Thursday, February 1, 2024. Annette’s News Roundup.

I think the Roundup makes people feel not so alone.

To read an article excerpted in this Roundup, click on its blue title. Each “blue” article is hyperlinked so you can read the whole article.

Please feel free to share.

Invite at least one other person to subscribe today! https://buttondown.email/AnnettesNewsRoundup

______________________________________

Joe is always busy.

Touch to watch the ad that the Biden Campaign is running on Trump’s social media outlet, Truth Social. How is this for Biden stickin a finger in Trump’s eye. 👇

NEW: The Biden campaign just trolled Trump by posting a new ad on Truth Social, which spends an entire minute exposing Trump’s gaffes & mental decline. The Biden campaign isn’t holding back & they’re taking it directly on Trump’s app. So good. Watch 👇

— Victor Shi (@Victorshi2020) January 31, 2024

pic.twitter.com/6WyU0qupwB

This is the question I’m referring to. 55% of young people say they will vote for Joe Biden, which is more than any other age group. Still a lot of work to do, but enough with the idea that young people don’t support Joe Biden. We do. We’ve got to continue mobilizing my peers. pic.twitter.com/1ZX2NkJyij

— Victor Shi (@Victorshi2020) January 31, 2024

I know how hard it is some days to sweep the clouds away and get to sunnier days.

— President Biden (@POTUS) January 31, 2024

Our friend Elmo is right: We have to be there for each other, offer our help to a neighbor in need, and above all else, ask for help when we need it.

Even though it's hard, you're never alone. https://t.co/ffMJekbowo

—

Biden is getting another bi-partisan bill across the finish line. This time it’s Taxes.

Gabe Fleisher yesterday Morning - here’s a refresher on the tax deal’s provisions:

Expands the refundability of the Child Tax Credit. Tax credits are considered “refundable” if individuals who don’t owe federal income tax can still receive the credit. The CTC is partially refundable, meaning low-income families can receive up to $1,600, out of the full $2,000 credit.

This deal would expand how much of the credit low-income families can receive, increasing to $1,800 for tax year 2023, $1,900 in tax year 2024, and $2,000 in tax year 2025. Meanwhile, the credit itself would eventually become more generous for all beneficiaries, increasing along with inflation in tax years 2024 and 2025.

That means the main beneficiaries of the bipartisan deal will be families who don’t currently earn enough to receive the CTC in full. According to an estimate by the left-leaning Center on Budget and Policy Priorities, around 16 million families would benefit from the expansion, which would lift up to 400,000 children above the poverty line in its first year.

Extends three corporate tax breaks. These changes include deductions for research costs (which would be able to be written off in one year, rather than having to spread out the deduction over five years, as currently required); for the cost of equipment and other “short-lived” capital investments; and for interest expenses.

All three tax breaks had been peeled back by the 2017 tax bill, in order to offset the costs of the measure. Under the 2017 package, they had either already expired or were poised to soon do so; now, they will be extended through 2025, which is also how long the CTC provisions will last under the deal.

Companies with large capital and domestic research costs will benefit, such as Apple, Amazon, Microsoft, and Boeing.

Boosts affordable housing. The deal will increase the Low-Income Housing Tax Credit (LIHTC), which provides a tax incentive to encourage developers to construct affordable housing units. Per the National Housing Law Project, the LIHTC program is the “largest source of new affordable housing” in the country.

The bill up for a vote today would increase the LIHTC by 12.5% through 2025. According to an estimate by the consulting firm Novogradac, the increase will spur the construction of more than 200,000 affordable housing units over the next two years.

Ends “double taxation” with Taiwan. Currently, Taiwanese companies doing business in the U.S. and American companies doing business in Taiwan are both taxed in both places, discouraging investment in each other’s economies. The U.S. has tax treaties in place with many countries to avoid this “double taxation,” but can’t sign one with Taiwan since the two governments lack official diplomatic ties.

The deal will effectively create a tax treaty with Taiwan, which will likely lead to more Taiwanese investment in the U.S. semiconductor industry. The provision will only go into effect when Taiwan provides the same benefits to American companies.

Provides tax relief for communities hit by disaster. In general, Americans must pay taxes on any “gross income” — no matter where that income came from. However, disaster relief payments are typically excluded from this sort of taxable income.

The tax bill will clarify that disaster payments made after wildfires and after last year’s East Palestine train derailment do not count as taxable income.

Repeals a pandemic-era tax benefit. Finally, the deal would end the Employee Retention Credit (ERC), a Covid-era tax credit offered to companies that could show they kept their employees on the payroll during the pandemic. The ERC quickly became a “magnet for fraud,” sparking thousands of bogus claims.

Per the Joint Committee on Taxation, the $79 billion saved by ending the ERC will be enough to fully offset the costs incurred by the other tax changes in the package. However, the Committee for a Responsible Federal Budget has warned that the deal could carry a $650 billion price tag if extended past 2025 without an additional offset. ( Wake up to Politics.)

So far, the bill has passed the House -

House Passes Bipartisan Tax Bill, but Election-Year Politics Complicate Its Path.

The House approved a $78 billion tax package Wednesday with a large bipartisan margin. The effort is a test of whether a dysfunctional Congress can pass major legislation in an election year.

The House gave broad bipartisan approval on Wednesday to a $78 billion bill that would expand the child tax credit and restore a set of corporate tax breaks, a rare feat in an election year by a Congress that has labored to legislate.

The bill passed 357 to 70, with mainstream lawmakers in both parties driving the House’s first major bipartisan bill of the year to passage. Forty-seven Republicans and 23 Democrats voted against the bill.

But despite the lopsided show of support, the measure faces a fraught path to enactment amid political divides over who should benefit the most. The effort, which faces resistance from Senate Republicans, is a test of whether a divided Congress with painfully thin margins can buck the dysfunction of the Republican-led House, set aside electoral politics and deliver legislation that would contain victories for both parties.

Representative Jason Smith, Republican of Missouri and chairman of the House Ways and Means Committee, championed the legislation as “pro-growth, pro-jobs and pro-America.”

“It’s a strong, common sense, bipartisan step forward in providing urgent tax relief for working families and small businesses,” Mr. Smith added.

The package would expand the child tax credit — though a version substantially scaled back from its pandemic-era level — and restore a set of business tax breaks related to research and development and capital expenses. Both would last through 2025. It would also bolster the low-income housing tax credit and extend tax benefits to disaster victims and Taiwanese companies and individuals.

The plan would be financed by curbing the employee retention tax credit, a pandemic-era measure meant to encourage employers to keep workers on the payroll that has become a magnet for fraud.

Lawmakers in both parties regard it as a policy victory and a way to show voters they can actually accomplish something despite the chaos and turmoil that have come to define the Republican-led House.

The majority of the country is really thirsty for us to do things in a bipartisan manner,” Representative Greg Murphy, Republican of North Carolina, said in an interview. “We’ve seen a lot of gridlock because some people really want to, basically, say no to everything. And I think we do need to move forward and actually show people that we can govern.”

In a sign of the political hurdles that are complicating the bill’s path, Mr. Johnson brought it to the floor on Wednesday under special expedited procedures that required a two-thirds majority for passage. The maneuver allowed him to steer around Republicans who could otherwise have blocked the bill over their policy and political objections.

Senate Republicans have also sought to pump the brakes, in another indication of the political challenges the package still faces. The bill would be a win for President Biden and Democrats, who have made expanding the child tax credit a signature issue, including Senator Sherrod Brown of Ohio, who is up for re-election this year and is a key target for Republicans in November.

Senator Michael D. Crapo of Idaho, the top Republican on the Finance Committee, said on Wednesday that he still had concerns with the bill — including a provision that would allow parents to use their previous year’s earnings to claim a bigger credit, which he argued would discourage work — and wanted to see it amended in the Senate. Mr. Crapo, and many other Senate Republicans, previously voted in favor of the same provision in previous bills.

“I’m sure there are going to be a number of issues, like raised yesterday in the House, that didn’t get resolved,” Mr. Crapo said. “I’m guessing that a lot of those kinds of issues will come up, and we’ll have to work through them.”

A group of lawmakers from New York and other blue states with high tax rates was angry that the measure omitted an increase it had sought to the cap on state and local tax deductions, known as SALT, which would benefit high earners. New York Republicans signaled their ire on Tuesday by briefly blocking a procedural measure in protest.

“The point, as has been made multiple times in this Congress, is obviously that there are strength in numbers,” said Representative Mike Lawler, who joined Representatives Anthony D’Esposito, Nick LaLota and Andrew Garbarino in defecting on the unrelated measure on Tuesday, only to switch their votes once their point had been made. “But for us that delivered the majority, this is the issue that matters.”

Mr. Johnson assuaged their concerns after a long night of meetings on Tuesday by committing to working with them to find a way to address SALT separately, said Athina Lawson, a spokeswoman for the speaker’s office.

The package that the House passed on Wednesday was brokered by the top two tax writers in Congress: Mr. Smith, and Senator Ron Wyden, Democrat of Oregon and the chairman of the Finance Committee. It has the support of the White House, key leaders in both parties on Capitol Hill and a variety of rank-and-file members. It gained momentum after the Ways and Means Committee approved it on an overwhelmingly bipartisan basis in January.

Proponents point to that vote, and to how unlikely it had seemed for a tax deal to come together, as a good sign for its prospects.

“Most prognosticators would have told you as recently as a month ago that this bill was destined to die in negotiations or collect dust on a shelf if it ever got introduced,” Mr. Wyden said in a statement Wednesday. “Given the sorry state of our political climate, it’s a real victory to have such strong momentum behind this bill that will help 16 million American kids from low-income families get ahead.”

Republican proponents have argued that the business tax breaks are worth embracing, and have framed the child tax credit as a conservative win as well.

“The child tax credit reforms in this bill are pro-family policies that maintain the child tax credit structure of the Trump-era G.O.P. tax reform,” Mr. Smith said in a statement. “The child tax credit provisions in this bill help families crushed by inflation, remove the penalty for families with multiple children and maintains work requirements.”

The legislation would make the $2,000-per-child credit more accessible to families with multiple children and gradually raise the cap on how much lower-income families can claim to match the amount for higher-income families. It would also automatically adjust the credit for inflation and allow parents to use their previous year’s earnings if it meant they could receive a larger credit.

Right-wing Republicans denounced the expansion, arguing that it would discourage work. They also objected to allowing undocumented immigrants who have U.S.-born children to receive the credit, for which they are eligible under current law.

“I’m not going to support something that expands the child tax credit, which is expanding the welfare state massively,” said Representative Bob Good, Republican of Virginia and chairman of the House Freedom Caucus. “And I’m not going to support child tax credit going to illegals. I think that’s incentivizing this illegal invasion, and we ought to stand united against it as the Republican Party.”

Progressive Democrats, on the other hand, argued that the bill did not expand the tax credit enough and disproportionately benefited corporations. It falls far short of the pandemic-era version of the child tax credit, which deposited up to $3,600 per child in families’ bank accounts and helped to pull millions of children out of poverty.

“I cannot vote for a deal that so lopsidedly benefits big corporations while failing to ensure a substantial tax cut to middle and working class families,” Representative Rosa DeLauro of Connecticut, the top Democrat on the Appropriations Committee, said on the floor before the vote. “This bill provides billions of dollars in tax relief for the wealthy and pennies for the poor.” (New York Times).

—

Polling starts to shift.

1/31/24 - 2024 Matchups: Biden Opens Up Lead Over Trump In Head-To-Head, Quinnipiac University National Poll Finds

Haley Leads Biden 1 On 1, But Trails When Third Party Candidates Are Added.

As signs point to the 2024 presidential election being a repeat of the 2020 race between President Joe Biden and former President Donald Trump, Biden holds a lead over Trump 50 - 44 percent among registered voters in a hypothetical general election matchup, according to a Quinnipiac (KWIN-uh-pea-ack) University national poll of registered voters released today.

In Quinnipiac University's December 20, 2023 poll, the same hypothetical 2024 general election matchup was 'too close to call' as President Biden received 47 percent support and former President Trump received 46 percent support.

In today's poll, Democrats (96 - 2 percent) and independents (52 - 40 percent) support Biden, while Republicans (91 - 7 percent) support Trump.

The gender gap is widening.

Women 58 - 36 percent support Biden, up from December when it was 53 - 41 percent.

Men 53 - 42 percent support Trump, largely unchanged from December when it was 51 - 41 percent.

"The gender demographic tells a story to keep an eye on. Propelled by female voters in just the past few weeks, the head-to-head tie with Trump morphs into a modest lead for Biden," said Quinnipiac University Polling Analyst Tim Malloy.

In a five-person hypothetical 2024 general election matchup that includes independent and Green Party candidates, Biden receives 39 percent support, Trump receives 37 percent support, independent candidate Robert F. Kennedy, Jr. receives 14 percent support, independent candidate Cornel West receives 3 percent support, and Green Party candidate Jill Stein receives 2 percent support.

Among independents in the five-person hypothetical 2024 general election matchup, Biden receives 35 percent support, Trump receives 27 percent support, Kennedy receives 24 percent support, West receives 5 percent support, and Stein receives 5 percent support.

______________________________________

25 Historians tell the Supreme Court Trump should be disqualified from the Presidency.

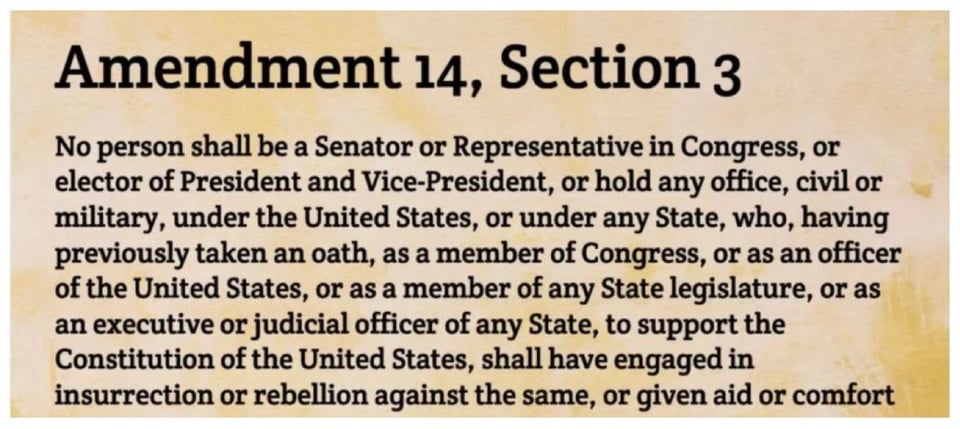

The Colorado case on the whether Trump should be disqualified based on the 14th Amendment is set for oral argument on Thursday, Feb.8.

US historians sign brief to support Colorado’s removal of Trump from ballot | US Supreme Court.

Twenty--five historians of the civil war and Reconstruction filed a US supreme court brief in support of the attempt by Colorado to remove Donald Trump from the ballot under the 14th amendment, which bars insurrectionists from running for office.

“For historians,” the group wrote, “contemporary evidence from the decision-makers who sponsored, backed, and voted for the 14th amendment [ratified in 1868] is most probative. Analysis of this evidence demonstrates that decision-makers crafted section three to cover the president and to create an enduring check on insurrection, requiring no additional action from Congress.”

Lawyers for Trump argue that the presidency is not an “office” as described in the 14th amendment, that only congressional action can stop someone from running, and that Trump did not incite an insurrection.

Trump was impeached in Congress (for the second time) for inciting an insurrection: the Capitol attack of 6 January 2021, an attempt to overturn defeat by Joe Biden now linked to nine deaths, more than 1,200 arrests and hundreds of convictions.

Pointing out that section 3 of the 14th amendment is self-executing, and that “no former Confederate instantly disqualified from holding office under section three was disqualified by an act of Congress”, the historians also noted that Jefferson Davis, the Confederate president, cited his own disqualification as reason an indictment for treason should be quashed.

“Contemporary information provides direct evidence of the enduring reach of the 14th amendment,” the historians wrote. “Congress … chose to make disqualification permanent through a constitutional amendment.

“Republican senator Peter Van Winkle of West Virginia said, ‘This is to go into our constitution and to stand to govern future insurrection as well as the present.’ To this end, the Amnesty Acts of 1872 and 1898 did not pardon future insurrectionists.”

The historians also said “adverse consequences followed” amnesty, many ex-Confederates winning office and “participat[ing] in the imposition of racial discrimination in the south that vitiated the intent of the 14th and 15th amendments to protect the civil and political rights of the formerly enslaved people.”

The historians concluded: “The court should take cognisance that section three of the 14th amendment covers the present, is forward-looking, and requires no additional acts of Congress for implementation.”

In a forthcoming article for the New York Review of Books, seen by the Guardian, Sean Wilentz of Princeton – an eminent historian not part of the supreme court brief – calls such arguments “risible”.

“By their reasoning,” Wilentz writes, “Trump’s misdeeds aside, enforcement of the 14th amendment poses a greater threat to our wounded democracy than Trump’s candidacy. In the name of defending democracy, they would speciously enable the man who did the wounding and now promises to do much more.”

Trump and allies including Elise Stefanik of New York, a House Republican leader, have refused to commit to certifying the result should Trump lose in November.

Wilentz continues: “Whether motivated by … fear of Trump’s base, a perverted sense of democratic evenhandedness, a reflexive hostility toward liberals, or something else, [commentators who say Trump should stay on the ballot] betray a basic ignorance of the relevant history and thus a misconception of what the 14th amendment actually meant and means. That history, meanwhile, has placed the conservative members of the supreme court in a very tight spot.”

Wilentz says justices who subscribe to originalism, a doctrine that “purports to divine the original intentions of the framers [of the constitution] by presenting tendentious renderings of the past as a kind of scripture”, will in the Colorado case have to contend with evidence – as presented by the historians’ brief – of what the framers of the 14th amendment meant.

Recently used to remove the right to abortion and to gut voting rights, originalism now threatens, Wilentz says, to become a “petard … exploding in the majority’s face”.

He also writes: “The conservative majority of the supreme court and the historical legacy of the [Chief Justice John] Roberts court have reached a point of no return. The law, no matter the diversions and claptrap of Trump’s lawyers and the pundits, is crystal clear, on incontestable historical as well as originalist grounds … the conservatives face a choice between disqualifying Trump or shredding the foundation of their judicial methodology.”

If the court does not “honour the original meaning of the 14th amendment and disqualify Donald Trump”, Wilentz writes, “it will trash the constitutional defense of democracy designed following slavery’s abolition; it will guarantee, at a minimum, political chaos no matter what the voters decide in November; and it will quite possibly pave the way for a man who has vowed that he will, if necessary, rescind the constitution in order to impose a dictatorship of revenge.”

The brief itself. Only 34 pages.

https://www.supremecourt.gov/DocketPDF/23/23-719/298895/20240126151819211_23-719%20Brief.pdf

______________________________________

I love my Patagonia jackets even more now. Do you?

Patagonia’s Profits Are Funding Conservation — and Politics.

$71 million of the clothing company’s earnings have been used since September 2022 to fund wildlife restoration, dam removal and Democratic groups.

A little more than $3 million to block a proposed mine in Alaska. Another $3 million to conserve land in Chile and Argentina. And $1 million to help elect Democrats around the country, including $200,000 to a super PAC this month.

Patagonia, the outdoor apparel brand, is funneling its profits to an array of groups working on everything from dam removal to voter registration.

In total, a network of nonprofit organizations linked to the company has distributed more than $71 million since September 2022, according to publicly available tax filings and internal documents reviewed by The Times.

The gusher of philanthropic money is the product of an unconventional corporate restructuring in 2022, when Patagonia’s founder, Yvon Chouinard, and his family relinquished ownership of the company and declared that all its future profits would be used to protect the environment and combat climate change.

Patagonia and the Chouinards set up a series of trusts, limited liability corporations and charitable groups designed to protect the independence of the clothing company while distributing all of its profits through an entity known as the Holdfast Collective.

Patagonia paid an initial $50 million dividend to Holdfast in 2022. It made another payment to Holdfast last year. That figure is not available in tax filings or the internal documents, and the company would not disclose it. Each year going forward, Patagonia will transfer all the profits it does not reinvest in the company to Holdfast.

“This is a new model of how wealthy people can approach their philanthropy,” said Stacy Palmer, chief executive of The Chronicle of Philanthropy. “It’s a combination of charity and politics, and it’s the beginning of changes we’re going to see more of.”

For a group that is distributing so much money, the Holdfast Collective has so far managed to remain largely under the radar, unknown to several philanthropy experts and Democratic fund-raisers who were asked about it.

Holdfast Collective created and manages five nonprofit groups — Holdfast Trust, Chalten Trust, Sojourner Trust, Wilder Trust and Tail Wind Trust. They are registered under a section of the tax code, 501(c)(4), that allows them to make unlimited political donations, provided their primary purpose is social welfare. The nonprofit groups, which pay management fees to Holdfast Collective, hold 98 percent of Patagonia’s nonvoting shares. The shares are valued at $1.7 billion but will not be sold.

The group still has no website, and there is no formal process through which organizations can apply for grants. There is also just one full-time employee: Greg Curtis.

Mr. Curtis, formerly the deputy general counsel of Patagonia, is responsible for recommending recipients that are subsequently approved by distribution committees at each trust. The Chouinard family personally approves many of the gifts.

Holdfast made contributions to more than 70 groups during its first year in operation. There were big donations for conservation projects, including efforts to protect the Vjosa River in Albania and Bristol Bay in Alaska, and grants to environmental organizations such as Earthjustice.

And there was a slew of political contributions last cycle, including $100,000 each to Senate Majority PAC and House Majority PAC, which work to elect Democrats to Congress, as well as smaller gifts to groups such as the Black Voters Matter Fund, the Center for American Progress Action Fund and the Georgia Investor Action Fund.

“One of the principles that we had when we set this up is that all the money that we get every year is supposed to be spent,” Mr. Curtis said in an interview. “So we’re in a more or less constant spend down mode.”

Dark money

Political donations constitute just a fraction of the Holdfast Collective’s overall spending. To date, its donations are barely a drip in the tsunami of outside spending expected around the 2024 election, which already exceeded $300 million earlier this month, according to an analysis by OpenSecrets, a nonpartisan group that tracks campaign finance.

But Holdfast’s early donations hint at the prospect of a new pool of cash for the advocacy groups and political action committees that support Democratic candidates and causes.

Representatives from Senate Majority PAC and House Majority PAC declined to comment, while most of the other political groups that received grants did not respond to questions about whether they solicited the cash or received input about how to spend it from Holdfast Collective.

Some conservatives are raising questions about the Holdfast Collective. Caitlin Sutherland, the executive director of the conservative watchdog group Americans for Public Trust, called Holdfast “a $1.7 billion political organization in waiting.”

Her group flagged public filings by the nonprofit organizations funded by Holdfast, which listed a range of causes, including combating disinformation and advocating for reproductive health care and prison reform.

“I personally fail to see the connection between spending money on abortion and climate change,” she said, adding that her group planned to file a complaint with the Federal Election Commission for incorrectly reporting donations as having come from the Holdfast Collective, rather than the nonprofit groups it administers.

The scrutiny of major donors hits close to home for Americans for Public Trust. It is affiliated with a big-money network of nonprofit groups shaped by the conservative activist Leonard A. Leo. The network received a $1.6 billion infusion from Barre Seid, a reclusive businessman who donated all the shares of his Chicago device manufacturing company in a transaction that shook the political world, and drew comparisons to the Chouinards’ transfer of Patagonia to Holdfast.

Mr. Curtis said Holdfast did not intend to be partisan.

“We are not aiming to be an extension of the Democratic Party,” he said. “The sole purpose in engaging in politics and policy is to advance stronger environmental policy.”

But so far, the group’s political giving has hewed closely to causes that could help Democrats. Shortly after it was founded, Holdfast made a flurry of contributions to groups working to get out the vote in Georgia ahead of the 2022 midterm election.

Since then, it has made gifts to organizations supporting local politicians campaigning on environmental issues.

“We would be really interested in supporting any climate leader — Republican, Democrat or independent,” Mr. Curtis said. “It just so happens that a lot of those folks are Democrats.”

Yet there is no guarantee Holdfast’s funds will be spent backing candidates who are aligned with its stances on climate change. A nonprofit affiliate of Senate Majority PAC last year spent more than $1.5 million on ads praising Senator Joe Manchin of West Virginia, a Democrat who has repeatedly sunk climate legislation. One ad praised him for working with former President Donald J. Trump to protect coal miners.

More recently, Holdfast has backed a campaign to preserve a California state law that prohibits oil and gas operations in residential neighborhoods.

Chris Lehman, an organizer for the Campaign for a Safe and Healthy California, which is working on the effort, said his group received $500,000 from Holdfast this month, allowing it to compete against deep pocketed corporations on the other side of the fight.

“There is such a lack of pro-climate funding that wants to get into straight-up political fights,” he said. “With Patagonia, you now have major player that cares deeply and is putting their name and reputation on the line.”

Lean philanthropy

Patagonia’s founder, Yvon Chouinard, and his family relinquished their ownership of the company in 2022

Mr. Chouinard, who founded Patagonia in 1973, struggled with his role as a businessman for his entire career. An avid rock climber, surfer and skier, he became deeply troubled by the degradation and depletion of natural resources.

As Patagonia grew into a billion-dollar business, he wrestled with his own role in promoting consumerism, and tried to create a responsible company that aimed to use organic and recycled materials and treat its employees and suppliers well.

For decades, Patagonia has given away 1 percent of its sales to environmental causes — totaling some $230 million — and Mr. Chouinard has used his own money to help create national parks in South America.

But a few years ago, Mr. Chouinard decided it was time to resolve the one conundrum that bothered him most: the fate of Patagonia.

After an extensive process, Patagonia’s leadership team landed on a structure to allow the company to continue operating as a for-profit entity while donating its earnings to nonprofit groups.

Because the Chouinards did not sell the company and retain the proceeds or leave the company to their children, they did not face a significant tax bill. And because they donated the shares to 501(c)(4) organizations, they did not receive a substantial tax write off. Instead, the family paid about $17.5 million in taxes to facilitate the transaction in 2022.

The first full year of Holdfast’s giving reflects Mr. Chouinard’s commitment to conservation work and political activism.

Holdfast said its grants have protected 162,710 acres of wilderness around the world, and it has pledged to protect another three million acres, much of it in Australia and Indonesia.

Shortly after the ownership change, Mr. Curtis learned about an effort to buy a swath of land in Alaska that would make it difficult to build Pebble Mine, a proposed gold and copper mine. In a matter of weeks, he agreed to provide the final $3.1 million that allowed the Conservation Fund to make the purchase, snarling the project.

“We were nearing the end of the deadline, and it was a grant in the amount that we needed to get across the finish line,” said Mark Elsbree, senior vice president for the western region for the Conservation Fund. “They were able to commit and enable us to act.”

The Holdfast Collective’s bare bones structure reflects a growing trend in philanthropy — embodied by MacKenzie Scott, the former wife of Amazon founder Jeff Bezos — to give away vast sums of money with little to no overhead.

“It’s more proof that it doesn’t take an army to give a ton of money away successfully,” Ms. Palmer of The Chronicle of Philanthropy said. “Going lean and getting more money going out the door is important when you have urgent problems like the environment.” (New York Times).

______________________________________

Do Cecile Richards a favor.

From Emma Hinchliffe, “The Broadsheet.”

Cecile Richards on her abortion chatbot Charley, cancer diagnosis.

– Abortion access. For the past several months, former Planned Parenthood president Cecile Richards has been supporting the launch of Charley, a new chatbot that provides information about how to access abortion in each zip code in the U.S.

In a conversation last week, she told me she was “more committed than ever to restoring the rights we have in this country to make our own decisions about pregnancy.” A few days later, the extent of Richards’s commitment became even clearer. On Sunday, a New York Magazine profile revealed that for the past six months Richards has been living with glioblastoma, a form of brain cancer with a 15-month median survival rate. In that article, Richards said that her current course of treatment has helped to “focus on what I want to do with the time I have.”

Richards, the daughter of former Texas Gov. Ann Richards, led Planned Parenthood between 2006 and 2018. Two years after the 2016 presidential election, she left her role and pivoted to Supermajority, an organization that worked to build the voting bloc of women. She cofounded Charley after the 2022 reversal of Roe v. Wade with former Planned Parenthood chief strategy officer Tom Subak, with support from various reproductive rights organizations; the donor-funded project is now led by executive director Kiana Tipton.

Charley’s chatbot launched this fall. Initially an attempt to combat abortion misinformation, Charley evolved into a platform that provides details about how to get an appointment or receive medication abortion by mail. Seventeen thousand people have used the chatbot in the past four months, the organization says.

While Richards went up against a host of anti-abortion activists and legislation during her time at the helm of Planned Parenthood, a chatbot may trigger new kinds of battles. Digital privacy has become paramount as abortion seekers in states with abortion bans search for information on Google or communicate about appointments and transportation over text or DM. Meta complied with Nebraska police warrants and turned over Facebook messages between a mother and daughter in one closely-watched abortion case. Jessica Burgess, who helped her daughter access medication abortion and dispose of the fetus, was sentenced to two years in prison in September.

Richards told me she’s “not worried about legal challenges” and is focused on helping abortion seekers find information and access care. Charley only asks users for their location and the date of their last period and says it doesn’t know further information about the people who exchange messages with the chatbot.

Looking ahead, Richards says a 2024 GOP presidential win would be a catastrophe. “It’s indescribable how bad it will be if Donald Trump wins the election,” she says. “We know that he’ll sign a national abortion ban if he has the chance.”

In the meantime, Richards urges everyone who cares about this issue to share information about medication abortion—which, while ensnared in an upcoming Supreme Court case, is still widely available—and be a resource for friends, family, and colleagues.

“If we can get information out to anyone who needs it, it will go a long way to solving an immediate problem as we work on restoring abortion rights in America,” she says. (Broadsheet, Fortune mag).

______________________________________

Racism in full force in the Senate yesterday.

Tom Cotton: "Have you ever been a member of the Chinese Communist Party?"

— Justin Baragona (@justinbaragona) January 31, 2024

TikTok CEO Shou Zi Chew: "Senator, I'm Singaporean. No!"

Cotton: "Have you ever been associated or affiliated with the Chinese Communist Party?"

Chew: "No, Senator. Again, I'm Singaporean!" pic.twitter.com/5Wa72aJIr9

______________________________________

Update on Republicans.

Grifter Trump takes full advantage of his supporters’ money.

Donald Trump’s PACs spent $50 million of donors' money on the corrupt former president’s legal bills in 2023, The New York Times reports.

— Republicans against Trump (@RpsAgainstTrump) January 31, 2024

Suckers. pic.twitter.com/kSPQtKZ58F

Kentucky Republicans.

BREAKING. Kentucky Senate Republicans just passed a bill that would BAN students from using college photo IDs as their identification for voting. Republicans are actively suppressing young voices because they are scared of us. Be alarmed & outraged. We will make them find out.

— Victor Shi (@Victorshi2020) January 30, 2024

The Taylor Swift situation.

Trump Privately Grouses He’s ‘More Popular’ Than Taylor Swift

— Republicans against Trump (@RpsAgainstTrump) January 30, 2024

Taylor Swift hasn’t even endorsed Joe Biden’s 2024 campaign, but MAGA world is already preparing for a “holy war” against herhttps://t.co/4LPyr13IJ6

Taylor Swift, Travis Kelce and a MAGA Meltdown.

The fulminations surrounding the world’s biggest pop icon — and girlfriend of Chiefs tight end Travis Kelce — reached the stratosphere after Kansas City made it to the Super Bowl.

Taylor Swift and Travis Kelce after the Chiefs’ victory on Sunday. They are the focus of right-wing vitriol and conspiracy theories

For football fans eager to see a new team in the Super Bowl, the conference championship games on Sunday that sent the Kansas City Chiefs and San Francisco 49ers back to the main event of American sports culture were sorely disappointing.

But one thing is new: Taylor Swift. And she is driving the movement behind Donald Trump bonkers.

The fulminations surrounding the world’s biggest pop icon — and girlfriend of Travis Kelce, the Chiefs’ star tight end — reached the stratosphere after Kansas City made it to the Super Bowl for the fourth time in five years, and the first time since Ms. Swift joined the team’s entourage.

The conspiracy theories coming out of the Make America Great Again contingent were already legion: that Ms. Swift is a secret agent of the Pentagon; that she is bolstering her fan base in preparation for her endorsement of President Biden’s re-election; or that she and Mr. Kelce are a contrived couple, assembled to boost the N.F.L. or Covid vaccines or Democrats or whatever.

“I wonder who’s going to win the Super Bowl next month,” Vivek Ramaswamy, the conspiratorial presidential candidate, turned Trump surrogate, pondered on social media on Monday. “And I wonder if there’s a major presidential endorsement coming from an artificially culturally propped-up couple this fall.”

The pro-Trump broadcaster Mike Crispi led off on Sunday by claiming that the National Football League is “rigged” in order to spread “Democrat propaganda”: “Calling it now: KC wins, goes to Super Bowl, Swift comes out at the halftime show and ‘endorses’ Joe Biden with Kelce at midfield.”

Other detractors of Ms. Swift among Mr. Trump’s biggest fans include one of his lawyers, Alina Habba, one of his biggest conspiracy theorists, Jack Posobiec, and other MAGA luminaries like Laura Loomer and Charlie Kirk, who leads a pro-Trump youth organization, Turning Point USA.

The right has been fuming about Ms. Swift since September, when she urged her fans on Instagram to register to vote, and the online outfit Vote.org reported a surge of 35,000 registrations in response. Ms. Swift had embarked on a world tour that helped make her a billionaire. Gavin Newsom, the California governor, praised her as “profoundly powerful.” And then Time magazine made her Person of the Year in December, kicking off another round of MAGA indignation.

The love story that linked her world with the N.F.L. has proved incendiary. Mr. Kelce’s advertisements promoting Pfizer’s Covid vaccine and Bud Light — already a target of outrage from the right over a social media promotion with a transgender influencer, Dylan Mulvaney — added fuel to that raging fire.

The N.F.L.’s fan base is huge and diverse, but it includes a profoundly conservative element that cheered on the star quarterback Aaron Rodgers’s one-man crusadeagainst Covid vaccines and jeered Black players whoknelt during the national anthem. The league has long battled charges of misogyny, from the front offices of the Washington Commanders to multiple cases of sexual and domestic assault and abuse.

The Swift-Kelce story line, for some, has delivered a bruising hit to traditional gender norms, with a rich, powerful woman elevating a successful football player to a new level of fame.

Some of the Monday morning quarterbacking has been downright silly, including speculation that Ms. Swift is after Mr. Kelce for his money. (Her net worth exceeds $1 billion, a different universe than the athlete’s merely wealthy status.)

Other accusations appear to be driven by fear and grounded in some truth, or at least in her command of her 279 million Instagram followers: that she has enormous influence, and has supported Democrats in the past. For much of her extensive music career, Ms. Swift avoided politics, but in 2018, she endorsed two Democrats in Tennessee, where she owns two homes: former Gov. Phil Bredesen, who was running for the Senate against then-Representative Marsha Blackburn, and Jim Cooper, a House member who has since retired.

“I always have and always will cast my vote based on which candidate will protect and fight for the human rights I believe we all deserve in this country,” she wrote on social media. “I believe in the fight for L.G.B.T.Q. rights, and that any form of discrimination based on sexual orientation or gender is WRONG.”

She added, “I believe that the systemic racism we still see in this country towards people of color is terrifying, sickening and prevalent.”

The alarm bells were loud enough to pull Mr. Trump into loudly backing Ms. Blackburn: “I’m sure Taylor Swift doesn’t know anything about her,” he said at the time, knowing all too well how influential Ms. Swift could be. “Let’s say that I like Taylor’s music about 25 percent less now, OK?”

He probably liked her even less in 2020 when she criticized his pandemic response, and then endorsed Mr. Biden.

While her early pop music may have mainly attracted teens and preteens, those fans have reached voting age, and her music has grown more sophisticated with the albums “Evermore” and “Folklore” to match her millennial roots and her fans’ taste.

Much of the Swift paranoia has lurked on the MAGA fringes, with people like Ms. Loomer, the conspiracy theorist from Florida who declared in December that “2024 will be MAGA vs Swifties” and Mr. Kirk, who declared in November that Ms. Swift would “come out for the presidential election” after Democrats had another strong showing in an election that demonstrated the issue of abortion motivated voters to the polls.

“All the Swifties want is swift abortion,” he said.

Then Swift-bashing reached Fox News in mid-January. The host Jesse Watters suggested the superstar was a Defense Department asset engaging in psychological warfare. He tied Ms. Swift’s political voice with her boyfriend’s Pfizer endorsement to the remarkable success of her Eras tour, which bolstered local economies and landed her on the cover of Time.

“Have you ever wondered why or how she blew up like this?” Mr. Watters wondered on air. “Well, around four years ago, the Pentagon psychological operations unit floated turning Taylor Swift into an asset during a NATO meeting.”

Andrea Hailey, the chief executive of Vote.org, made the most of the Fox News criticism, saying the organization’s partnership with Ms. Swift “is helping all Americans make their voices heard at the ballot box,” adding that the star is “not a psy-op or a Pentagon asset.”

But her appearance on the field with Mr. Kelce in Baltimore after the Chiefs beat the Ravens on Sunday, complete with a kiss and a hug, appears to have sent conservatives into a fit of apoplexy that may only grow in the run-up to Super Bowl LVIII in Las Vegas Feb. 11.

The feelings are so strong that Fox News ran a segment on Sunday lamenting that Ms. Swift’s private “jet belches tons of CO2 emissions,” showing a sudden awareness of the leading cause of global warming.

Mr. Ramaswamy said his Super Bowl conjecture was dead serious.

“What your kind of people call ‘conspiracy theories,’ I simply call an amalgam of collective incentives hiding in plain sight,” he said.

The White House press secretary Karine Jean-Pierre stoked speculation still more by invoking the Hatch Act, which prohibits political actions by civil servants, in declining to answer whether Mr. Biden would be appearing with Ms. Swift.

“I’m just going to leave it there,” she said Monday. “I’m not going to get into the president’s schedule at all from here, as it relates to the 2024 elections.”

The Trump campaign, which had initially planned to ignore the frenzy, dispatched Karoline Leavitt, a campaign spokeswoman, to dismiss concerns about a potential Biden endorsement.

“I don’t think this endorsement will save him from the calamity” of his record, she said. (New York Times).

Liz Cheney shows no mercy.

Taylor Swift is a national treasure.

— Liz Cheney (@Liz_Cheney) January 31, 2024

______________________________________