Wednesday, October 8, 2025. Annette’s Roundup for Democracy.

Zohran Mamdani, Democratic Candidate for Mayor, speaks on October 7th anniversary of Hamas attack on Israel and on Gaza.

My statement on the two year anniversary of October 7, 2023. pic.twitter.com/JlsXUeAeYd

— Zohran Kwame Mamdani (@ZohranKMamdani) October 7, 2025

The Trump Shut Down.

Q: Is Trump calling Democratic senators? Can you say what he's doing today to resolve the shutdown?

— FactPost (@factpostnews) October 6, 2025

Leavitt: He was on the phone with Speaker Johnson. He's also spoken with the Senate Majority Leader

(These are not Democrats) pic.twitter.com/nxbJ3dCBld

Trump’s no-negotiation position.

Trump’s shutdown costs $15/billion a week.

One more thing.

Federal workers erupt over latest White House threat to withhold their pay.

Federal workers say they are frustrated, scared and angry after the White House threatened to withhold their back pay once the government shutdown ends.

Why it matters: Many of these folks are living paycheck to paycheck and can't afford to simply not be paid. It's the latest blow to the country's largest workforce.

750,000 federal employees are on furlough — that is, they've been told not work during the shutdown and aren't getting paid. Others are working without pay.

Where it stands: It's "chaos," says Imelda Avila-Thomas, an official with the federal worker union that represents employees at the Department of Labor where she works.

She tells Axios that that she's been getting blasted with texts from colleagues asking if this is lawful or if they should look for another job.

"The irony is I work for the Wage and Hour Division. We ensure that people get paid correctly."

The big picture: When employees were furloughed on Oct. 1, they received paperwork guaranteeing that they'd get back pay upon their return, Avila-Thomas notes.

Now, after Axios reported that the White House was considering not paying furloughed workers, workers don't know what to believe.

Union officials, former government officials, Democrats and lawyers who are experts in administrative law say that the administration is legally required to provide back pay.

Even some Republicans agree: Sen. Thom Tillis (R-N.C.) told reporters that threatening not to pay back workers is "bad strategy" and "probably not a good message to send right now to people who are not being paid," Axios' Andrew Solender reports.

Catch up quick: In every other previous shutdown, federal workers who were furloughed received back pay.

A federal law passed after the last shutdown, in President Trump's first term, was believed to enshrine the practice into law — until Tuesday morning, when Axios' Marc Caputo reported that the administration was taking a different view and considering not paying furloughed workers.

Asked about not paying furloughed workers, Trump told reporters, "it depends on who you're talking about."

"For the most part, we're going to take care of our people," the president said. "There are some people that really don't deserve to be taken care of, and we'll take care of them in a different way."

Reality check: The OMB's official guidance still says federal workers should receive compensation.

Nothing is official yet.

Zoom in: Five other federal employees independently told Axios that they were angry over this latest threat — after a year of layoffs and nasty rhetoric from the White House maligning their work.

Avila-Thomas notes that half of her colleagues have left this year, taking early retirement or pushed out by the White House.

The federal workforce overall is already down by more than 200,000 employees this year. Another 100,000 are expected to leave by December, an administration official said recently.

What they're saying: "I think the mood has moved past anxious and well into pissed-off territory," says one federal worker. "I also think it's a bluff."

"It's telling that this administration's approach to negotiation is to threaten to blatantly break the law," says one employee, currently on furlough from the Bureau of Land Management. "They're just doing this to see what Congress will let them get away with."

What to watch: The unions that represent federal workers have already filed complaints over the administration's threats to fire workers in the shutdown.

The argument that workers aren't guaranteed back pay violates the law, Everett Kelley, president of the American Federation of Government Employees, said in a statement Tuesday.(Axios)

The Trump military takeover of our cities.

Touch to watch.👇

My video report from the perilous front lines of what President Trump described as “war-ravaged” Portland, a city “on fire,” requiring troops to come save us. pic.twitter.com/EarWVjkpx3

— Nicholas Kristof (@NickKristof) October 6, 2025

Q: Don’t Democrats have reason to worry that this administration plans to keep troops in U.S. cities long-term?

— Republicans against Trump (@RpsAgainstTrump) October 7, 2025

Leavitt: "You guys are framing this like the president wants to take over American cities with the military."

pic.twitter.com/Yqn7IPYwGG

Stephen Miller is portraying opposition to Donald Trump in any form, including by judges issuing legal rulings, as an illegal rebellion, Jonathan Chait argues: pic.twitter.com/YD3phtNFiM

— The Atlantic (@TheAtlantic) October 7, 2025

Steven Miller's cousin, Alisa:

— Brown Eyed Susan (@smc429) October 6, 2025

He went from being an "awkward, funny, needy middle child who loved to chase attention but was always the sweetest with the littlest family members." She once saw him as "young, conservative, misguided, but lovable and harmless."

And now, he's a… pic.twitter.com/1FcUZRMzTG

Speculation about the effects of AI mount.

AI will change our world, for better and for worse. One thing is clear. Unemployment will grow.

Here is something worth thinking about.👇

AI revolution threatens older white-collar workers

Gen X may be the first to need a universal basic income after late-career job loss.

Some estimates suggest that half of all white-collar jobs will disappear as artificial intelligence advances. How will older white-collar workers displaced in the AI revolution fare?

Our recent book, “American Idle: Late-Career Job Loss in a Neoliberal Era,” summarizes interviews we conducted with 62 baby boomers who lost their white-collar jobs during another unemployment crisis: the 2008 Great Recession and its sluggish recovery. Statistics show that workers over age 50 experienced the highest rates of long-term joblessness. Their layoffs also coincided with a precarious stage of the life course: “too young to retire but too old to start all over,” as one of our interviewees put it. Gen Xers today face the same quandary.

There were, however, vastly different financial outcomes after these post-2008 layoffs. At one end of the spectrum were those boomers who experienced “hard falls.” Because long-term unemployment and back-to-back job losses were common within this group, some turned to accessing food pantries, applying for welfare benefits, or losing a home to a short sale or foreclosure. Job losses at the other end of the spectrum were “soft landings,” and individuals were more or less financially unscathed.

Several factors facilitated soft landings. For instance, because these interviewees experienced years of job stability, their extended length of service translated into generous severance packages. Several also departed with defined benefits pension plans in hand. A guaranteed income stream for the remainder of their lives allowed for an unplanned early retirement for some. Family members, such as employed spouses or wealthy parents, were another source of financial support.

Evidence suggests that compared to the boomers we studied, a larger proportion of Gen X are susceptible to hard falls than their predecessors. This demands a structural solution and a universal basic income might be the answer.

First, baby boomers entered the labor force when white-collar workers were rewarded with job security and financial stability. In contrast, today’s office workers are encouraged to always be on the lookout for new opportunities. Frequent job changes, however, translate into a much smaller severance package when length of service factors into the equation. And whereas many of our soft landers had pensions, Gen X entered the labor force just as these secure retirement plans were being replaced with 401(k)s.

Workers are expected to contribute a portion of their salary into these defined contribution plans. But because savings are personally invested, financial illiteracy and market volatility increase the level of risk. At the same time, low wage workers typically lack employer-supported retirement plans, and even if they do have access, they are less likely to participate due to financial hardship.

Not to mention the collective net worth of Gen X is about half that of boomers. Because this generation also carries the highest rates of debt, the ability to retire comfortably will be jeopardized. With lower rates of home ownership than boomers at the same age, many Gen Xers will miss out on the long-term gains that can be derived from owning property.

Finally, a growing share of older adults now live alone. In addition to lacking the financial support of an employed spouse, people who live alone tend to earn less than individuals who are married. This predisposes one-person Gen X households to a financial disadvantage that may turn a layoff into a hard fall.

There is always the possibility that AI-induced job losses don’t materialize, given the current failure of artificial intelligence to increase worker productivity. Still, advancements are inevitable and with almost 900,000 private sector employees having already lost their jobs and another 300,000 federal government employees out of work by the end of 2025, white-collar workers are under threat from many sides.

Older workers are encouraged to protect their finances in this unstable environment but as our research shows, it’s impossible to prepare for a bout of unemployment

extended indefinitely by age discrimination in the hiring process.

Targeted education and training programs would empower unemployed Gen Xers to access fields in which job growth is predicted to increase. We must also consider developing a universal basic income program to address long-term joblessness among those older workers who are too young to collect Social Security. Such experiments in other countries have been successful in increasing both well-being and employment rates.

Here at home, several U.S. cities and counties, in both red and blue states, have already experimented with limited basic income programs. For white-collar Gen Xers seeking new employment, this could mean the difference between a soft landing with minimal financial strife, and a hard fall that stresses both personal households and other shrinking social safety nets.

Annette Nierobisz is professor of sociology at Carleton College in Northfield, Minn. Dana Sawchuk is professor and chair of sociology at Wilfrid Laurier University in Waterloo, Ontario. They are the authors of “American Idle: Late Career Job Loss in a Neoliberal Era” (Rutgers University Press, 2025).

(The Hill).

Another college in Massachusetts supports “students ready to change the world.”

Smith College to offer free tuition for families making up to $150K.

Commemorating its 150th anniversary, Smith College will offer free tuition for families with annual incomes of up to $150,000, according to a Monday announcement.

The initiative, beginning in fall 2026, will be for not only domestic students but also international students. It is the first women’s college in the nation to offer free tuition for some students with its loan-free financial aid.

“When the cost of college is beyond so many students and their families, Smith is committed to keeping higher education within reach,” said Smith College President Sarah Willie-LeBreton. “I am thrilled that in the same year Smith celebrates its 150th anniversary, we are also able to announce The Next 150 Pledge, an initiative both reflective of our founding mission and invested in access to an extraordinary education for every one of our admitted students.”

The announcement comes after recent tuition-free pledges by other institutions, including Tufts University, Mount Holyoke College and Harvard University.

Smith already meets 100% of the demonstrated needs of students and provides high-need incoming students with $1,000 startup grants.

“We estimate that more than 75% of families in the United States will now qualify for free tuition under The Next 150 Pledge,” said Joanna May, vice president for enrollment. “This policy is not only about reducing financial barriers, but also making our financial aid policy more transparent and easily understandable for low and middle-income families. We hope this will open Smith’s doors wider than ever before to exceptional students who are ready to change the world.”

The tuition-free program is supported by the college’s endowment and the gifts of alumnae and donors.

Read more: There are now over 30 Mass. colleges offering free tuition. Here’s a list.

(Masslive)

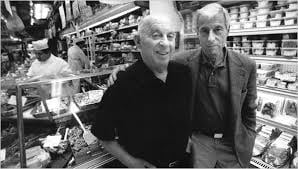

Saul Zabar has died. An era has ended on New York’s Upper Westside.

Saul Zabar, Smoked Fish Czar of Upper West Side, Dies at 97

He led his parents’ appetizing store, Zabar’s, for more than 70 years, turning it into an institution synonymous with New York.

Saul Zabar in 2014. He intended to become a doctor, but left college after his father died to help out with the family business. He never left.

Saul Zabar, who across more than seven decades as a principal owner of the Upper West Side food emporium bearing his family name kept New Yorkers amply fortified with smoked fish, earthy bread and tangy cheese, not to mention pungent coffee, died on Tuesday in Manhattan. He was 97.

His daughter Ann Zabar, who confirmed the death, at a hospital, said Mr. Zabar had been admitted there with a brain bleed.

The oldest of three brothers, Mr. Zabar did not intend to go into the family business, which his parents, Louis and Lillian (Teit) Zabar, started in 1934 as the smoked-fish department of a Daitch supermarket on Broadway. Saul had visions of becoming a doctor. But when his father died in 1950 at 49, Saul left college and returned home to help out.

“I really came into Zabar’s as a temporary assignment,” he told The New York Times in 2008. He never left. Instead, he became one of New York’s leading lox-smiths, partnering with his brother Stanley, and for many years with a marketing maven, Murray Klein, to turn a 22-foot-wide shop into a world-renowned enterprise.

Early on, the Zabars had five small stores, scattered along Broadway from West 80th to 110th Streets in Manhattan. Over time, they consolidated the operation into a single market commanding nearly $55 million in yearly sales and sprawling across roughly 20,000 square feet at Broadway and West 80th Street.

Early on, the Zabars had five small stores on the Upper West Side. They eventually consolidated the operation into a single market of roughly 20,000 square feet at Broadway and West 80th Street.

A broad assortment of delicacies, including some 800 types of cheese and various breads to go with them, covered the ground floor. One flight up was an array of cookware. A small cafe was later added next door. Zabar’s also operates a thriving mail-order business through its website and catalogs, shipping its lox, bagels and gift baskets far and wide.

The youngest brother, Eli, 15 years Saul’s junior, saw no place for himself in that setup and carved his own path in 1973 with the first in a chain of food shops bearing his name, Eli Zabar, principally on the East Side of Manhattan. The brothers played down any suggestions of a family schism.

I acted as Eli’s surrogate father,” Saul said in 2011. “Eli has always wanted to be able to control his own destiny and has always enjoyed the East Side, whereas we had more of the social ethic of the West Side.”

Saul, usually dressed in a polo shirt and khaki trousers, kept his eye on the Zabar’s operation for more than 70 years. In particular, he had dominion over the counters where an estimated 2,000 pounds of smoked fish and 8,000 pounds of coffee were sold to the 40,000 customers who filled the store in a typical week. (Those numbers dipped in 2020 and 2021 as Zabar’s, like other retailers, struggled through the Covid-19 pandemic, though the mail-order operation continued to reach customers sequestered at home.)

The store roasted its own coffee, and Mr. Zabar’s office doubled as a tasting room. He visited fish wholesalers who allowed him to sample the latest catch. One supplier told New York magazine in 1992 that he once saw Mr. Zabar get so angry about a whitefish that didn’t taste right when it was delivered to the store that he threw it on the floor and stepped on it.

What did he look for in a fish? His response to The New York Sun in 2007 was worthy of a cryptic Zen master: “It’s got to have taste. Not too this, not too that.”

Mr. Zabar in 2014. “We have a modern appearance,” he said, “but we really do things the way they were done 40, 50, 75, even 200 years ago.”

But he was clear about his store’s iconic status. “There’s a romance about what we do,” he said in 2012. “We have a modern appearance, but we really do things the way they were done 40, 50, 75, even 200 years ago.”

As for being a cultural landmark on the Upper West Side, he told a CUNY-TV interviewer in 2005: “That’s where we are. I mean, when Willie Sutton was asked why he robs banks — ‘That’s where the money is.’ We’re on the West Side because that’s where our customers are.”

Part of the Zabars’ success lay in understanding and adapting to New Yorkers’ increasingly sophisticated tastes. They benefited from having had Mr. Klein as a partner for three decades.

A pugnacious man who had survived the Holocaust, Mr. Klein assumed Lillian Zabar’s share of the business and drove many key decisions about what to buy and how much to charge. He relished price wars, whether over Beluga caviar or Pommery mustard or Cuisinarts. He had, to put it mildly, a turbulent relationship with the Zabars; Saul didn’t like even being around him.

Murray Klein, left, and Mr. Zabar at Zabar’s in 1994. Mr. Klein assumed Lillian Zabar’s share of the business and was responsible for key decisions about what to buy and how much to charge.

After Mr. Klein retired in 1994, control of Zabar’s remained with Saul as president and Stanley as vice president and chief financial officer.

Saul Zabar was born on June 4, 1928, in Brooklyn and moved to Manhattan when his family opened a smoked-fish outlet there. In those days, so-called blue laws restricted commercial activity on Sundays. The young Saul was posted as a lookout for approaching police officers. “But when I saw a policeman, I could not make myself run,” he told The Times in 2008. “I walked right back to the store, and the policeman followed right afterwards.” His father, unsurprisingly, was not pleased.

Saul attended Stuyvesant High School in Manhattan for two years, then transferred to the private Horace Mann School in the Bronx on the recommendation of a Zabar’s customer. After graduating in 1946, he attended the University of Kansas until his father died.

A marriage in 1949 to Rosalie Rothstein did not last. In 1968, Mr. Zabar married Carole Ann Kishner, who was a Hebrew teacher when they met; she later became a lawyer. They lived in Manhattan.

In addition to their daughter Ann, his wife survives him, along with two other children, Aaron and Rachel Zabar; four grandchildren; and his brothers. Two of Mr. Zabar’s children went into the family business: Aaron Zabar is a senior manager at Zabar’s; Ann Zabar is an assistant vice president.

Now and then, a Zabar’s controversy arose. One, in 2011, involved a discovery that the lobster salad contained no lobster.

There was no intention to deceive, Mr. Zabar said, and he cited a Wikipedia entry that defined crawfish, which the salad did contain, as “freshwater crustaceans resembling small lobsters, to which they are related.”

Nonetheless, he changed the name of the dish to “seafare salad.” But that didn’t work either, because crawfish aren’t saltwater fish. Thus was “zabster zalad” born, the first word a portmanteau of Zabar’s and lobster, the second Z tossed in for fun.

In the 1980s, the Zabars, stressed out by their uneasy relationship with Mr. Klein, were reportedly ready to sell the store. Concerned customers at the cash-only register would break into a chorus of “don’t sell!” when Mr. Zabar passed by. In the end, Zabar’s remained with the Zabars.

“We get asked often why we don’t franchise, because we have a lot of branded products,” he told the magazine Edible Manhattan in 2022.

“Money is not why we do this, not why we’re here seven days a week,” he said. “It’s a way of life for us. It’s kind of old-fashioned.”