My #SundaySwing ideas for the week of 2/22 based on #TheStrat

The market is crazy right now, we see movements per day up or down that are bigger than the movements of a whole month 2-3 years ago.

Which makes it difficult to find good #SundaySwing trades, but my scanners worked hard to find possible great setups…

TLDR;

Mixed content of bullish and bearish ideas this week. However due to the market, bears lead 3:1.

- $PG 3/18 165c > 161.06

- $BABA 3/18 100p < 117.20

- $NCLH 3/18 20p < 20.91

- $PTON 3/18 27p < 29.08

Recap of 2/13 SundaySwing

The rotation to other sectors caught me completely on the wrong foot last week. The Energy sector was so strong and didn’t showed and weakness. I even did a Youtube video on sectors with Tradytics to show how to find great setups.

And then… Energy got crushed right on Monday. The only ticker that got triggered is $DVN. The others didn’t even come close. The good thing is, that they not triggered, so no money invested and therefore nothing lost.

The stocks from the week prior, 2/6 SundaySwing are still very profitable and some even already hit my profit targets and I exited and took the profits.

Disclaimer: Not advice, instead these are my ideas based on my knowledge analyzing the charts for possible swing trades based on #TheStrat. So please always do your own due diligence before entering a trade.

Chart setups

Since I got always questions about the colors in my charts and the setups:

- I always chart in multiple time frames Monthly, Weekly, Daily, and 4-hour or 60min

- Purple lines last months high&low

- Orange lines last weeks high&low

- Blueish lines last day high&low

- Green lines are my targets

- Sometimes white and yellow for intermediate targets or 50% rule setups

- The brownish-boxes on the Daily and 4-hour chart you see sometimes show a gap that hasn’t filled yet.

If some of the broadening formation lines looking a bit curved, it is because I switched to logarithmic scale on the charts, but they are still correct.

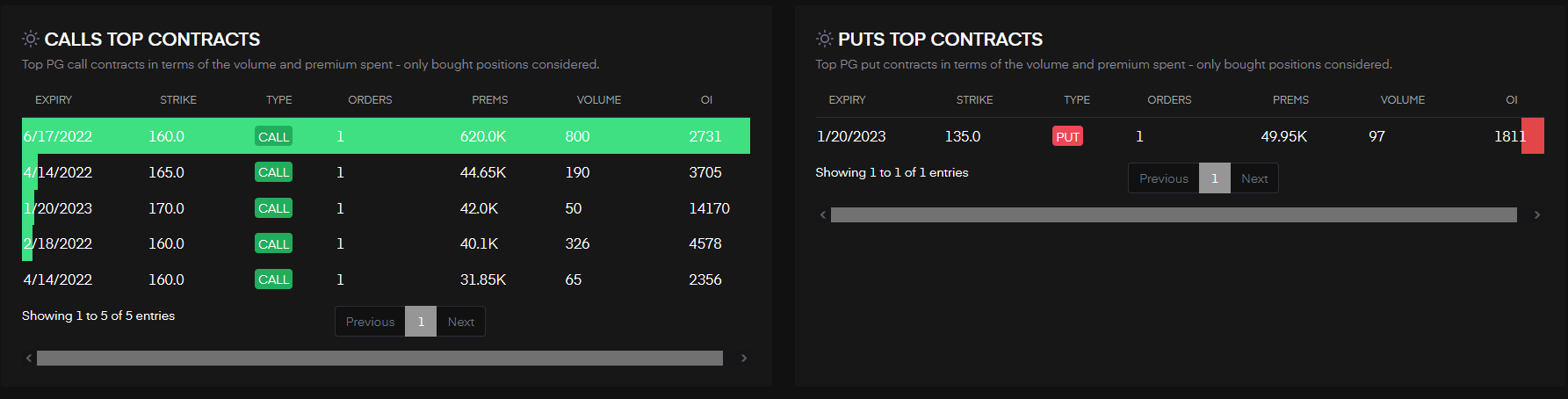

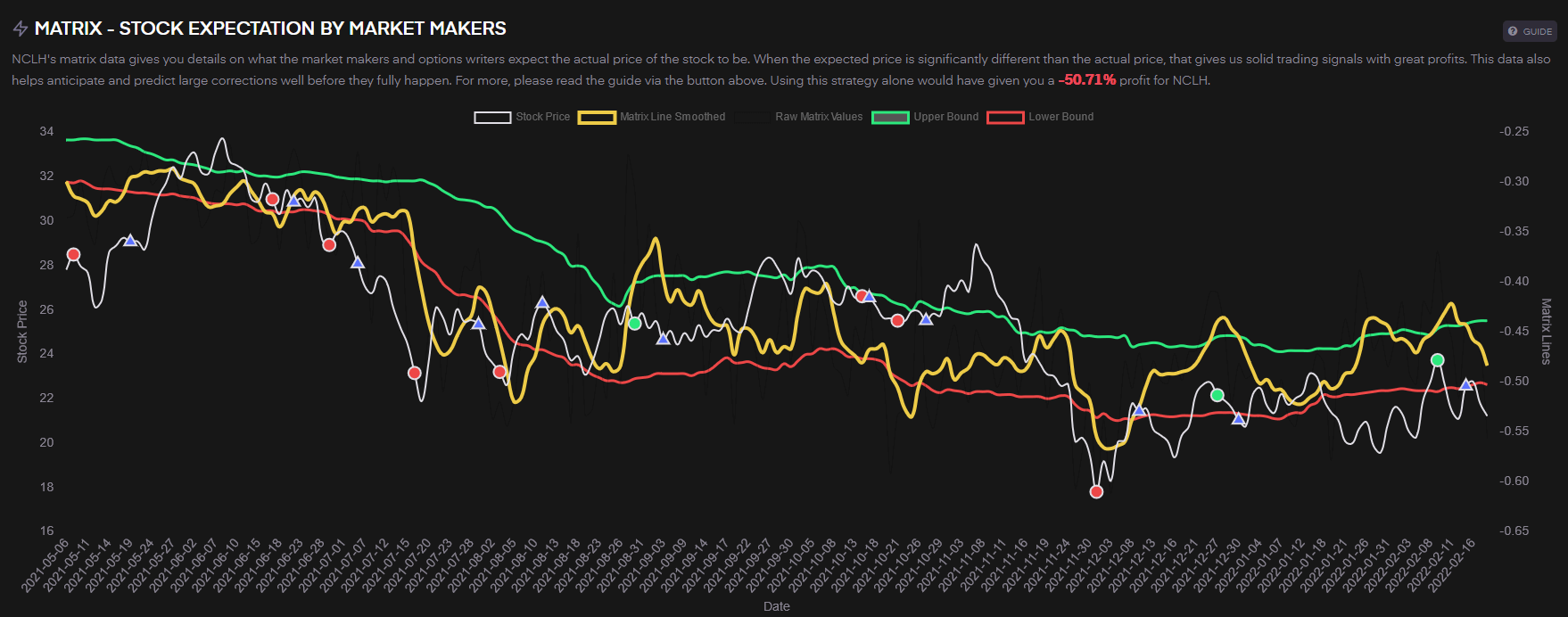

Flow info from Tradytics

I’m adding Tradytics screenshots for additional confirmation of my strikes. The link to Tradytics is a referral link, so if you find that service helpful and want to try it for yourself, I would appreciate it, if you use that link to support me.

Outlook

As always lets have a look at $SPY and $QQQ for a rough prediction of what I think the market will do next. Or course it’s just my interpretation, so keep that in mind!

$SPY

The weekly candles are still inside the compound outside bar from 4 weeks ago, closer to the downside, which would also trigger the month 2d below 420.76. Can’t see a good bullish reversal, not before SPY runs above 448.05 for a 2d-2u Bullish Reversal on the Weekly.

$QQQ

Same for $QQQ, 334.15 is the trigger for the month 2d and it is very close to this trigger.

Profits and Stops

I usually target around 25-40% of profits on those swings and decide during the market hours if I leave a runner on a position or close the entire one.

To view the charts in full detail, click to open them in a new browser window.

As you notice below, I’m going out to the March 18th expiration which gives me ~6 weeks of time if one of the stocks triggers this week and I’m suprised how “cheap” some of the contracts are compared to the tech stocks.

$PG 3/18 165c > 161.06

The whole Consumer Stapes sector ($XLP) was strong, PG is one of them, so with the possible 2-2u Bullish Reversal on the Week I set an alert to buy the 165c contracts with 3/18 expiration. Only risk here is, that PG is near ATH at 165.35.

My targets are 162.26 and 164.98 before ATH.

$BABA 3/18 100p < 117.20

I selected that contract because of the price and some time. $BABA contracts on the bearish side are more expensive and I don’t expect it to go ITM. But if it makes my projected 25-40% I’m happy with it.

The idea here is the 3-2u-2d Weekly Bearish Reversal below 117.20.

FTFC is red and if BABA can stay inside month in February, there are still 3 weeks on the contract to go for a possible 2u-1-2d in March.

Nothing noteworthy on Tradytics, except a huge LEAP for 350c in 2023, so I ignore that for now because that is far OTM.

$NCLH 3/18 20p < 20.91

Travel sector seemd strong but lost some momentum on most of the same stocks like RCL, CCL and NCLH. I picked NCLH because of the red week insde. A possible 2u-1-2d Bearish Reversal Weekly is the idea here below 20.91. Target is 20.41 and maybe 19.14 as well.

FTFC is mixed because Month is still green, but 2u, eyeing on the 50% rule below 21.02, which also has the possible target of 18.31.

$PTON 3/18 27p < 29.08

After good earnings last week it seemed like $PTON can run up again. For me after watching the weekly and daily charts it looks more like a TTO setup to shake some bulls out and now go lower again. The idea is a possible 2u-1-2d Bearish Reversal Weekly below 29.08. Targets are 27.91 and 26.59. The trigger for Month red is 27.39 which would turn PTON into FTFC down. The monthly target in March for a possible 2-2d would be 23.21.

The 3/18 25p is way more liquid but also way OTM yet, that’s why I selected the 27p here and will try to get a fill near the bid.

That’s it for this weeks #SundaySwing issue. If you found some ideas or learned something from my thoughts, feel free to give me some feedback and share this post to help reach more audience and educate more people trading with #TheStrat.

Have a nice green successful week!