efforts in the U.S. and abroad, and further build out its proprietary software platform and data infrastructure.

Led by Jeff Luber, Chief Executive Officer, binx health provides in-clinic/at-retail locations with the binx io rapid molecular point of care platform that offers onsite convenience in a CLIA–waived solution for chlamydia and gonorrhea that can provide testing, diagnosis and treatment in the same visit.

binx health Raises $104M in Series E Financing - FinSMEs

binx health, a Boston, MA-based healthcare technology and diagnostics company, closed a Series E financing of $104m

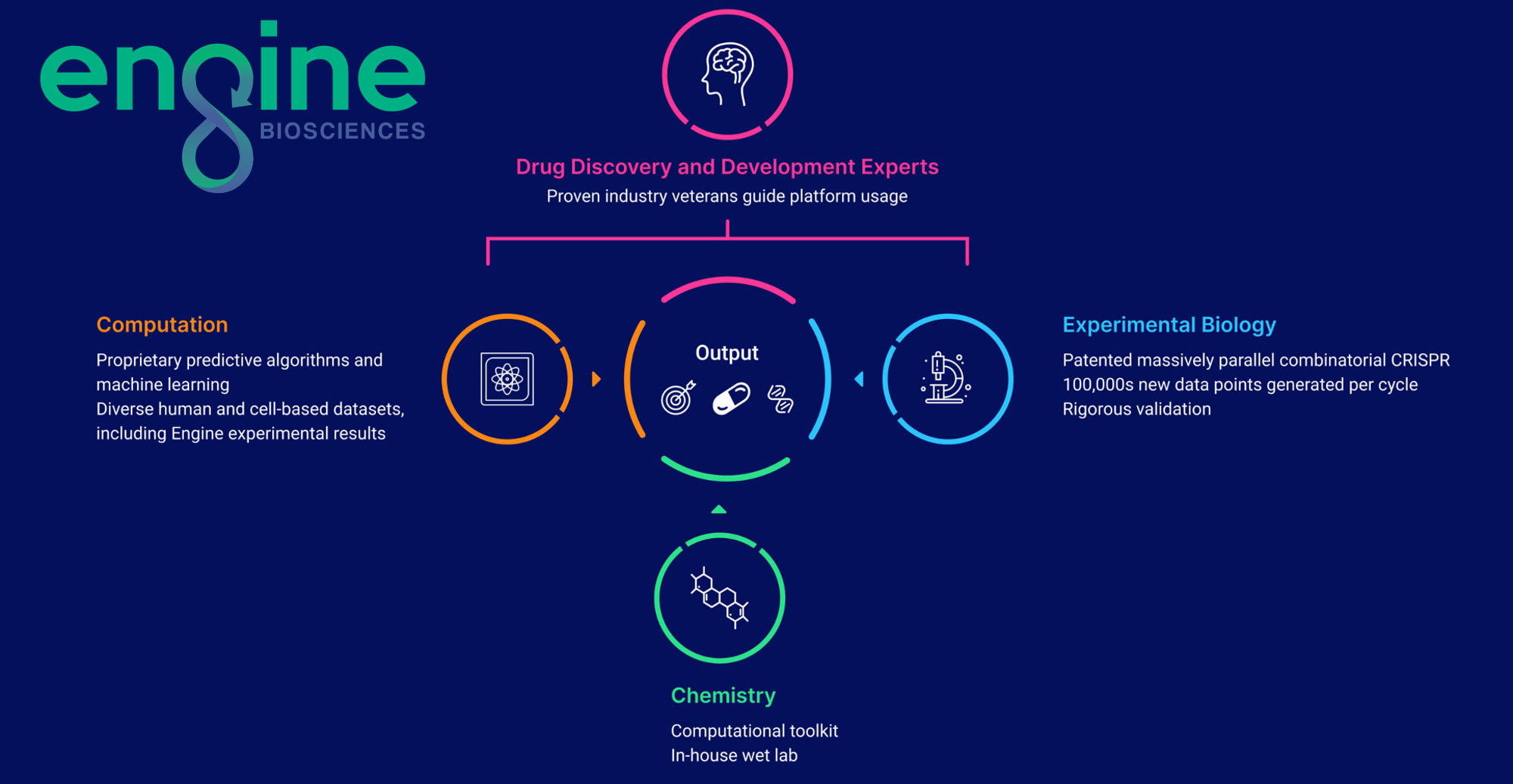

Engine Biosciences Raises $43M in Series A Funding

Engine Biosciences, Singapore- and San Carlos, CA-based company deciphering complex biology to create medicines , raised $43m in Series A funding round.

The round was led by Polaris Partners qith participation from new investors Invus and one of the world’s premier institutional investors, based in Singapore, as well as existing investors 6 Dimensions Capital, WuXi AppTec, DHVC, EDBI, Baidu Ventures, etc.

The company, which has now raised $53m to date, including $10m in a 2018 seed round, intends to use the funds to to expand its portfolio of precision oncology therapeutics, prepare for its first clinical programs, and scale its proprietary technology platform.

Led by Jeffrey Lu, Co-Founder and CEO, Engine Biosciences leverages complex biology to advance medicines. Its proprietary NetMAPPR platform integrates data science and machine learning, high-throughput biological experiments using patented CombiGEM combinatorial genetics system, computational and wet lab chemistry, and drug discovery to enable researchers and drug developers to uncover the gene interactions and biological networks underlying diseases. Additionally, the company generates important insights for precision medicine applications.

Engine Biosciences Raises $43M in Series A Funding - FinSMEs

Engine Biosciences, Singapore- and San Carlos, CA-based company deciphering complex biology to create medicines , raised $43m in Series A funding round

Ever/Body Raises $38M In Series B Funding

Ever/Body, a cosmetic dermatology provider of personalized, tech-enabled services, raised $38M in Series B funding, consisting of both venture equity and debt.

The round, which brought total capital raised to date to $52m, was led by Tiger Global Management, with participation from Addition, Fifth Wall, MetaProp, and Gaingels, and existing investors Declaration Partners, ACME Capital and Redesign Health.

The company intends to use the funds for:

market expansion, with the planned opening of multiple new brick and mortar locations, roll out of a line of branded prescription dermatology products, enhancement of proprietary technology and client experience, and investment in new services to expand its current treatment menu. Founded in 2019 by Amy Shecter, CEO, Ever/Body is a cosmetic dermatology company with a personalized, tech-driven experience from online booking, medical records and progress tracking, to advanced treatments. The company offers a curated menu of medically-tested procedures, vetted and administered by experienced medical professionals and tailored to each patient’s unique features and skincare goals.

The company was founded by Kate Twist, who leads its Board of Directors as Board Chair, and Karen Castelletti, who serves as Chief Technology Officer.

Ever/Body Raises $38M In Series B Funding

Ever/Body, a cosmetic dermatology provider of personalized, tech-enabled services, raised $38M in Series B funding, consisting of both venture equity and debt

Octave Raises $20M in Series B Funding

Octave, a San Francisco CA-based company which specializes in behavioral health, raised $20M in Series B funding.

The round was led by Health Velocity Capital, and joined by Cigna Ventures as well as existing investors Greycroft, Obvious Ventures, Company Ventures and Felicis Ventures.

The company plans to use the funding for technology and clinical innovation and expansion of business operations.

Led by Sandeep Acharya, Co-Founder and CEO, Octave is a national behavioral health practice that provides care through in-person and virtual coaching, individual, relationship and group therapy. The company launched its evidence-based therapy and coaching practice in New York in 2018, and now serves clients across California and New York.

Octave Raises $20M in Series B Funding - FinSMEs

Octave, a San Francisco CA-based company which specializes in behavioral health, raised $20M in Series B funding

Pack4U Raises $20M in Funding

Pack4U, a Mountain View CA-based personalized medication delivery and monitoring company, raised $20 in funding.

The backers were not disclosed.

The company intends to use the funds to expand operations and its business reach.

Led by founder Shane Bishop and President Rahul Chopra and Pack4U is a digital health company that optimizes prescribed medications. The company connects people with community pharmacists to manage drug complexity and maximize health benefits through personalized medication delivery, monitoring and proactive care.

Pack4U Raises $20M in Funding - FinSMEs

Pack4U, a Mountain View CA-based personalized medication delivery and monitoring company, raised $20 in funding

Phanes Therapeutics Raises $40M in Series B Funding

Phanes Therapeutics, Inc., a San Diego CA- and Shanghai, China-based company that specializes in innovative drug discovery in immuno-oncology, raised $40M in Series B funding.

The round was led by Sequoia Capital China with participation from new investors and current shareholders.

Led by Ming Wang, PhD/MBA, CEO, Phanes Therapeutics is a biotech company focused on discovery and development of innovative biologic drugs in oncology and eye diseases.

The company intends to use the funds to advance several preclinical programs to clinic, expand the research and clinical teams, and support the advancement of research projects in the PACbody™ and ATACCbody™ platforms.

Phanes Therapeutics Raises $40M in Series B Funding - FinSMEs

Phanes Therapeutics, Inc., a San Diego CA- and Shanghai, China-based company that specializes in innovative drug discovery in immuno-oncology, raised $40M in Series B funding

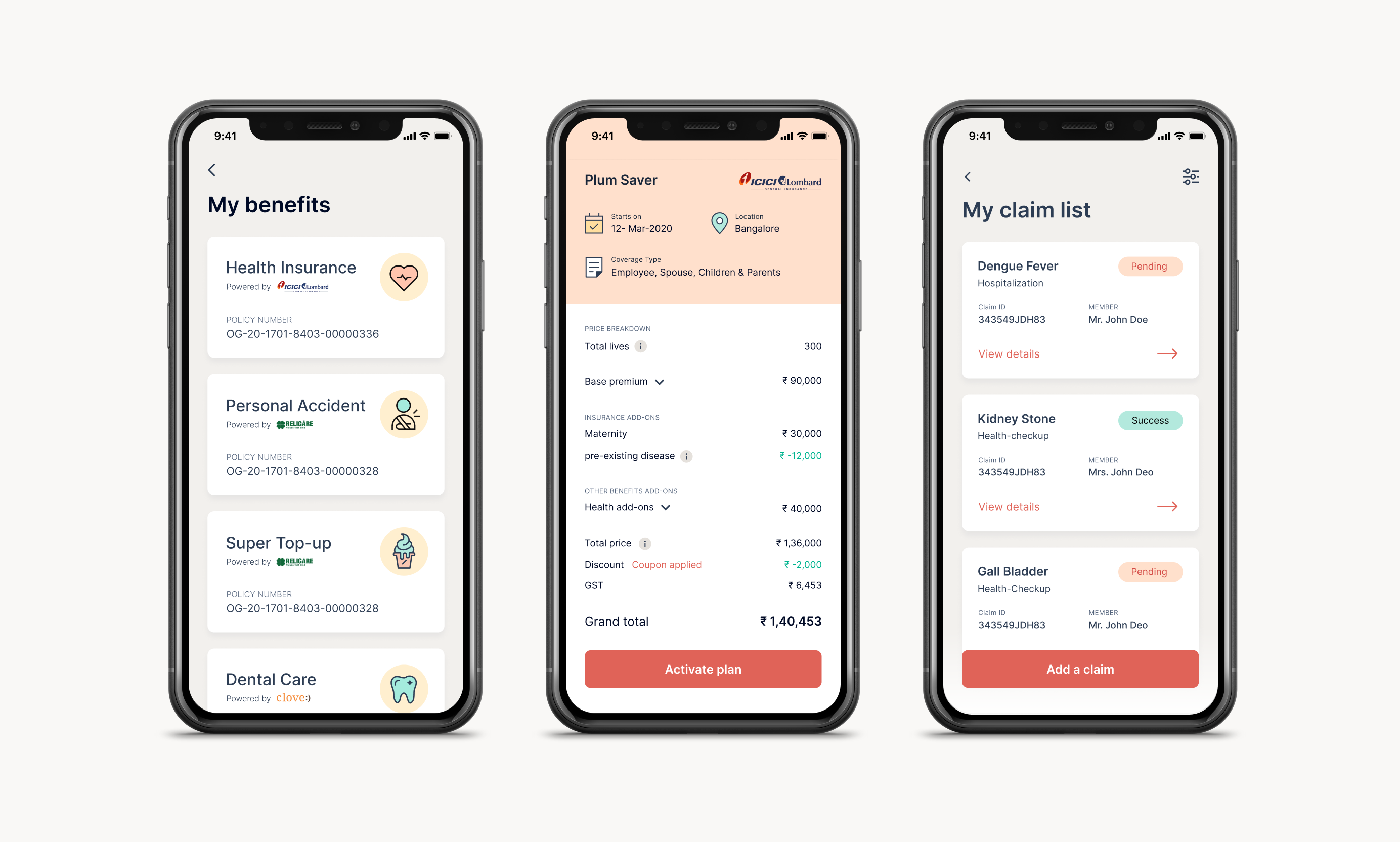

Plum Raises $15.6M in Series A Funding

Plum, a Bengaluru, India-based group health insurance startup aiming to provide health insurance, raised $15.6m in Series A funding.

The round was led by Tiger Global with participation from Sequoia Capital India’s Surge, Tanglin Venture Partners, Incubate Fund and Gemba Capital, as well as Kunal Shah (founder, Cred), Gaurav Munjal, Roman Saini and Hemesh Singh (founders of Unacademy), Lalit Keshre, Harsh Jain and Ishan Bansal (founders of Groww), Ramakant Sharma & Anuj Srivastava (founders of Livspace), and Douglas Feirstein (founder of Hired).

The company intends to use the funds to further scale engineering, business development and operations teams.

Founded in late 2019 by Abhishek Poddar and Saurabh Arora, Plum is building insurance products for SMEs who have teams as small as 7 employees and cannot afford to pay annual premiums. The platform’s real-time insurance design and pricing enables companies to buy insurance quickly and offers employees an easy claims experience through an integrated digital process.

Plum Raises $15.6M in Series A Funding - FinSMEs

Plum, a Bengaluru, India-based group health insurance startup aiming to provide health insurance, raised $15.6m in Series A funding

Laguna Health Raises $6.6M in Seed Funding

Laguna Health, a Tel Aviv, Israel-based post-hospital recovery assurance company, raised $6.6M in seed funding.

The round was led by Pitango HealthTech and LionBird with participation from Assaf Wand, founder and CEO of Hippo Insurance and Josh Riff, founder and CEO of Onduo.

The company intends tu use the funds to expand operations and its business reach.

Founded by Yoni Shtein and Yael Adam, Laguna Health leverages digital care and behavioral therapists to reduce readmissions and shorten recovery time. The recovery platform combines data, digital care tools, and proven behavioral health interventions to reduce negative outcomes suc as lost productivity, mental health issues, substance use disorder or misuse. With this system, all the key stakeholders in the health care ecosystem—including employers, health plans, and health systems—have the ability to ensure every patient recovers with confidence.

Laguna Health Raises $6.6M in Seed Funding - FinSMEs

Laguna Health, a Tel Aviv, Israel-based post-hospital recovery assurance company, raised $6.6M in seed funding

SA e-health company LifeQ raises $47m funding round for expansion

South African company LifeQ, an independent provider of biometrics and health information derived from wearable devices and used in world-leading health management solutions, has raised a US$47 million funding round to help it scale operations.

With offices in South Africa, the United States (US) and the Netherlands, LifeQ provides a 24/7 lens into the body, generating business-grade biometrics for consumers, athletes, and the acutely and chronically ill to detect health problems earlier, manage their existing problems, and prevent illness.

Investors include Invenfin, 4Di Capital, Allectus Capital, Mogul Capital, Tenhong Holdings, Analog Devices, Hannover Re, Convergence Partners, Stellar Capital Partners, Nedbank Corporate and Investment Bank, Delos, etc.

The company was already well-funded, and has now secured a US$47 million round to significantly expand its working capacity and drive higher reach, growth and profitability.

https://disrupt-africa.com/2021/05/27/sa-e-health-company-lifeq-raises-47m-funding-round-for-expansion/Olympus Buys Israeli Medi-Tate

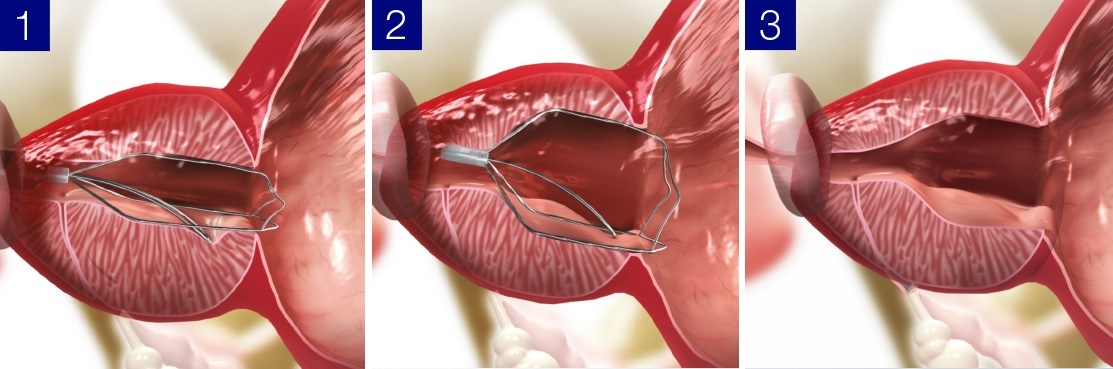

Olympus Corporation acquired Medi-Tate Ltd., an Israeli medical device company.

The amount of the deal was not disclosed.

Through the acquisition, Olympus expands its business line in offering in-office treatment for benign prostatic hyperplasia (BPH) treatment and solidifies its position as a leader in the field of urological devices.

Led by CEO Ido Kilemnik, Medi-Tate is a medical device manufacturer engaged in the research and development, production, and sale of devices for the minimally invasive treatment of BPH. The flagship iTind treatment for BPH currently has the EU CE Mark and is approved for sale in the European Union, UK, Israel, Australia, Brazil, and the FDA cleared for use in the United States.

Olympus Buys Israeli Medi-Tate

Olympus Corporation acquired Medi-Tate Ltd., an Israeli medical device company

Frazier Healthcare Partners Closes $1.4 Billion Growth Buyout Fund

Frazier Healthcare Partners, a Seattle, WA-based healthcare-focused investment firm, closed its 10th dedicated healthcare private equity fund focused on the middle market, at $1.4 billion.

Frazier Healthcare Growth Buyout Fund X, L.P. (FHGB X) received support from new and existing limited partners, which including public pension funds, financial institutions, foundations and endowments, family offices, corporate pensions and sovereign wealth funds, with commitments coming globally from investors in the United States, Europe, the Middle East and Asia. The majority of investors from its previous fund, FHGB IX, increased their commitment for FHGB X.

Frazier focuses on acquiring controlling interests in healthcare companies with EBITDA between $10 million and $75 million where it can invest between $50 million and $300 million of equity. Investments can take the form of corporate carveouts of private and publicly traded companies, recapitalizations and buy-and-build strategies.