Debt Spending, Michael Scott, and TINSTAFL

Cheers RVA!

Today should be slightly cooler with a high of 81, with a 60% chance of rain. The weekend looks similar, with highs in the upper 80’s and variable storms and sunshine.

I’d say roll the dice on whatever cook-outs are planned.

the juice:

Mayor Stoney had a special announcement yesterday: Richmond earned a Triple-A rating. The rating affords the city more borrowing power and lower interest rates.

Richmond joins surrounding counties Chesterfield, Henrico and Hanover in having the rating.

My first reaction was recalling the scene from The Big Short when Mark Baum visits the ratings agency:

Just answer me Georgia. Can you name one time in the past year where you checked the tape and didn’t give the banks the triple AAA percentage they wanted?

The report from channel 12 seems like it’s positive news for the city, but StrongTowns.org has a different take, suggesting most cities are flying blind when it comes to their own debt. See the dive for more.

the pulp:

RPS school graduations to have heightened security, metal-detectors via channel 8

Get a free taco for the year by being one of the first 100 people to visit Taco Bamba when it opens in Willow Lawn June 4, from channel 6

the dive:

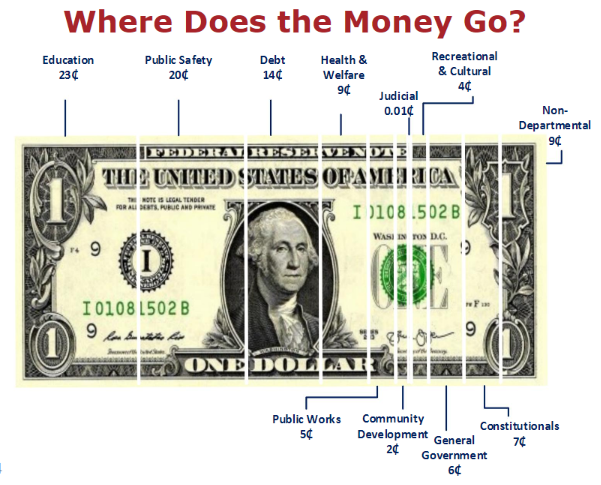

Charles Marohn from StrongTowns.org dives into the issue of City Debt. In the FY 2024 Richmond City Budget, 14% of all expenditure was on debt:

Mahron explains how cities use cash accounting v the private sector’s standard of accrual accounting:

This means that when the city borrows money, it immediately shows up as revenue in the budget. The only corresponding liability is the repayment amount.

So, if a city borrows a million dollars on December 31 and doesn’t pay any interest until the next year, that city will have a million dollars of cash to spend in the year they borrow it. Free and clear.

He argues projects often come from the gut of politicians rather than from detailed financial analysis:

These are projects they desire, just as with spending sales tax revenue. There is never a point in time where someone says “this bridge costs x and building it will yield this many multiples of x in new tax revenue.”

As I wrote in my article on sales tax, that kind of projection is near impossible to perform because of how the sales tax is collected. Debt takes that incongruity and supercharges it.

When has incongruence worked in any healthy public system?

This approach to spending he argues results in larger debt-funded projects which devalues basic maintenance:

All projects funded through these large debt offerings are large. Go big or go home. So, if your sidewalk is cracked and needs a panel here or there to be replaced, the city needs to take that money from sales tax revenue, which is scarce.

Or, they can simply wait until more of the sidewalk fails and the entire failure can be bundled into a large debt project. The latter is the path of least resistance. Instead of spending nickels and dimes on maintenance year after year, keeping the place nice, things have to fail so that the repairs can be aggregated into big debt-funded projects.

He goes on to critique how politicians will argue a good credit rating is a sign of a good management, exactly as Mayor Stoney did today:

City leaders like to portray a good credit rating as a sign of good fiscal management, but it’s not. Bond ratings are for investors, not taxpayers, and so a good bond rating is merely an indication that the city can repay the debt they have assumed.

Since there is no line item for debt in the city’s budget—no real accounting of the total amount of debt, including all kinds of bonds, IOUs, and interfund obligations—the analysis is mostly backward looking.

Has the city historically paid their debt? If yes, then they are likely to continue to do so. Congratulations: here’s your AAA bond rating. (It really is that simple, although there is a veneer of analysis added to justify the agency’s fee.)

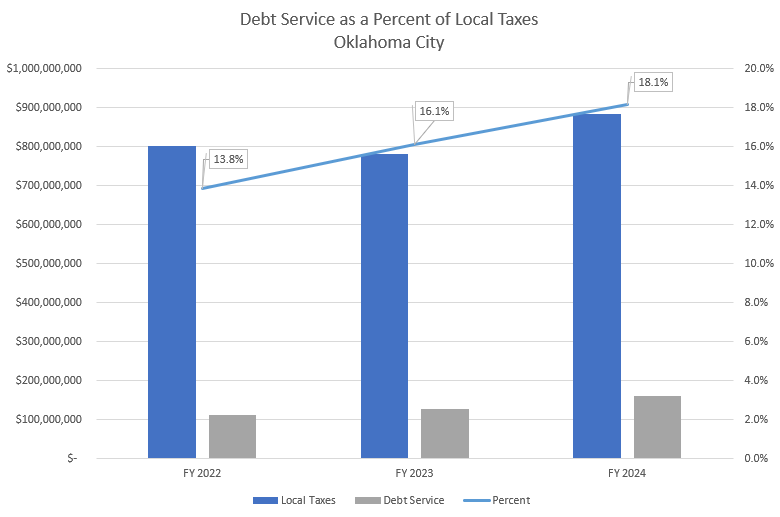

He concludes with an analysis of Oklahoma City, which shows how the debt as a percent of local taxes is increasing over time, due to the city flying blind.

the vibe:

Here’s a picture of Hollywood Cemetery from reddit:

All of Richmond’s Public swimming pools will be open Saturday and Sunday from noon-7 pm.

Have a great Memorial Day weekend RVA!

Help me out by asking a friend to subscribe. Feedback appreciated.