Bio and health tech startups are really going for it this week.

AgomAb Therapeutics Raises $74M in Series B Funding

AgomAb Therapeutics N.V., a Ghent, Belgium-based therapies that modulate regenerative pathways to achieve structural tissue repair and functional organ recovery, closed a $74m Series B financing round.

The round was led by Redmile Group, with participation from Cormorant Asset Management and previous investors Advent France Biotechnology, Andera Partners, Boehringer Ingelheim Venture Fund, Omnes Capital, Pontifax, and V-Bio Ventures. In conjunction with the financing round, a Redmile representative will join the Board of Directors.

The company intends to use the capital to fund clinical proof of concept of the lead program AGMB-101, an HGF-mimetic agonistic antibody, which is currently progressing through IND-enabling studies, and grow its pipeline of drug candidates designed to modulate regenerative pathways to induce functional organ recovery in acute and chronic diseases.

https://www.finsmes.com/2021/03/agomab-therapeutics-raises-74m-in-series-b-funding.html

HelloSelf Raises £5.5M in Series A Funding

HelloSelf, a London, UK-based AI-powered digital therapy service, raised £5.5M in Series A funding.

The round was led by OMERS Ventures, with participation from Manta Ray Ventures, Oxford Capital Partners, and 2EnablePartners. In conjunction with the funding, Harry Briggs, OMERS Ventures Managing Partner will join the board.

The company intends to use the funds to grow its @Work service, increasing its clinical provision for employers of all sizes across the UK.

Founded in 2018 by Charlie Wells (former COO of online donation platform JustGiving), HelloSelf is an online therapy and psychological coaching service, combining app-based automated reminders and encouragement with AI-enhanced video sessions with clinical psychologists.

https://www.finsmes.com/2021/03/helloself-raises-5-5m-in-series-a-funding.html

OncoDiag Raises €2.5M in Series A Funding

OncoDiag, a Miserey, near Evreux, France-based company specializing in the development of diagnostic tests for the early detection of cancer, raised €2.5m ($3M) in Series A funding.

Of this, €1.5m ($1.8m) was from Angels Santé, Business Angels des Grandes Ecoles (BADGE), Normandie Business Angels (NBA), Paris Business Angels (PBA), and the Société de Financement de l’Innovation Numérique en Essonne (SFINE). The funds will allow OncoDiag to market its Urodiag diagnostic test in France and to expand its international presence, in particular in Europe, the United States, Canada and Japan.

Led by Claude Hennion, co-founder and CEO, OncoDiag specializes in the development and marketing of innovative solutions for the screening, diagnosis and monitoring of cancer, with a focus on bladder, colorectal and prostate cancer. The company is working on the validation of two new diagnostic tests:

– Prostadiag for the detection of localized prostate cancer and

– Colodiag for the detection of colorectal cancer.

https://www.finsmes.com/2021/03/oncodiag-raises-e2-5m-in-series-a-funding.html

ElevateBio raises $525M to advance its cell and gene therapy technologies

ElevateBio, one of the leading biotech companies focused on gene-based therapies, has raised a massive $525 million Series C round of financing, more than doubling the company's $193 million Series B funding which closed last year.

This new funding comes from existing investor Matrix Capital Management, and also adds new investors SoftBank and Fidelity Management & Research Company, and will be used to help the company expand its R&D and manufacturing capabilities, as well as continue to spin out new companies and partnerships based on its research.

Cambridge, Massachusetts-based ElevateBio was founded to bridge the world of academic research and development of cell and gene therapies with that of commercialization and production-scale manufacturing. The startup identified a need for more efficient means of bringing to market the ample, promising science that was being done in developing therapeutics that leverage cellular and genetic editing, particularly in treatment of severe and chronic illness.

https://finance.yahoo.com/news/elevatebio-raises-525m-advance-cell-115918598.htmlForward Health Raises $225M in Series D Funding

Forward Health, a San Francisco, CA-based healthcare system empowering doctors with technology and data to monitor and guide long-term health, raised $225m in Series D funding.

Backers included Founders Fund, Khosla Ventures, SoftBank Vision Fund 2, Marc Benioff, and The Weeknd, among others.

The company intends to use the funds to expand its healthcare system nationwide with several new locations slated to open in the first half of 2021 and to introduce new doctor-led programs focused on heart health, cancer detection, COVID-19, stress, anxiety, and weight management.

Forward Health Raises $225M in Series D Funding - FinSMEs

Forward Health, a San Francisco, CA-based healthcare system empowering doctors with technology and data to monitor and guide long-term health, raised $225m in Series D funding

Neurelis Raises $114M in Series D Financing

Neurelis, Inc., a San Diego, CA-based neuroscience company, closed a $114m Series D financing round.

Cormorant Asset Management and Decheng Capital joined existing investors LYZZ Capital and HBM Healthcare Investments. In conjunction with this financing, Alexander Kwit has been appointed to the company’s Board of Directors. Kwit is a private investor who previously held the position of Executive Vice President of Royalty Pharma, a publicly traded company that buys royalty interests in biopharmaceutical products. Other investors were organized by Philos & Partners SA, a Swiss-based asset manager.

The company intends to use the funds to commercialize its lead orphan drug product, VALTOCO® (diazepam nasal spray), and to continue the development and expansion of its neuroscience pipeline.

Neurelis Raises $114M in Series D Financing

Neurelis, Inc., a San Diego, CA-based neuroscience company, closed a $114m Series D financing round

Ventyx Biosciences Raises $114M in Funding

Ventyx Biosciences, an Encinitas, California-based clinical-stage biotechnology company advancing a broad pipeline of potent and selective small-molecule drug candidates to treat inflammatory diseases and autoimmune disorders, raised $114m in funding.

The round was led by venBio Partners alongside new investors, including Third Point, RTW Investments, LP, Janus Henderson Investors, etc.

The company intends to use the funds to clinical development of immunology programs and advance preclinical programs against novel drug targets with its prolific drug discovery engine.

Led by Raju Mohan, Chief Executive Officer, Ventyx operates an internally discovered and wholly-owned portfolio of potent and selective small molecule drug candidates that target multiple indications in the immunology space, including gastrointestinal and dermatological diseases.

Ventyx Biosciences Raises $114M in Funding - FinSMEs

Ventyx Biosciences, an Encinitas, California-based clinical-stage biotechnology company advancing a broad pipeline of potent and selective small-molecule drug candidates to treat inflammatory diseases and autoimmune disorders, raised $114m in funding

Monte Rosa Therapeutics Raises $95M in Series C Financing

Monte Rosa Therapeutics, a Boston, MA-based biotechnology company focused on discovering and developing precision medicines that degrade disease-causing proteins, closed a $95m Series C financing.

The round was led by Avoro Capital Advisors with participation from additional new investors Fidelity Management & Research Company LLC, funds and accounts managed by BlackRock, funds and accounts advised by T. Rowe Price Associates, Inc., and RTW Investments, LP.

The company intends to use the proceeds to advance its lead development candidate into the clinic, accelerate pipeline growth and bolster its platform capabilities to rationally design and develop small molecule degraders (also known as molecular glues) that hijack the body’s innate ability to degrade proteins.

Led by Markus Warmuth, M.D., CEO, Monte Rosa is a biotechnology company discovering and developing molecular glues to degrade disease-causing proteins. The company has created a platform to rationally design small molecules that reprogram ubiquitin ligases to eliminate disease drivers previously deemed undruggable. The drug discovery platform combines diverse and proprietary chemical libraries of small molecule protein degraders with in-house proteomics, structural biology, machine learning-based target selection and computational chemistry capabilities to predict and obtain protein degradation profiles.

Monte Rosa Therapeutics Raises $95M in Series C Financing - FinSMEs

Monte Rosa Therapeutics, a Boston, MA-based biotechnology company focused on discovering and developing precision medicines that degrade disease-causing proteins, closed a $95m Series C financing

Nano Cures Raises $90M in Pre IPO Funding

Nano Cures Inc., an Austin, Texas-based clinical stage biotechnology and infectious disease immunity platform company, raised $90M pre-IPO funding round.

The investment will be led by a $20M commitment from Opulence Capital Management, a Dubai based private investment fund, with existing and new investors participating.

The company intends to use the funds to accelerate the global scale up of its Cures Platform for Covid-19 variants, including vaccines and persistent immunity delivery.

Led by Steve Papermaster, Chief Executive Officer, Nano has developed novel self-administered technology that moves delivery beyond syringes and shots, to an array of nasal, dermal, ophthalmic, sub-lingual, and oral options. Nano will open up its Cures Platform to other pharmaceutical companies and their vaccines, providing new ways to conquer deliver billions of doses directly to those in need.

Nano Cures Raises $90M in Pre IPO Funding - FinSMEs

Nano Cures Inc., an Austin, Texas-based clinical stage biotechnology and infectious disease immunity platform company, raised $90M pre-IPO funding round

ixlayer Raises $75M in Series A Funding

ixlayer, a San Francisco, CA-based provider of technology-based solutions for diagnostic testing, raised $75m in Series A funding round.

The round was led by General Catalyst with participation from PearVC, Signatures Capital’s Bobby Yazdani, Uber CEO Dara Khosrowshahi, 23andMe CEO Anne Wojcicki, MBX Capital’s Zeshan Muhammedi and Prologis CEO Hamid Moghadam.

Led by Pouria Sanae, CEO, ixlayer provides innovative solutions for enabling health systems, payors, biopharma, and health focused companies to offer health testing in a virtual environment. The platform delivers end-to-end solutions for the technical, security, regulatory, and user experience components of complex health testing. The solution can be added to existing patient engagement platforms and patient portals to enable real time health and wellness lab testing. Founded in 2018, ixlayer currently supports millions of patients and has launched hundreds of testing programs for large organizations, health systems and every level of the government.

ixlayer Raises $75M in Series A Funding - FinSMEs

ixlayer, a San Francisco, CA-based provider of technology-based solutions for diagnostic testing, raised $75m in Series A funding round

Eirion Therapeutics Closes $40M Series A Funding

Eirion Therapeutics, Inc., a Woburn, Mass.-based aesthetic dermatology company, raised $40M in Series A funding.

The company closed a deal with Shanghai Haohai Biological Technology Ltd., that will result in a $32m Series A Preferred Stock investment into Eirion along with exclusive licenses that will be for all of Eirion’s products for the territory of China in exchange for an upfront payment in the amount of $8m. The deal is structured in segments over the next approximately 18 months.

Haohai, a Chinese aesthetic medicine company headquartered in Shanghai and is publicly traded on the Hong Kong (6826.HK) and Shanghai (688366.SS) stock exchanges, is investing $31m and a US investor is co-investing $1m in Eirion that in aggregate will obtain a minority stake in the company. Eirion has been funded previously through approximately $11m of convertible notes which will convert into Series A Preferred Stock in connection with Haohai’s investment.

Eirion Therapeutics Closes $40M Series A Funding - FinSMEs

Eirion Therapeutics, Inc., a Woburn, Mass.-based aesthetic dermatology company, raised $40M in Series A funding

Visus Therapeutics Raises $36M in Series A Financing

Visus Therapeutics Inc., a Seattle, WA- Orange County, Calif.-based based clinical-stage pharmaceutical company developing a presbyopia-correcting eye drop, closed a $36m Series A financing.

Backers included Johnson & Johnson Innovation – JJDC, Inc. (JJDC), RTW Investments, LP, and Wille AG, as well as existing shareholders. In conjunction with the funding, Tony Nguyen, managing director at RTW Investments, LP, joined Visus’ board of directors.

The company intends to use the funds to advance the clinical development program for its lead asset, BRIMOCHOL™.

Led by Ben Bergo, co-founder and chief executive officer, Visus Therapeutics is a clinical-stage company in pursuit of developing a presbyopia-correcting eye drop with the potential to last a minimum of eight hours. Its lead clinical candidate is BRIMOCHOL, an eye drop designed to correct the loss of near vision associated with presbyopia. In parallel, Visus Therapeutics is focused on advancing its pipeline of early-stage ophthalmic product candidates.

Visus Therapeutics Raises $36M in Series A Financing

Visus Therapeutics Inc., a Seattle, WA- Orange County, Calif.-based based clinical-stage pharmaceutical company developing a presbyopia-correcting eye drop, closed a $36m Series A financing

100Plus Raises $25M in Seed Funding

100Plus, a San Francisco, CA-based Remote Patient Monitoring (RPM) platform for doctors and their patients, raised $25m in seed funding.

The round was leed by Henry Kravis, George Roberts, and other angel investors.

The company intends to use the funds to expand operations and its business reach.

Led by Ryan Howard, CEO, 100Plus is a remote patient monitoring solution that helps physicians remotely monitor patients and provides data that informs clinical decisions throughout their course of care. The remote patient monitoring product utilizes artificial intelligence (AI) and offers an end-to-end solution, including patient outreach, device setup, patient engagement and automated billing. Utilizing short message service (SMS), the platform sends personalized messages to drive patient involvement in the management of their health, including monitoring reminders, follow up on care instructions and feedback on their remote monitoring numbers. Patients can interact and ask questions and receive tailored responses based on their treatment plan. When needed, the platform will triage messages that require immediate physician interaction. https://www.finsmes.com/2021/03/100plus-raises-25m-in-seed-funding.html

Cybrexa Therapeutics Completes $25M Series B Financing

Cybrexa Therapeutics, a New Haven, CO-based oncology-focused biotechnology company, completed its $25m Series B financing.

Backers included HighCape Capital and new investor Elm Street Ventures.

The company intends to use the funds for planned advancement of its lead candidate CBX-12 (alphalex™-exatecan) into the clinic. The first patient dosing in the Phase 1 study is expected in the first half of 2021.

Led by Per Hellsund, President & CEO, Cybrexa Therapeutics is an oncology-focused biotechnology company developing a new class of therapeutics through its alphalex™ Peptide Drug Conjugate (PDC) tumor targeting platform. https://www.finsmes.com/2021/03/highcape-capital-and-new-investor-elm-street-ventures.html

Tausight Closes $20M Series A Financing

Tausight, a Boston, MA-based platform to discover and help secure Protected Health Information (PHI), raised $20m in Series A funding.

The round was co-led by existing investors Polaris Partners and Flare Capital Partners, alongside new investor .406 Ventures.

The company intends to use the funds to expand its go-to-market team and further build out its healthcare-specific solution for exposing the hidden vulnerabilities in clinical workflows that can put patient data at risk.

Founded by David Ting, the cofounder and former CTO of Imprivata and a former appointee to the U.S. Department of Health and Human Services Health Care Industry Cybersecurity Task Force, and led by Dave Dickinson, CEO, Tausight aims to help healthcare CIOs and CISOs understand in real-time the risks that are inherent in how PHI is used so the threats can be eliminated. https://www.finsmes.com/2021/03/tausight-closes-20m-series-a-financing.html

Variantyx Secures $20M in Series C Funding

Variantyx, a Boston, MA-based hereditary disease testing company, secured $20M in Series C funding.

The round was led by GHS Fund (Quark Venture LP and GF Securities) and includes new investor, IBM Ventures and current investors, Pitango Venture Capital, New Era Capital Partners, 20/20 HealthCare Partners. In conjunction with the funding, Zafrira Avnur, PhD, Quark Venture Chief Scientific Officer & Partner, will join the Variantyx board of directors.

The company intends to use the funds for development of its tumor diagnostic solutions and the expansion of sales.

Led by Haim Neerman, CEO, Variantyx is a CLIA/CAP laboratory providing Genomic Unity®, a whole genome sequencing (WGS)-based testing program for diagnosis of rare inherited disorders. Its single method approach to comprehensive genetic testing identifies multiple variant types within a single patient sample to provide a unified clinical report.

Variantyx Secures $20M in Series C Funding - FinSMEs

Variantyx, a Boston, MA-based hereditary disease testing company, secured $20M in Series C funding round

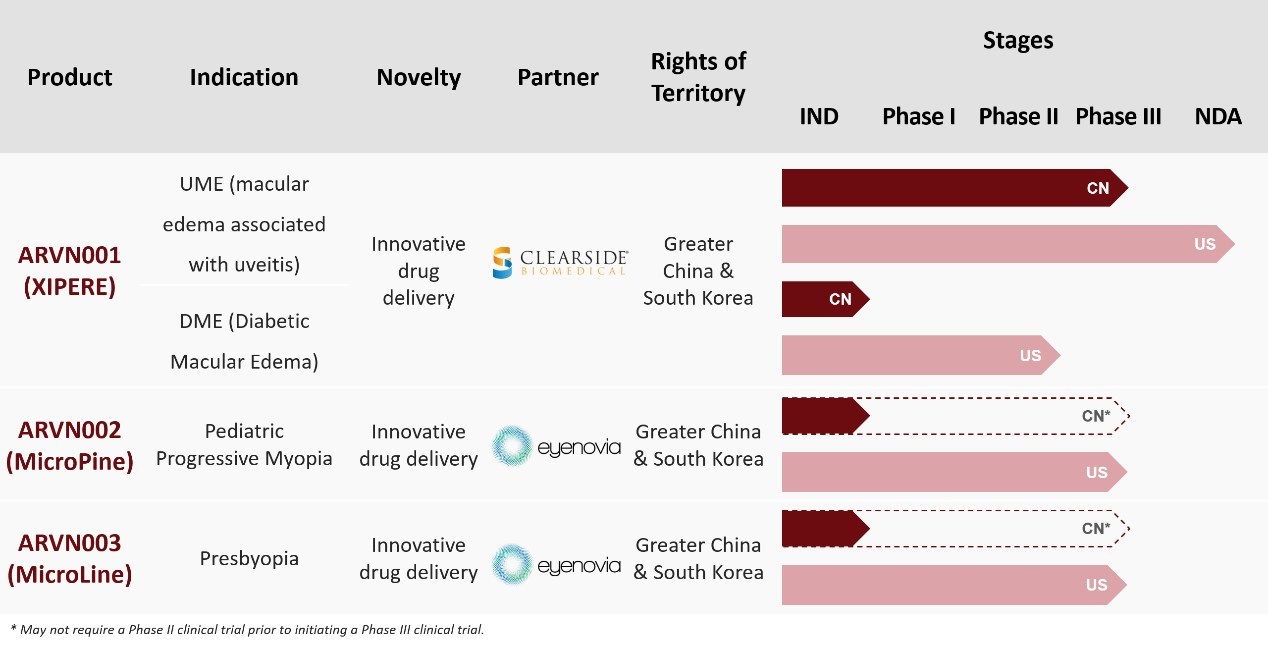

Arctic Vision Closes Over US$100M Series B Financing

Arctic Vision, a Shangai, China-based clinical-stage ophthalmology company focused on developing innovative therapies for pan-ocular diseases, completed an over US$100m Series B financing.

The round was led by Loyal Valley Capital, with participation from Tencent, Octagon Capital, and Dr. Adrian Cheng, renowned entrepreneur from New World Development Group, along with existing investors Nan Fung Life Sciences, Pivotal bioVenture Partners China and Morningside Ventures.

The proceeds will continue to support the progress of Arctic Vision’s pipeline, including clinical developments, registrational activities, and commercialization; as well as the establishment of in-house R&D capabilities; business development, and organizational growth.

Arctic Vision Closes Over US$100M Series B Financing - FinSMEs

Arctic Vision, a Shangai, China-based clinical-stage ophthalmology company focused on developing innovative therapies for pan-ocular diseases, completed an over US$100m Series B financing

Ibex Medical Analytics Raises $38M in Series B Funding

Ibex Medical Analytics, a Tel Aviv, Israel-based AI-powered cancer diagnostics company, raised $38m in Series B financing.

The round was led by Octopus Ventures and 83North, with participation from aMoon, Planven Entrepreneur Ventures and Dell Technologies Capital, the corporate venture arm of Dell Technologies, bringing total funding of Ibex to $52m since its inception in 2016 as part of the Kamet Ventures incubator. Will Gibbs, early stage health investor at Octopus Ventures, will be joining the Ibex Board as part of this funding round.

The company intends to use the funds to expand its customer base of clinical deployments in labs and health systems in North America and Europe, grow talent across R&D, clinical and commercial teams, accelerate expansion of the Galen™ solution portfolio, bringing new AI tools for more tissue types, including novel AI-based enhancements of the pathology workflow and oncology focused AI-markers.

Led by Joseph Mossel, CEO and Co-founder, Ibex uses AI to develop clinical-grade solutions that help pathologists detect and grade cancer in biopsies.

Ibex Medical Analytics Raises $38M in Series B Funding

Ibex Medical Analytics, a Tel Aviv, Israel-based AI-powered cancer diagnostics company, raised $38m in Series B financing

EyeYon Medical Raises $25M in Series C Funding

EyeYon Medical, a Tel Aviv, Israel-based company that develops advanced technology to treat acute problems in the ophthalmic world, closed a $25m Series C funding round.

The round, which brings the company’s valuation to $36m, was led by a global strategic leader in the ophthalmic industry and CR-CP Life Science Fund with participation from Global Health Sciences (GHS) Fund (Quark Venture LP and GF Securities), BPC and existing investors Triventures, Rimonci, Pontifax and Diamond BioFund.

The company intends to use the funds to expand the clinical trials of EndoArt.

Founded in 2011 by Dr. Ofer Daphna, CEO Nahum Ferera MD, and Dr. Arie Marcovich, MD., EyeYon Medicalv is advancing the EndoArt®, a synthetic implant which enables doctors to treat chronic corneal edema with a minimally invasive surgery that erodes the use of human tissue.

EyeYon Medical Raises $25M in Series C Funding - FinSMEs

EyeYon Medical, a Tel Aviv, Israel-based company that develops advanced technology to treat acute problems in the ophthalmic world, closed a $25m Series C funding round

Delonix Bioworks Raises $14M in Seed Financing

Delonix Bioworks Ltd., a Shangai, China-based biotechnology company dedicated to developing the next generation vaccines with synthetic biology approaches, closed a $14m seed financing.

The round was led by Boehringer Ingelheim Venture Fund (BIVF) and IDG Capital, with participation from ZhenFund and an undisclosed investor.

The company intends to use the funds to accelerate the building of synthetic biology vaccine platforms and advance pipelines of synthetic vaccines to clinical trials.

Led by Dr. Qiubin Lin, CEO, Delonix is a biotech company working on innovative synthetic biology approaches to develop the next generation medical solutions to address global public health challenges. Its synthetic biology and antigen discovery platforms enable rational design and programming of bacteria into more safe and effective vaccines. Current lead programs target anti-microbial resistance (AMR). https://www.finsmes.com/2021/03/delonix-bioworks-raises-14m-in-seed-financing.html