Refuge's Tech Safety Newsletter March 2025

Women and Girls Rising: Reclaiming Financial Freedom

It has been long known that access to financial resources such as banking, credit, and investments not only improves women's lives, but also boosts the economy. Research consistently shows that women are more likely to save consistently, repay loans, and invest in their families' well-being, with studies from across the globe supporting this. Research also suggests that women leaders drive stronger financial performance. A widely cited 2012 Harvard Business Review survey of 7,300 leaders found that women outscored men in 12 of 16 leadership competencies. At every level, they were rated as more effective leaders. But it hasn’t always been this way. For much of history, women were excluded from financial decision making at home, and at work.

Pre-20th century, women tended to be financially dependent on their husbands or male family members, with limited to no control over property or finances. English common law defined the role of the wife as a ‘feme covert’, which essentially meant that women were subordinate to their husbands. This, however, changed in 1882, when the Married Women's Property Act allowed married women to own property in their name. Following this, in the early 20th century, women entered the workforce in greater numbers, while trailblazing suffragette Emmeline Pankhurst led the fight for voting rights; a victory achieved shortly after her death in June 1928.

During WWI, women began taking on what were once thought to be traditionally male roles, demonstrating their capability to take on factory work, agricultural jobs and serving as medical personnel in active warzones. Women began gaining more economic opportunities over time, with moments such as the Sex Disqualification (Removal) Act of 1919, which allowed women to pursue professions such as law, and in 1970, the Equal Pay Act which ensured that men and women couldn’t be paid differently for doing the same job. Just nine years later, the UK saw its first female Prime Minister, and today, more women are in higher education and the workplace than ever before.

However, as the barriers once holding women back continue to fall, new challenges have emerged, and one of those challenges is economic abuse. Paradoxically, economic abuse against women would appear to have increased as they gain more financial control, freedom, and opportunities, and as we work to end economic abuse, it is equally as important to recognise and celebrate the remarkable resilience of the women who, despite these obstacles, continue to fight for economic empowerment.

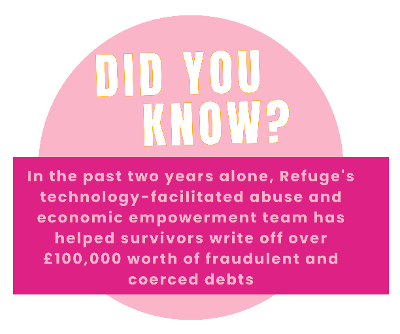

Economic abuse is a form of control where an abuser limits access to financial resources. Those who have experienced it often share painful stories of how their abusers restrict their access to money, pressure them into taking on debt, hinder access to work or education, and accumulate fraudulent debts in their names. These actions can impact a survivor’s ability to achieve financial independence, making it difficult to rebuild their lives. At Refuge, we recognise that these tactics not only hurt individuals but also threaten the progress that women have tirelessly fought for over generations.

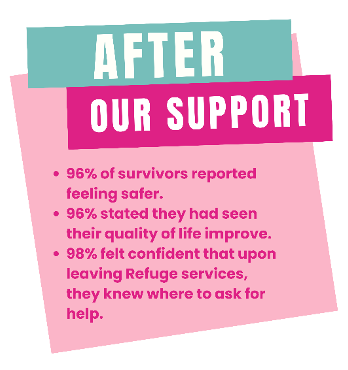

This International Women’s Day (8th March 2025), we invite you to stand with survivors of economic abuse and recognise the extraordinary strength and resilience they show every day as they overcome their challenges. Their courage is inspiring, and it is through their stories that we discover the true meaning of empowerment.