Last week's latest: Bluu Biosciences, Leyden Labs, Redbird and more

Exclusive: Mario Götze is in the Plusdental - Berlin startup

he dental splint startup Plusdental receives millions more from investors, with footballer Mario Götze at the forefront. His involvement could quickly pay off.

Plusdental sells clear aligners that are supposed to help adults get straight teeth within a few months. First of all, customers have to have an impression of their teeth made by a cooperating dentist. Plusdental then produces a suitable aligner in its own laboratory in Berlin and sends it to the customer by post.

Mario Götze investiert in Berliner Zahnschienen-Startup Plusdental - Business Insider

Das Zahnschienen-Startup Plusdental erhält weiteres Geld von Investoren – unter anderem von Mario Götze. Seine Beteiligung könnte sich schnell auszahlen.

Germany’s Bluu Biosciences raises €7m to produce cell-based fish

Berlin, Germany-based start-up Bluu Biosciences has secured €7 million from food and impact investors to produce cell-based fish. Cultivated fish is healthy seafood created without the animal - directly from cells, using advanced biotechnology. Bluu Biosciences is the first cultivated seafood company in Europe with a dedicated focus on creating the most nutritious and delicious fish products. They are on a mission to bring cell biotechnology and food technology together to make cultivated fish a reality.

Their goal is to ensure that the seafood we know and love can be enjoyed for generations to come, without harming animals or our planet’s fragile ocean ecosystems.

Bluu Biosciences

Gyroscope Therapeutics Raises $148M in Series C Financing

Gyroscope Therapeutics Limited, a London, UK-based clinical-stage gene therapy company focused on treating diseases of the eye, raised USD $148.0m in Series C financing.

The round was led by Forbion’s Growth Opportunities Fund and includes Sofinnova Investments, funds and accounts advised by T. Rowe Price Associates, Inc., Tetragon Financial Group Limited, an undisclosed healthcare focused fund, Fosun Pharma, Cambridge Innovation Capital and founding investor Syncona.

The company plans to use proceeds from the financing to advance the clinical development of GT005, its lead investigational gene therapy being evaluated for the treatment of geographic atrophy (GA) secondary to age-related macular degeneration (AMD).

Gyroscope Therapeutics Raises $148M in Series C Financing

Gyroscope Therapeutics Limited, a London, UK-based clinical-stage gene therapy company focused on treating diseases of the eye, raised USD $148.0m in Series C financing

Meatable Raises $47M in Series A Funding

Meatable, an Amsterdam, The Netherlands-based cultivated meat startup, closed a $47m USD Series A funding round.

The round, which brought total funding to $60m, was led by Dr. Rick Klausner, Section 32, Dr. Jeffrey Leiden, and DSM Venturing, and includes existing investors, such as BlueYard Capital, Agronomics, Humboldt, and Taavet Hinrikus.

The company intends to use the funds to advance small-scale production at the Biotech Campus Delft and to diversify its product portfolio.

Founded in 2018 by Krijn de Nood (CEO), Daan Luining (CTO), and Dr. Mark Kotter (principal inventor of opti-ox technology), Meatable is a food company, aiming to deliver, at scale, natural, cultivated meat, for which no animals are slaughtered, fewer GHG emissions are released, and less land and water are required by leveraging a proprietary tech platform. This enables a scalable production process, which replicates the natural process of fat and muscle growth, in proportions that emulate traditional cuts of meat. After completing its first pork showcase product, Meatable is currently focused on the further development of cultivated pork and beef.

Meatable Raises $47M in Series A Funding | FinSMEs

Meatable, an Amsterdam, The Netherlands-based cultivated meat startup, closed a $47m USD Series A funding round

Leyden Labs Secures €40M in Series A Funding

Leyden Laboratories B.V., an Amsterdam, The Netherlands-based company targeting commonalities of viral families to protect humanity from known and future viruses, closed a €40M Series A financing.

The round was led by GV (formerly Google Ventures), with participation from F-Prime Capital, Casdin Capital, LLC and Brook Byers. Concurrent with the financing, David Schenkein, M.D., general partner at GV, and Stephen Knight, M.D., president and managing partner at F-Prime, will join the board of directors.

The company intends to use the funds to further develop the platform and portfolio of product candidates and to build out the team.

Co-founded by Koenraad Wiedhaup, CEO, Jaap Goudsmit, CSO, Ronald Brus and Dinko Valerio (executive chair), Leyden Labs provides a platform that targets commonalities of viral families to protect humanity from known and future viruses. Its portfolio of accessible intranasal product candidates may provide people with the freedom to protect themselves from and prevent the spread of many strains of respiratory viruses, including ones in the influenza and coronavirus families.

Leyden Labs Secures €40M in Series A Funding | FinSMEs

Leyden Laboratories B.V., an Amsterdam, The Netherlands-based company targeting commonalities of viral families to protect humanity from known and future viruses, closed a €40M Series A financing

Step Pharma Raises €35M in Series B Financing

Step Pharma, an Archamps, France-based biotech company developing novel drugs for oncology and autoimmune diseases, closed a €35m Series B financing.

New investors Hadean Ventures and Sunstone Life Science Ventures co-led the round, joining existing investors Kurma Partners, Pontifax and Bpifrance, which reinvested through its Innovative Biotherapies and Rare Diseases fund and InnoBio 2 fund. As part of the financing, Jacob L Moresco from Sunstone Life Science Ventures and Walter Stockinger from Hadean Ventures will join the Step Pharma Board of Directors.

The company intends to use the funds to advance:

- its lead proprietary CTPS1 inhibitor, STP938, into clinical development for the treatment of T-cell malignancies, and

- development of CTPS1 inhibitors in other haematological malignancies and solid tumours.

Founded in June 2014 by Kurma Partners, the Imagine Institute and Sygnature Discovery based on the scientific discoveries of Prof. Alain Fischer and Dr Sylvain Latour’s laboratory at the Imagine Institute, Paris and led by Andrew Parker, CEO, Step Pharma is focused on the development of a novel class of oral nucleotide synthesis inhibitors targeting CTPS1 for the improved treatment of a range of oncology and autoimmune diseases. The company has identified several inhibitors of CTPS1, with the most advanced, STP938, being prepared for clinical studies in T-cell malignancies.

Step Pharma Raises €35M in Series B Financing | FinSMEs

Step Pharma, an Archamps, France-based biotech company developing novel drugs for oncology and autoimmune diseases, closed a €35m Series B financing

Manual Secures $30M in Series A Funding

Manual, a London, UK-based men’s health company, raised $30m in Series A funding.

Backers included Sonoma Brands, Felix Capital and Cherry Ventures, Waldencast, Gisev and FJ Labs.

The company intends to use the funds for:

- product development

- international expansion across Europe, Asia and Latin America, and

- hiring of talent.

George Pallis, Founder and CEO, Manual provides a platform for men’s health and wellbeing offering a suite of diagnostic tools and blood tests, providing customers with personalised advice and a treatment plan to help them achieve their goals, all while giving them medical support along the journey and access to a community of like-minded men.

Manual Secures $30M in Series A Funding | FinSMEs

Manual, a London, UK-based men’s health company, raised $30m in Series A funding

Birmingham/Porto-based medtech Adapttech raises £2 million

A fresh round of funding will be used to fuel new technology developments and increase sales at Birmingham/Porto-based biomedical company Adapttech.

The £2 million round was supported by existing investors Bionova Capital, and the MEIF Proof of Concept & Early Stage Fund, an arm of the Midlands Engine Investment Fund. The round also saw new investors including ACF investors, Wealth Club, and Wren Capital.

The company’s INSIGHT system is designed to make lower-limb prostheses fittings faster and easier, as well as monitor the rehabilitation process.

Birmingham/Porto-based medtech Adapttech raises £2 million – Tech.eu

A fresh round of funding will be used to fuel new technology developments and increase sales at Birmingham/Porto-based biomedical company Adapttech. The £2 million round was supported by existing investors […]

Ro Raises $500M in Series D Funding

Ro, a NYC-based healthcare technology company, completed a $500m Series D funding.

The round, which brought total funding since its founding in 2017 to $876m, was led by existing investors General Catalyst, FirstMark Capital and TQ Ventures, with participation from existing investors SignalFire, Torch Capital and BoxGroup as well as new investors Altimeter Capital, Baupost Group, Dragoneer Investment Group, ShawSpring Partners, Radcliff, and 776.

The company intends to use the funds to strengthen its vertically integrated primary care platform, expand its pharmacy distribution network, continue to enhance its proprietary EMR (the Ro Collaborative Care Center), build new capabilities such as remote patient monitoring with integrated devices, and broaden into additional treatment areas that leverage its diagnostic capabilities.

Led by Zachariah Reitano, Co-Founder & CEO, Ro is a healthcare technology company building a patient-centric healthcare system. The company’s integrated primary care platform powers a personalized, end-to-end healthcare experience from diagnosis, to delivery of medication, to ongoing care. With a nationwide provider network, in-home care API, and proprietary pharmacy distribution centers, Ro connects telehealth, diagnostics, and pharmacy services to provide high-quality, affordable healthcare without the need for insurance.

Ro Raises $500M in Series D Funding | FinSMEs

Ro, a NYC-based healthcare technology company, completed a $500m Series D funding

Cityblock Health Raises $192M in Series C Extension Funding

Cityblock Health, a Brooklyn, N.Y.-based healthcare provider for Medicaid and lower-income Medicare beneficiaries, completed a $192m Series C extension funding round.

The round was led by new investor Tiger Global, with participation from existing investors including Kinnevik AB, Maverick Ventures, General Catalyst, Wellington Management, Thrive Capital, Redpoint Ventures, Echo Health Ventures, 8VC, and AIMS Imprint of Goldman Sachs Asset Management. The Series C extension brings Cityblock’s total fundraising since its founding in 2017 to about $500m.

The company will use the capital to accelerate deployment of its community and value-based care model nationwide.

Founded in 2017 and Iyah Romm, Chief Executive Officer and Co-Founder, Cityblock Health is a healthcare provider for Medicaid and lower-income Medicare beneficiaries. They partner with community-based organizations and health plans to deliver medical care, behavioral health, and social services virtually, in-home, and in their community-based clinics. The company currently serves 70,000 members across New York, Connecticut, Massachusetts, and Washington, DC.

Cityblock Health Raises $192M in Series C Extension Funding | FinSMEs

Cityblock Health, a Brooklyn, N.Y.-based healthcare provider for Medicaid and lower-income Medicare beneficiaries, completed a $192m Series C extension funding round

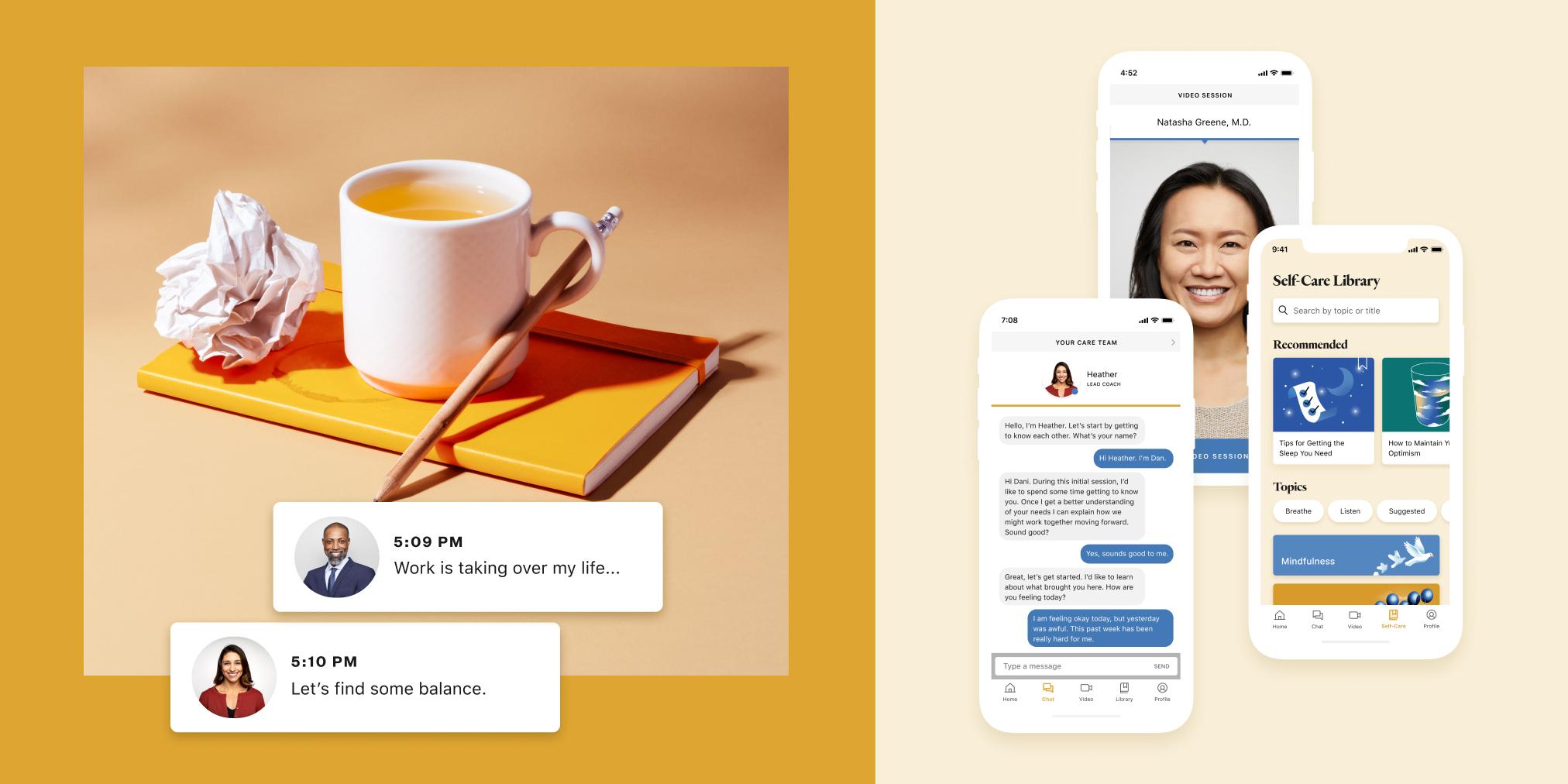

Ginger Raises $100M in Series E Financing

Ginger, a San Francisco, CA-based on-demand mental health company, raised $100m in Series E financing.

The round, which bring total funding to over $220m, was led by funds managed by Blackstone Growth, which joined existing investors from Kaiser Permanente Ventures, Cigna Ventures, Bessemer Venture Partners, Advance Ventures Partners, Khosla Ventures, Health Velocity Capital, City Light Capital, and WP Global Partners. As part of this funding round, Ginger has added Blackstone’s Ram Jagannath to its Board of Directors.

The company intends to use the funds to continue expanding access to value-based mental healthcare through additional partnerships with multinational employers and health plans, extend its reach to support underserved populations through new government payer relationships and collaborations with non-profit organizations and continue the acquisition of innovative technologies and clinical services to improve and scale its on-demand mental health system.

Ginger Raises $100M in Series E Financing | FinSMEs

Ginger, a San Francisco, CA-based on-demand mental health company, raised $100m in Series E financing

Scipher Medicine Raises $82M in Series C Funding

Scipher Medicine, a Waltham, Mass.-based precision immunology company matching patients with the most effective therapy, completed an $82m Series C financing.

The round was led by aMoon and Northpond Ventures, with participation from Echo Health Ventures and existing investors, Khosla Ventures and Alumni Ventures.

The company, which has raised $117m in total funding to date, intends to use the funds to expand commercial efforts for its patient molecular signature test, PrismRA.

Led by Alif Saleh, Chief Executive Officer, Scipher is a precision immunology company that leverages a proprietary Network Medicine platform and artificial intelligence to commercialize blood tests revealing a persons’ unique molecular disease signature and match such signature to the most effective therapy. The company partners with payers, providers, and pharma along the health care value chain to bring precision medicine to autoimmune diseases.

Scipher Medicine Raises $82M in Series C Funding | FinSMEs

Scipher Medicine, a Waltham, Mass.-based precision immunology company matching patients with the most effective therapy, completed an $82m Series C financing

Fortis Therapeutics Raises $40M in Series A Funding

Fortis Therapeutics, Inc., a San Diego, CA-based immuno-oncology biotech company, closed a $40m Series A financing.

Backers included Avalon Ventures, Bregua Corporation, Lilly Asia Ventures, Osage University Partners, and Vivo Capital, as well as new investors, the Myeloma Investment Fund, the venture philanthropy fund of the Multiple Myeloma Research Foundation (MMRF), and Fulcrum 2020, LLC, which shares a portion of its profits with the Prostate Cancer Foundation (PCF) to fund future research.

The company intends to use the funds to advance FOR46 in clinical trials for the treatment of relapsed or refractory multiple myeloma and metastatic castration-resistant prostate cancer (mCRPC).

Led by Jay Lichter, Ph.D., President and CEO, Fortis Therapeutics is an immuno-oncology biotech developing a novel antibody-drug conjugate for late-stage multiple myeloma and metastatic castration-resistant prostate cancer.

Fortis Therapeutics Raises $40M in Series A Funding | FinSMEs

Fortis Therapeutics, Inc., a San Diego, CA-based immuno-oncology biotech company, closed a $40m Series A financing

Emalex Biosciences Raises $35M in Series C Funding

Emalex Biosciences, Inc., a Chicago, IL-based biopharmaceutical company founded to develop treatments for central nervous system movement disorders and fluency disorders, raised $35m in Series C funding.

The round was led by Paragon Biosciences with participation from Fidelity Management & Research Company LLC and Valor Equity Partners.

The company intends to use the funds to continue to develop its critical work as it pursues an effective drug therapy for people living with Tourette syndrome and childhood-onset fluency disorder (stuttering)—two conditions with high unmet needs.

Emalex Biosciences is a biopharmaceutical company focused on developing treatments for central nervous system movement disorders and fluency disorders with limited or no treatment options. Aligned with its mission, the company is evaluating treatments for childhood-onset fluency disorder(stuttering), and for children and adolescents with Tourette syndrome.

Emalex Biosciences Raises $35M in Series C Funding | FinSMEs

Emalex Biosciences, Inc., a Chicago, IL-based biopharmaceutical company founded to develop treatments for central nervous system movement disorders and fluency disorders, raised $35m in Series C funding

AppliedVR Raises $29M in Series A Funding

AppliedVR, a Los Angeles, CA-based digital medicine company, raised $29m in Series A funding.

The round, which brought total funding raised to date to $35m, included investors such as F-Prime Capital, JAZZ Venture Partners, Sway Ventures, GSR Ventures, Magnetic Ventures and Cedars-Sinai.

The company intends to use the funds to accelerate growth as it pursues full FDA approval over the next year.

Led by Matthew Stoudt, co-founder and CEO, AppliedVR provides virtual reality-based treatments aimed at comprehensively treating chronic pain. Combining cognitive behavioral therapies with mindfulness exercises, the company’s EaseVRx solution recently received Breakthrough Device Designation from the FDA for treatment-resistant fibromyalgia and chronic intractable lower back pain.

AppliedVR Raises $29M in Series A Funding | FinSMEs

AppliedVR, a Los Angeles, CA-based digital medicine company, raised $29m in Series A funding

1910 Genetics Raises $26M in Seed and Series A Funding

1910 Genetics, a Cambridge, Mass.-based biotechnology company integrating artificial intelligence (AI), computation and biological automation to improve drug development, raised $22M in seed and Series A funding round.

The round was co-led by M12 – Microsoft’s Venture Fund and Playground Global.

Led by Dr. Jen Nwankwo, Founder and Chief Executive Officer, 1910 Genetics integrates AI, computation and biological automation to accelerate the design of small molecule and protein therapeutics. The company combines AI-driven drug design with biological wet lab automation to increase productivity and decrease failure rates across the pharmaceutical R&D process.

1910 Genetics Raises $26M in Seed and Series A Funding | FinSMEs

1910 Genetics, a Cambridge, Mass.-based biotechnology company integrating artificial intelligence (AI), computation and biological automation to improve drug development, raised $22M in seed and Series A funding round

On Target Laboratories Secures $21M in Expanded Series B Funding Round

On Target Laboratories, Inc., a West Lafayette, Ind.-based biotechnology company developing fluorescent markers to target and illuminate cancer during surgery, secured $21m in an expanded Series B funding round.

The funding was wholly backed by existing investors Johnson & Johnson Innovation – JJDC, Inc., H.I.G. Capital, Elevate Ventures, The Hurvis Group, and 3B Future Health Fund (formally Helsinn Investment Fund).

The company intends to use the funds for the continued development and commercialization of its novel compound, pafolacianine sodium injection and to complete the ELUCIDATE Trial, a Phase 3 clinical trial evaluating the use of pafolacianine sodium injection to intraoperatively identify lung cancer in real-time.

On Target Laboratories Secures $21M in Expanded Series B Funding Round

On Target Laboratories, Inc., a West Lafayette, Ind.-based biotechnology company developing fluorescent markers to target and illuminate cancer during surgery, secured $21m in an expanded Series B funding round

Tavotek Biotherapeutics Raises Over $20M in Series A1 and A2 Financing

Tavotek Biotherapeutics, a Lower Gwynedd, PA-based a biopharmaceutical company, raised over $20M in Round A1 and Round A2 financing in the preceding two months.

YuanBio Venture Capital led the A1 finance round followed by Oriza Holdings, Ming BioVentures, and New Alliance Capital. Series A2 financing was jointly invested by GF Xinde, CTS Capital, and Lanhu Capital.

The two rounds of financing will be used to accelerate the CMC production and IND filings of three antibody drugs (Tavo111, Tavo103, and Tavo101) developed by the company based on its TavoPrecise antibody platform. In addition, the funding will also be used to strengthen its bispecific / multispecific antibody pipelines and the development of multicyclic intracellular peptide (MIP) programs.

Established in early 2019, Tavotek Biotherapeutics is a biopharmaceutical company focused on discovering, acquiring, developing, and commercializing therapeutic medicines for patients suffering from debilitating diseases with significant unmet medical needs.

Tavotek Biotherapeutics Raises Over $20M in Series A1 and A2 Financing

Tavotek Biotherapeutics, a Lower Gwynedd, PA-based a biopharmaceutical company, raised over $20M in Round A1 and Round A2 financing

Brii Biosciences Closes US$155M Series C Financing

Brii Biosciences, a Durham, NC- and Beijing, China-based multi-national company developing innovative therapies for diseases including infectious diseases, liver diseases, and CNS diseases, closed a Series C financing of US$155m.

The round was led by Invesco Developing Markets Fund, with additional funding provided by GIC and another global leading investment management organization, followed by Lake Bleu Capital and an Asia-based investment organization, as well as three current investors.

The company intends to use the funds to advance its broad infectious diseases pipeline as well as its CNS program.

Led by Zhi Hong, Ph.D., CEO, Brii Bio is currently conducting clinical studies in multiple infectious diseases, and is preparing to enter clinical-stage research in diseases of the central nervous system. Brii Biosciences, a Durham, NC- and Beijing, China-based multi-national company developing innovative therapies for diseases including infectious diseases, liver diseases, and CNS diseases, closed a Series C financing of US$155m.

Brii Biosciences Closes US$155M Series C Financing

Brii Biosciences, a Durham, NC- and Beijing, China-based multi-national company developing innovative therapies for diseases including infectious diseases, liver diseases, and CNS diseases, closed a Series C financing of US$155m

Vibrant Raises $7.5M in Series E Funding

Vibrant, a Yokneam Illit, Israel-based developer of gastrointestinal treatments, held the first closing of a $7.5m Series E funding round.

The round was led by Unorthodox Ventures. With the investment, Unorthodox Ventures Founding Contrarian Carey Smith, who founded fan and light maker Big Ass Fans, will join Vibrant’s Board of Directors.

Led by CEO Lior Ben-Tsur, Vibrant has developed a non-drug treatment for the increasing number of people who live with chronic constipation and suffer from the common side effects caused by traditional medications. The company’s drug-free, orally administered vibrating capsule induces bowel movement, and a companion patient app allows remote monitoring of patients’ condition by physicians.

Vibrant Raises $7.5M in Series E Funding | FinSMEs

Vibrant, a Yokneam Illit, Israel-based developer of gastrointestinal treatments, held the first closing of a $7.5m Series E funding round

Ghana’s Redbird raises $1.5M seed to expand access to rapid medical testing in sub-Saharan Africa

Redbird, a Ghanaian health tech startup that allows easy access to convenient testing and ensures that doctors and patients can view the details of those test results at any time, announced today that it has raised a $1.5 million seed investment.

Investors who participated in the round include Johnson & Johnson Foundation, Newton Partners (via the Imperial Venture Fund) and Founders Factory Africa. This brings the company’s total amount raised to date to $2.5 million.

The health tech company was launched in 2018 by Patrick Beattie, Andrew Quao and Edward Grandstaff. As a founding scientist at a medical diagnostics startup in Boston, Beattie’s job was to develop new rapid diagnostic tests.

https://finance.yahoo.com/news/ghanas-redbird-raises-1-5m-120058231.html