BetterUp, Honor Technology, Twin Health

Pivotal Analytics Raises $10.2M in Series A Funding

Pivotal Analytics, a Washington MD-based provider of healthcare analytics solutions, raised $10.2M in Series A funding.

This investment was led by one of the largest owner-operators of medical office buildings in the United States, with participation from three existing investors. Their names were not disclosed.

The company intends to use the funds to expand its development efforts, which includes growing its library of top-tier data partners and proprietary algorithms and redesigns the user experience to support different user types, and scale up talent and tools in areas needed for growth, including product development and engineering.

Led by Carl Davis, CEO, Pivotal Analytics provides Pivotal, a business intelligence and healthcare analytics solution that empowers healthcare organizations, developers, REITs, consultants, and other healthcare facility experts to predict care supply and demand in specific target markets. By combining deep healthcare knowledge, top-tier data sets, and an analytics engine, Pivotal translates raw, objective data into meaningful information that fuels any healthcare system planning scenario. The result is a precise and timely understanding of unmet care needs, now and in the future, and the ability to dynamically project the facility and talent resources necessary to meet those needs.

https://www.finsmes.com/2021/10/pivotal-analytics-raises-10-2m-in-series-a-funding.html

Catalyst OrthoScience Raises $12.3M in Series D Funding

Catalyst OrthoScience Inc., a Naples, Fla.-based medical device company focused on the upper extremity orthopedics market, raised $12.3m in Series D financing.

The round was led by River Cities Capital and Mutual Capital Partners.

Founded in 2014 by orthopedic surgeon Steven Goldberg, M.D., and led by Brian K. Hutchison, chairman and CEO, Catalyst OrthoScience is a shoulder replacement surgery company with a portfolio of patents and pending patents on its surgical offerings. The company recently rebranded its product portfolio with the Archer family name, received FDA 510(k) clearance and began a limited launch for the Archer R1 Reverse Shoulder System and introduced its Archer 3D Targeting imaging software for its current product offerings.

https://www.finsmes.com/2021/10/catalyst-orthoscience-raises-12-3m-in-series-d-funding.html

Honor Technology Closes $370M Debt and Series E Equity Round

Honor Technology, a San Francisco, CA-based senior care network and technology platform, raised $70m in Series E funding and $300 million in debt financing.

The round, which brings Honor’s total equity funding to date to $325m and values the company at over $1.25 billion, was led by Baillie Gifford with participation from existing investors.

Honor intends to use the funds to triple R&D investment and expand the technology and operations platform to the recently acquired Home Instead network.

Led by Seth Sternberg, co-founder and CEO, and Sandy Jen, co-founder and chief technology officer, Honor provides a proprietary technology platform that extracts insights to match the right caregivers with the right clients based on a range of personalized factors and assists with caregiver recruiting, training, scheduling, and performance analysis.

Honor Technology Closes $370M Debt and Series E Equity Round

Honor Technology, a San Francisco, CA-based senior care network and technology platform, raised $70m in Series E funding and $300 million in debt financing

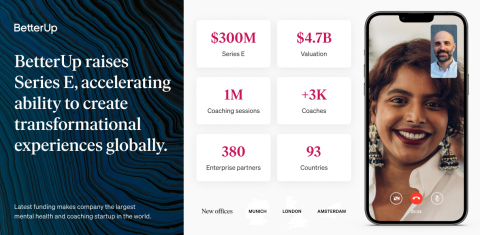

BetterUp Raises $300M in Series E Funding

BetterUp, a San Francisco CA-based virtual professional coaching and Mental fitness platform, raised $300M in Series E funding.

The round was led by Wellington Management, ICONIQ Growth, and Lightspeed Venture Partners with participation from Salesforce Ventures and Mubadala Investment Company, also customers of BetterUp, along with Sapphire Ventures, Morningside Group, SV Angel, and PLUS Capital.

The company intends to use the funds to accelerate growth, expand operations and its business reach.

The funding will also accelerate BetterUp’s international growth, having most recently opened new offices in Munich, London, and Amsterdam, along with recent strategic acquisitions of advanced people experience platforms Motive and Impraise, announced last month.

Led by Alexi Robichaux, CEO, BetterUp provides a platform that combines coaching with AI technology and behavioral science to deliver personalized behavior change and improve the well-being, adaptability, and effectiveness of the workforce.

BetterUp Raises $300M in Series E Funding - FinSMEs

BetterUp, a San Francisco CA-based virtual professional coaching and Mental fitness platform, raised $300M in Series E funding.

Exo Therapeutics Raises $78M in Series B Financing

Exo Therapeutics, Inc., a Cambridge, Mass.-based small molecule drug discovery and development company, closed a $78m Series B financing.

The round was led by new investor Nextech Invest with participation from BVF Partners, Samsara Biocapital, Morningside and Casdin Capital, and existing investors Newpath Partners, Novartis Venture Fund, CRV and 6 Dimensions Capital. As part of the financing, Thilo Schroeder, PhD, Partner at Nextech Invest, and Kanishka Pothula, Managing Director at BVF Partners, L.P., joined Exo’s Board of Directors.

The company intends to use the funds to advance therapeutic candidates in oncology and inflammation derived from its proprietary ExoSightTM platform towards proof-of-concept and into the clinic and expand its pursuit of new targets with the ExoSight platform.

Led by Michael Bruce, PhD, CEO, Exo Therapeutics is a small molecule drug discovery and development company with technology to address intractable pharmaceutical targets. By leveraging the company’s ExoSightTM platform, Exo is developing a deep pipeline of potent drug candidates that bind exosites, distal and unique binding pockets that have the potential to reprogram enzyme activity for precise and robust therapeutic effect.

https://www.finsmes.com/2021/10/exo-therapeutics-raises-78m-in-series-b-financing.html

Intergalactic Therapeutics Raises $75M in Series A Funding

Intergalactic Therapeutics, a Boston, MA-based non-viral gene therapy platform, raised $75m in Series A financing.

ATP, a life sciences venture capital firm, made the founding investment.

Intergalactic’s breakthrough approach to non-viral gene therapy deploys two proprietary technologies: 1) C3DNA, covalently closed and circular DNA that does not integrate into the genome or lead to adverse immune reactions, permits large gene cargoes, and relies on a cell-free manufacturing process; and 2) COMET®, a clinically advanced, pulsed electric field focal gene therapy delivery system.

Led by Michael Ehlers, M.D., Ph.D., founder and Chief Executive Officer, Intergalactic Therapeutics is developing non-viral gene therapies in ophthalmology, oncology, and respiratory diseases. Potential applications of its technology platform in other areas include cardiology, hepatology, CNS, and musculoskeletal disorders.

The company recently entered into a five-year strategic partnership with Resilience, a differentiated provider of manufacturing solutions for next-generation medicines including cell and gene therapies, under which Resilience will provide cGMP capacity and resources to manufacture C3DNA products for Intergalactic’s first in human clinical trials, and process and analytical development support to advance Intergalactic’s novel cell-free manufacturing.

https://www.finsmes.com/2021/10/intergalactic-therapeutics-raises-75m-in-series-a-funding.html

Affylmmune Therapeutics Raises $30M in Series A+ Funding

Affylmmune Therapeutics, a Natik MA-based clinical stage biotechnology company, raised $20M in Series A+ funding.

The round was led by ORI Capital (ORI). As part of the financing, Elaine Yang, Director at ORI Capital, will join the Board of Directors of AffyImmune.

The company intends to use the funds to advance the Phase 1 study of its lead asset, AIC1000, for the treatment of anaplastic thyroid cancer and refractory poorly differentiated thyroid cancer. In addition, AffyImmune will be able to conduct IND-enabling efforts for two additional pipeline candidates, and fund select drug discovery activities. The company also plans to double its headcount in the next nine months, with a focus on expanding its in-house discovery and leadership teams.

Led by Co-Founder & CEO Moonsoo Jin, Ph.D, and President & COO Eric von Hofe, Affylmmune Therapeutics provides cancer immunotherapy by extending the anti-cancer activity of CAR T cell therapy to solid tumors. Its “Tune & Track” platform tunes the affinity of CAR T cells to reduce toxicity and increase CAR T cell longevity while allowing in vivo monitoring through a proprietary tracking system.

Affylmmune Therapeutics Raises $30M in Series A+ Funding - FinSMEs

Affylmmune Therapeutics, a Natik MA-based clinical stage biotechnology company, raised $20M in Series A+ funding.

Brave Care Raises $25M in Series B Funding

Brave Care, a Portland OR-based pediatric healthcare and technology platform provider, raised $25M in Series B funding.

The round was led by Mednax, Inc. (NYSE:MD). Mednax’ Chief Development Officer, Dr. Jim Swift, also has been added to Brave Care’s Board of Directors.

The company intend sto use the funds to accelerate growth and expand operations.

Led by founders Dr. Corey Fish, Darius Monsef, Maryam Taheri and Asa Miller, Brave Care provides a pediatric primary and urgent care medical platform dedicated to improving healthcare for kids. A Y Combinator graduate, the company has been committed to pediatric clinical care advancement since 2019, utilizing technology and data platform to create care for both urgent care and regular visits for both pediatric patients and parents. Its clinics are open 12 hours a day, with remote care available 24/7 through their nurse line and Brave Care Parent Mobile App, helping parents find relief for their children around the clock.

Brave Care Raises $25M in Series B Funding - FinSMEs

Brave Care, a Portland OR-based pediatric healthcare and technology platform, raised $25M in Series B funding.

Kingdom Supercultures Raises $25M in Series A Funding

Kingdom Supercultures, a New York-based biodesign company that specializes in developing natural microbial cultures, raised $25M in Series A funding.

The round was led by Shine Capital with participation from Valor, Tao, Lux, SALT, Reference, Digitalis, and existing investors – along with recognized names in the future of food, including the founders of Daring Foods, Good Culture, Hungryroot, RXBAR and Waterloo.

The company intends to use the funds to expand its scientific platform and R&D facilities.

Led by Kendall Dabaghi, CEO, Kingdom Supercultures provides natural microbial cultures to transform the consumer packaged goods industry. Kingdom designs and supplies a new class of natural ingredients (“Supercultures”) that make it easy for food, beverage, and personal care manufacturers to create healthy and sustainable products. These Supercultures are composed entirely of microbial strains found naturally in food, which Kingdom rearranges into new combinations with new functionalities. Manufacturers then use these Supercultures to create plant-based yogurts and cheeses, lower-alcohol wines and beers with full flavor, and personal care products without artificial chemicals.

Kingdom Supercultures Raises $25M in Series A Funding

Kingdom Supercultures, a New York-based biodesign company that specializes in developing natural microbial cultures, raised $25M in Series A funding

Thyme Care Raises $22M in Funding

Thyme Care, a Nashville TN-based provider of oncology care management solutions, raised $22M in funding.

The round was led by Andreessen Horowitz, AlleyCorp, and Frist Cressey Ventures with participation from Casdin Capital and Bessemer.

The company intends to use the funds to accelerate the technology and advance partnerships with oncologists, health plans, employers, and risk-based entities.

Led by Robin Shah, Founder and CEO, Thyme Care provides a complete tech-enabled oncology care management solution for health plans, including partnership with Clover Health, offerinf tech-enabled cancer care navigation. The platform, which connects patients, caregivers, providers, and payers, generates actionable insights that enable identification of individuals early in the cancer journey, while optimizing the patient experience and empowering clinicians to be able to better serve patients’ needs at scale. With Thyme Care, every member is assigned a personalized team of oncology nurses and resource specialists who provide education, guidance, and advocacy as they navigate their care.

https://www.finsmes.com/2021/10/thyme-care-raises-22m-in-funding.html

Twin Health Raises $140M in Series C Funding

Twin Health, a Mountain View, Calif.- and Chennai, India-based maker of a Whole Body Digital Twin™ precision health service, raised $140m in Series C funding.

Backers included ICONIQ Growth, Sequoia Capital India, Perceptive Advisors, Corner Ventures, LTS Investments, Helena and Sofina.

The company intends to use the funds to scale its service in the U.S. and globally.

Founded in 2018 by Jahangir Mohammed, CEO, Twin Health invented the Whole Body Digital Twin™ to help reverse and prevent chronic metabolic diseases, while improving energy and physical health. Powered by artificial intelligence, the Whole Body Digital Twin™ is a dynamic representation of each individual’s unique metabolism, built from thousands of data points collected daily via non-invasive wearable sensors and self-reported preferences. The Whole Body Digital Twin™ is a predictive model that provides individualized nutrition, sleep, activity and breathing guidance to patients and their healthcare providers, helping to reverse and prevent multiple chronic metabolic diseases.

Twin Health Raises $140M in Series C Funding

Twin Health, a Mountain View, Calif.- and Chennai, India-based maker of a Whole Body Digital Twin™ precision health service, raised $140m in Series C funding

Chance Pharmaceuticals Raises $30M in Series C Funding

Chance Pharmaceuticals, a Hangzhou, China-based clinical-stage biotechnology company, raised $30M in Series C financing.

The round was led by Lapam Capital with participation from CMS Capital and HEDA BioVenture and existing investor Guozhong Capital.

The company intends to use the funds to advance its research and development efforts for its innovative pipeline of inhalation therapies, initiate additional business collaborations, and accelerate the construction of a manufacturing facility.

Led by Dr. Donghao Chen, founder and CEO, Chance Pharmaceuticals provides, discover, develops, and commercializes inhalation therapies for the world’s debilitating diseases such as chronic obstructive pulmonary disease, asthma, pulmonary arterial hypertension, and central nervous system disorders.