Monday, April 17, 2023. Annette’s News Roundup.

To read an article excerpted in this Roundup, click on its blue title. Each “blue” article is hyperlinked so you can read the whole article.

Please feel free to share.

Invite at least one other person to subscribe today! buttondown.email/AnnettesNewsRoundup

Kamala is always busy.

Vice President Kamala Harris leads rally for abortion rights in L.A. - CBS San Francisco

LOS ANGELES -- Vice President Kamala Harris on Saturday urged Americans to take action during "a critical point in our nation's history" as thousands of protesters demonstrated across the country against new limits to abortion rights making their way through the courts.

Saturday's nationwide rallies were sparked by the U.S. Supreme Court's actions the day before, when the high court intervened to delay rule changes that would have limited the way the abortion drug mifepristone could be used and dispensed. The limits were paused while the court reviews the case more thoroughly.

Harris made a surprise stop in Los Angeles at one of the rallies, where she called the latest upheaval over abortion rights a further incursion by conservatives into myriad "fundamental rights" many Americans thought they had.

"And so this is a moment that history will show required each of us — based on our collective love of our country — to stand up, and fight for, and protect our ideals. That's what this moment is," she said Saturday, speaking to several hundred demonstrators from the steps of City Hall. "When you attack the rights of women in America, you are attacking America." (CBS, SF).

Touch 👇 to watch.

This week, @Secondgentleman and I celebrated our nation’s wounded warriors.

— Vice President Kamala Harris (@VP) April 15, 2023

Through their courage and their resilience, these heroes represent the best of who we are as a nation. pic.twitter.com/ezUrEZL4PE

_______________________

Tuesday is Tax Day, the last day to file taxes or an extension.

Tax Time

Jill Lepore wrote this New Yorker History of the 16th Amendment and Taxation in America. This article is from 2012, but it is quite timely.

Politicians dislike talking about taxes, except to use them as a matador uses a red cape.

Politicians dislike talking about taxes, except to use them as a matador uses a red cape.

It began with an earthquake. What hit San Francisco in 1906 was one of the worst natural disasters in American history. Once the water mains broke, there was no way to fight the dozens of fires caused by ruptured gas mains, except by dynamiting buildings in the fire’s path, which made things worse. The fires lasted for days. More than three thousand people died, including the city’s fire chief, who fell two stories after the dome of the California Hotel crashed into the fire station. Most of the city was destroyed. Economic aftershocks were felt as far away as London. Twelve insurance companies went bankrupt, and, after a gold shortage and a doomed scheme to corner the copper market, the Knickerbocker, the second-largest trust in New York, failed, setting off the Panic of 1907. The New York Stock Exchange nearly collapsed. So did the United States Treasury.

The Panic of 1907 contributed to the passage of the Sixteenth Amendment, in 1913, which granted Congress the right to levy an income tax, and to the establishment of a central banking system, the Federal Reserve. Both the Sixteenth Amendment and the Federal Reserve will be a hundred years old in 2013. Hoopla is not anticipated. Not especially controversial a century ago, the tax and the bank lie at the core of a now popular account of American history in which 1913 was the real disaster, the original “fiscal cliff.” This year, [2012] the Republican Party platform included a call for the Federal Reserve to be audited—stopping short of Ron Paul’s promise to “end the Fed”—and a provision for the Sixteenth Amendment to be repealed.

It’s possible to think of the election of 2012 as a referendum on the role of government in the economy, and many people do, except that it’s difficult to have a referendum about the future when there’s so much disagreement about the past.

One of those revolutions lies behind American independence. Early Americans, though, didn’t only deny the king’s right to tax; they questioned the legislature’s. When American colonists challenged Parliament’s right to tax them, Edmund Burke predicted chaos, “a perpetual quarrel.” Meanwhile, another kind of debate had begun.

“The expenses of government, having for their object the interests of all, should be borne by every one,” the French minister Anne-Robert-Jacques Turgot remarked, “and the more a man enjoys the advantages of society, the more he ought to hold himself honoured in contributing to these expenses.”

Adam Smith expressed much the same view in “The Wealth of Nations,” in 1776: “The subjects of every state ought to contribute towards the support of the government, as nearly as possible, in proportion to their respective abilities.”

Taxes dominate domestic politics. They didn’t always. Since the nineteen-seventies, almost all of that talk has been about cuts, which ought to be surprising, because more than ninety per cent of Americans receive social or economic security benefits from the federal government. Americans, though, find it easier to see what they pay than what they get—not because they aren’t paying attention but because the case for taxation is so seldom made.

Damning taxes is a piece of cake. It’s defending them that’s hard.

“Taxes are what we pay for civilized society,” Oliver Wendell Holmes, Jr., said, nearly a century ago. (His words are engraved on the front of the I.R.S. Building in Washington.) No one’s said it better since.

And that, right there, is the problem.

The Constitution grants Congress the power “to lay and collect taxes, duties, imposts and excises, to pay the debts and provide for the common defence and general welfare,” except not “direct taxes,” unless levied in proportion to population, as assessments on states. The Constitutional Convention nearly fell apart over this. For purposes of representation, Southerners wanted their slaves counted as people. Northerners objected. By way of compromise, Pennsylvania’s Gouverneur Morris moved that “taxation shall be in proportion to Representation”: the South could have its slaves counted in exchange for an increased tax burden.

After Southerners balked, Morris proposed “restraining the rule to direct taxation.” When the Massachusetts delegate Rufus King “asked what was the precise meaning of direct taxation? No one answd.”

In the early republic, Congress briefly experimented with taxes on carriages and whiskey, but, before the Civil War, raised revenue almost exclusively through tariffs—duties on imports. “We are all the more reconciled to the tax on importations,” Jefferson explained, “because it falls exclusively on the rich.” But the tariff was uncontroversial, the historian Robin Einhorn has argued, because it skirted the question of human bondage: the American antitax tradition, she insists, has its roots not in democracy but in slavery.

In 1906, the day the earthquake hit and the fires began, people raced to the San Francisco Bay and boarded ferries to escape the flames. A handful of men rushed to the banks, but before long all that was left of the city’s deposit and lending institutions, aside from rubble and ashes, were their fireproof steel vaults: red hot, smoking, and locked.

During the recession that followed the panic that followed the earthquake, the number of people applying for poor relief in New York tripled; in Philadelphia, it increased nearly fivefold. A purpose of a federal reserve was to allow the government to halt a panic by shoring up faltering banks.

A purpose of a federal income tax was to undergird the Treasury with a stable source of revenue. But it had another purpose, too. The richest one per cent of households, which had held about a quarter of the nation’s wealth in 1890, now held more than a third.

The [income]tax was intended to answer populist rage at the growing divide between the rich and the poor.

In the election of 1908, both parties favored an income tax—Democrats hoping to close that gap, Republicans hoping to quiet that rage.

Taxes are what we pay for civilized society, for modernity, and for prosperity. The wealthy pay more because they have benefitted more. Taxes, well laid and well spent, insure domestic tranquillity, provide for the common defense, and promote the general welfare. Taxes protect property and the environment; taxes make business possible. Taxes pay for roads and schools and bridges and police and teachers. Taxes pay for doctors and nursing homes and medicine. During an emergency, like an earthquake or a hurricane, taxes pay for rescue workers, shelters, and services. For people whose lives are devastated by other kinds of disaster, like the disaster of poverty, taxes pay, even, for food.

What’s surprising, given how much money and passion have been spent to defeat a broad-based, progressive income tax over the past century, and how poorly it has been defended, is that it has endured—testimony, perhaps, to Americans’ abiding sense of fairness. Taxes are a pact. That pact needs renewing. ♦

To read more about the history of American taxation, click here.

_______________________

Wednesday is FDA - Mifepristone Day at the Supreme Court.

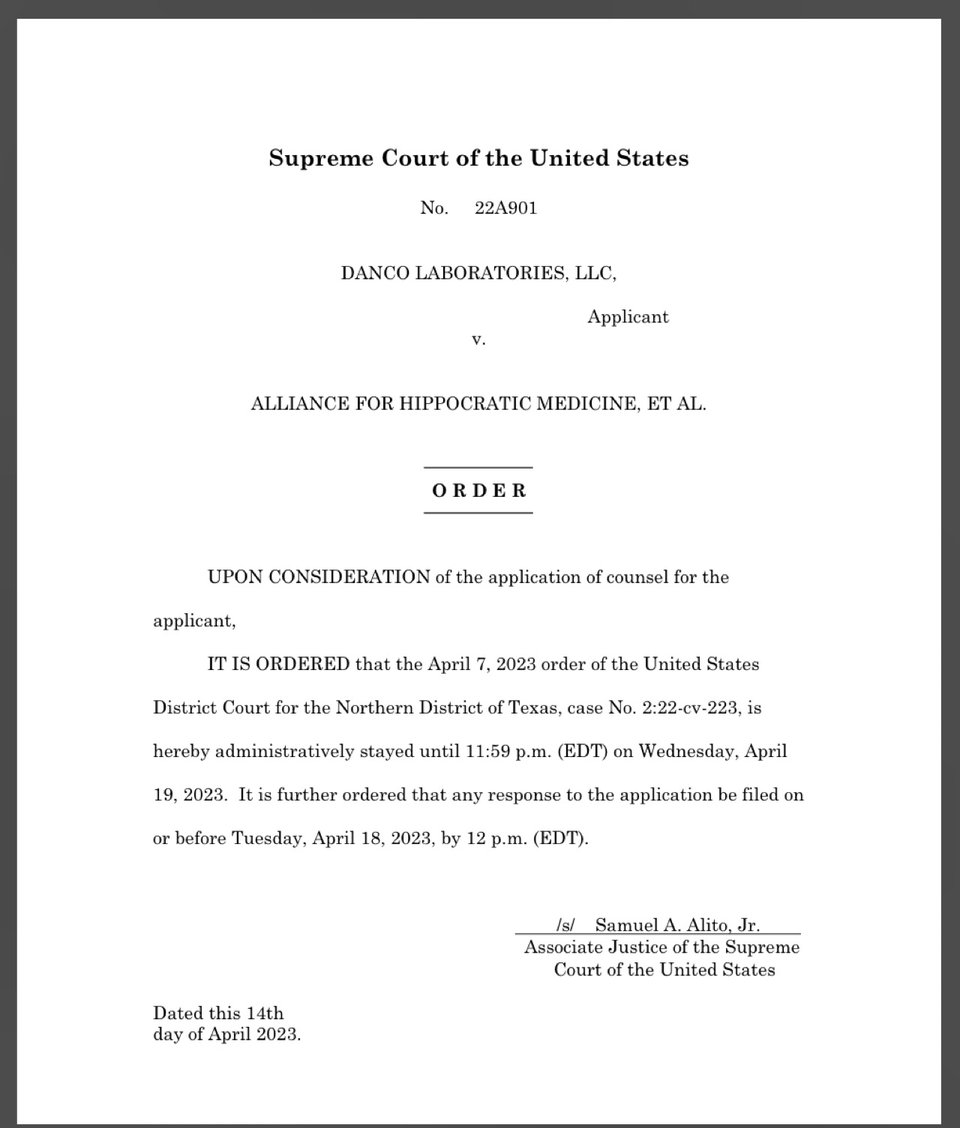

You likely recall that Mifepristone availability will remain unchanged until at least 11:59 Wednesday night.

SCOTUS asked arguments be filed on Tuesday, and will weigh in likely by Wednesday.

In the abortion case, SCOTUS granted an Administrative stay —temporarily halting entire trial court’s decision — until Weds while the Ct gets further briefing and considers the issue. So all the trial court restrix on mifepristone are now not in effect until Wednesday at least pic.twitter.com/PkbZ4l2jNW

— Neal Katyal (@neal_katyal) April 14, 2023

______________________

More Clarence Thomas.

Clarence Thomas has for years claimed income from a defunct real estate firm.

Over the last two decades, Supreme Court Justice Clarence Thomas has reported on required financial disclosure forms that his family received rental income totaling hundreds of thousands of dollars from a firm called Ginger, Ltd., Partnership.

But that company — a Nebraska real estate firm launched in the 1980s by his wife and her relatives — has not existed since 2006.

That year, the family real estate company was shut down and a separate firm was created, state incorporation records show. The similarly named firm assumed control of the shuttered company’s land leasing business, according to property records.

Since that time, however, Thomas has continued to report income from the defunct company — between $50,000 and $100,000 annually in recent years — and there is no mention of the newer firm, Ginger Holdings, LLC, on the forms.

The previously unreported misstatement might be dismissed as a paperwork error. But it is among a series of errors and omissions that Thomas has made on required annual financial disclosure forms over the past several decades, a review of those records shows.

Together, they have raised questions about how seriously Thomas views his responsibility to accurately report details about his finances to the public.

(Washington Post).

#FreshResists

— Feisty is proud to be a Democrat! (@FeistyLibLady) April 16, 2023

Clarence and Ginny Thomas aren't the only SCOTUS problem.

Jane Roberts’ placements as a recruiter for law firms included practices with frequent cases before her husband and commissions in 6 figures.

The Chief Justice reported her as a salaried employee and… pic.twitter.com/BWfPIjI2Uw

_______________________

More Evan Gershkovich.

Journalist Evan Gershkovich tells family he is not losing hope in Russian prison

Journalist Evan Gershkovich’s Colleagues at the Wall Street Journal.

Journalist Evan Gershkovich’s Colleagues at the Wall Street Journal.

In a handwritten letter sent to the U.S. since his arrest in Russia, journalist Evan Gershkovich told his family that he is "not losing hope" and continues to read and write in detention.

"I read. I exercise. And I am trying to write. Maybe, finally, I am going to write something good," Gershkovich wrote in Russian, the language he speaks at home with his parents, The Wall Street Journal reported.(NPR).

_______________________

Spring is beautifully here.

Wet winter gives way to colorful 'Superbloom' in US West.

The tiny rain-fed wildflowers, no bigger than a few inches, are so vivid and abundant across California this year that their hues of purple and yellow look like paint swatches from space.

From the mist-shrouded San Francisco Bay Area to the Mexican border and across the deserts of Arizona, there are flashes of color popping up after an unusually wet winter helped produce a so-called “ Superbloom.”

A series of powerful storms dumped record amounts of rain and snow across California, replenishing reservoirs, bringing an end — mostly — to the state’s three-year drought, and setting prime conditions for millions of dormant seeds to sprout. Botanists say wildflowers are expected to be blooming well into May, with some areas just starting.

“One of the things unique about this year is how incredibly widespread it is,” said Naomi Fraga, director of conservation programs at the California Botanic Garden. “It’s pretty spectacular.”

In Arizona’s deserts, blue lupine and orange poppies surround towering saguaro cactus, while delicate orchids dot Northern California’s forests, like the calypso orchid or “fairy-slipper.”

North of Los Angeles, visitors from around the globe have been making the trek to the Antelope Valley California Poppy Reserve to see the burst of orange and yellow flowers, which extended well beyond the park’s borders this year. On a recent afternoon, people pulled over along the freeway to shoot selfies with California’s official state flower.

In the low desert of Joshua Tree National Park in Southern California, too many wildflowers have sprouted up to list, according to the Theodore Payne Foundation for Wild Flowers & Native Plants. The barren landscape has come alive with Canterbury bells, purple mat and yellow cups.

Fragrant blooms can be smelled from car windows, and their colors captured from space. (Associated Press).

_______________________

Spring at the White House.

_______________________